Calculate the number of shares outstanding for the company and the market price per share at the end of 2020. 2. Calculate the cash flow from operations, net capital spending, and the change in NWC to calculate the cash flow from assets. Then, calculate the cash flow to creditors and cash flow to shareholders to calculate the cash flow from assets from the “uses” side and confirm that the cash-flow identity is satisfied.

Calculate the number of shares outstanding for the company and the market price per share at the end of 2020. 2. Calculate the cash flow from operations, net capital spending, and the change in NWC to calculate the cash flow from assets. Then, calculate the cash flow to creditors and cash flow to shareholders to calculate the cash flow from assets from the “uses” side and confirm that the cash-flow identity is satisfied.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

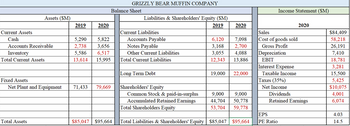

1. Calculate the number of shares outstanding for the company and the market price per share at the end of 2020.

2. Calculate the cash flow from operations, net capital spending, and the change in NWC to calculate the cash flow from assets. Then, calculate the cash flow to creditors and cash flow to shareholders to calculate the cash flow from assets from the “uses” side and confirm that the cash-flow identity is satisfied.

Transcribed Image Text:GRIZZLY BEAR MUFFIN COMPANY

Balance Sheet

Income Statement ($M)

Assets ($M)

Liabilities & Shareholders' Equity ($M)

2019

2020

2019

2020

2020

Current Assets

Cash

Current Liabilities

Accounts Payable

Notes Payable

Sales

$84,409

5,290

5,822

6,120

7,098

Cost of goods sold

58,218

26,191

Accounts Receivable

3,656

6,517

2,738

3,168

2,700

Gross Profit

Inventory

Total Current Assets

5,586

13,614

Other Current Liabilities

4,088

Depreciation

7,410

3,055

15,995

Total Current Liabilities

12,343

13,886

EBIT

18,781

Interest Expense

3,281

|Long Term Debt

19,000

22,000

Taxable Income

15,500

Fixed Assets

Taxes (35%)

5,425

$10,075

Shareholders' Equity

Common Stock & paid-in-surplus

Accumulated Retained Earnings

Total Shareholders Equity

Net Plant and Equipment

71,433

79,669

Net Income

9,000

9.000

Dividends

4,001

44,704

Retained Earnings

50,778

59,778

6,074

53,704

EPS

4.03

Total Assets

$85,047

$95,664

Total Liabilities & Shareholders' Equity | $85,047

$95,664

PE Ratio

14.5

Expert Solution

Step 1

The financial statement indicates the stand of the entity in the competitive market with the help of determining financial position and performance during the year.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 10 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

How do you find the red numbers on the balance sheet and income statement?

Transcribed Image Text:Current Assets

Cash

Accounts Receivable

Inventory

Assets (SM)

Total Current Assets

Fixed Assets

Net Plant and Equipment

Total Assets

2019

2020

GRIZZLY BEAR MUFFIN COMPANY

Balance Sheet

5,290

5,822

2,738

3,656

5,586

6,517

13,614 15,995

71,433 79,669

$85,047 $95,664

Liabilities & Shareholders' Equity (SM)

2019

Current Liabilities

Accounts Payable

Notes Payable

Other Current Liabilities

Total Current Liabilities

6,120

3.168

3,055

12,343

2020

7,098

2,700

4,088

13,886

Long Term Debt

Shareholders' Equity

Common Stock & paid-in-surplus

Accumulated Retained Earnings

Total Shareholders Equity

Total Liabilities & Shareholders' Equity $85,047 $95,664

19,000 22,000

9,000 9,000

44,704 50,778

53,704 59,778

Income Statement (SM)

Sales

Cost of goods sold

Gross Profit

Depreciation

EBIT

Interest Expense

Taxable Income

Taxes (35%)

Net Income

EPS

PE Ratio

2020

Dividends

Retained Earnings

$84,409

58,218

26,191

7,410

18,781

3,281

15,500

5,425

$10,075

4,001

6,074

4.03

14.5

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education