Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 4P

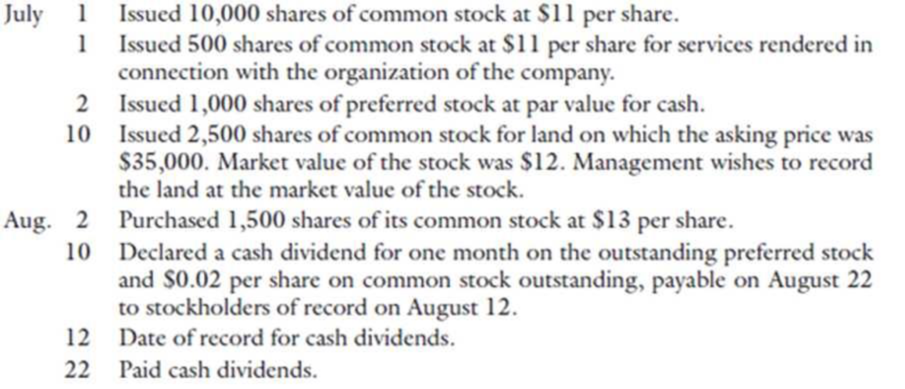

Kraft Unlimited, Inc., was organized and authorized to issue 5,000 shares of $100 par value, 9 percent

REQUIRED

- 1. Prepare

journal entries to record these transactions. - 2. Prepare the stockholders’ equity section of Kraft’s

balance sheet as it would appear on August 31, 2014. Net income for July was zero and August was $11,500. - 3. Calculate dividend yield, price/earnings ratio, and return on equity. Assume earnings per common share are $1.00 and market price per common share is $20. For beginning stockholders’ equity, use the balance after the July transactions. (Round to the nearest tenth of a percent.)

- 4. Discuss the results in requirement 3, including the effect on investors’ returns and the company’s profitability as it relates to stockholders’ equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The charter for Zenith, Inc., authorizes the company to issue 250,000 shares of $9, no-par preferred stock and

650,000 shares of common stock with $2 par value. During its start-up phase, Zenith, Inc. completed the following

transactions:

Requirement 2. Prepare the stockholders' equity section of Zenith's balance sheet at December 31, 2018.

Assume the company earned net income of $35,000 during this period. (Enter the accounts in the proper order for

the stockholders' equity section of the balance sheet.)

2018

Issued 400 shares of common stock to the promoters who organized the

Apr 6 corporation,

receiving cash of $13,600.

12 Issued 500 shares of preferred stock for cash of $22,000.

Issued 1,500 shares of common stock in exchange for land with a market

14 value of $24,000.

Stockholders' Equity

Paid-in capital:

Total stockholders' equity

The stockholders’ equity accounts of Pearl Company have the following balances on December 31, 2017.

Common stock, $3 par, 1,000,000 shares issued and outstanding

$3,000,000

Paid-in-capital in excess of par – common stock

4,600,000

Retained earnings

8,969,000

Shares of Pearl Company stock are currently selling on the Midwest Stock Exchange at $25.Prepare the appropriate journal entries for each of the following independent cases.

(a) A stock dividend of 10% is declared and issued

(b) The parts of this question must be completed in order. This part will be available when you complete the part above.

(c) The parts of this question must be completed in order. This part will be available when you complete the part above.

On January 1, 2020, Vaughn Manufacturing issued 15,000 shares of $4 par value common stock for $180,000. On March 1, 2020, the

company purchased 3,800 shares of its common stock for $17 per share for the treasury.

Journalize the stock transactions of Vaughn Manufacturing in 2020. (Credit account titles are automatically indented when the amount is

entered. Do not indent manually. Record journal entries in the order presented in the problem. If no entry is required, select "No Entry" for the

account titles and enter O for the amounts.)

Date

Jan. 1

March 1

Account Titles and Explanation

Cash

Common Stock

Paid-in Capital in Excess of Par Value-Common Stock

Treasury Stock

Cash

Debit

||||

64600

Credit

64600

Chapter 13 Solutions

Principles of Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 0 par common stock at 0, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a held- to-maturitv long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 545, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method, q. Accrued interest for three months on the Dream Inc. bonds purchased in (1). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions Journalize the selected transactions. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016. Income statement data: Advertising expense 150,000 Cost of merchandise sold 3,700,000 Delivery expense 30,000 Depreciation expense -office buildings and equipment 30,000 Depreciation expensestore buildings and equipment 100,000 Dividend revenue 4,500 Gain on sale of investment 4,980 Income from Pinkberry Co. investment 76,800 Income tax expense 140,500 Interest expense 21,000 Interest revenue 2,720 Miscellaneous administrative expense 7.500 Miscellaneous selling expense 14,000 Office rent expense 50,000 Office salaries expense 170,000 Office supplies expense 10,000 Sales 5,254,000 Sales commissions 185,000 Sales salaries expense 385,000 Store supplies expense 21,000 Retained earnings and balance sheet data: Accounts payable 194,300 Accounts receivable 545,000 Accumulated depreciationoffice buildings and equipment 1,580,000 Accumulated depreciationstore buildings and equipment 4,126,000 Allowance for doubtful accounts 8,450 Available for sale investments (at cost) 260,130 Bonds payable. 5%. due 2024 500,000 Cash 246,000 Common stock, 20 par (400,000 shares authorized; 100,000 shares issued. 94,600 outstanding) 2,000,000 Dividends: Cash dividends for common stock 155,120 Cash dividends for preferred stock 100,000 Goodwill 500,000 Income tax payable 44,000 Interest receivable 1,125 Investment in Pinkberry Co. stock (equity method) 1,009,300 Investment in Dream Inc. bonds (long term) 90,000 Merchandise inventory [December 31, 2016). at lower of cost (FIFO) or market 778,000 Office buildings and equipment 4.320,000 Paid-in capital from sale of treasury stock 13,000 Excess of issue price over parcommon stock 886,800 Excess of issue price over parpreferred stock 150,000 Preferred 5% stock. 80 par (30,000 shares authorized; 20,000 shares issued] 1,600,000 Premium on bonds payable 19,000 Prepaid expenses 27,400 Retained earnings, January 1, 2016 9,319,725 Store buildings and equipment 12,560,000 Treasury stock (5,400 shares of common stock at cost of 33 per share) 178,200 Unrealized gain (loss) on available for sale investments (6,500) Valuation allowance for available for sale investments (6,500)arrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4,000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 375. The bonds are classified as a heldtomaturity long-term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0.60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issued in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method. q. Accrued interest for three months on the Dream Inc. bonds purchased in (l). r. Pinkberry Co. recorded total earnings of 240,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39.02 per share on December 31, 2016. The investment is adjusted to fair value, using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments had a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transactions for the year ended December 31, 2016, had been posted [including the transactions recorded in part (1) and all adjusting entries], the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step income statement for the year ended December 31, 2016, concluding with earnings per share. In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. (Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 2016. c. Prepare a balance sheet in report form as of December 31, 2016.arrow_forwardSpring Company is authorized to issue 500,000 shares of $2 par value common stock. In its first year, the company has the following transactions: Journalize the transactions and calculate how many shares of stock are outstanding at August 3.arrow_forward

- Fortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Journalize the transactions and calculate how many shares of stock are outstanding at August 3.arrow_forwardThe controller of Red Lake Corporation has requested assistance in determining income, basic earnings per share, and diluted earnings per share for presentation on the companys income statement for the year ended September 30, 2020. As currently calculated, Red Lakes net income is 540,000 for fiscal year 2019-2020. Your working papers disclose the following opening balances and transactions in the companys capital stock accounts during the year: 1. Common stock (at October 1, 2019, stated value 10, authorized 300,000 shares; effective December 1, 2019, stated value 5, authorized 600,000 shares): Balance, October 1, 2019issued and outstanding 60,000 shares December 1, 201960,000 shares issued in a 2-for-l stock split December 1, 2019280,000 shares (stated value 5) issued at 39 per share 2. Treasury stockcommon: March 3, 2020purchased 40,000 shares at 38 per share April 1, 2020sold 40,000 shares at 40 per share 3. Noncompensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with 60 for 1 common share; effective December 1, 2019, each warrant became exchangeable for 2 common shares at 30 per share): October 1, 201925,000 warrants issued at 6 each 4. Noncompensatory stock purchase warrants, Series B (each warrant is exchangeable with 40 for 1 common share): April 1, 202020,000 warrants authorized and issued at 10 each 5. First mortgage bonds, 5%, due 2029 (nonconvertible; priced to yield 5% when issued): Balance October 1, 2019authorized, issued, and outstandingthe face value of 1,400,000 6. Convertible debentures, 7%, due 2036 (initially, each 1,000 bond was convertible at any time until maturity into 20 common shares; effective December 1, 2019, the conversion rate became 40 shares for each bond): October 1, 2019authorized and issued at their face value (no premium or discount) of 2,400,000 The following table shows the average market prices for the companys securities during 2019-2020: Adjusted for stock split Required: Prepare a schedule computing: 1. the basic earnings per share 2. the diluted earnings per share that should be presented on Red Lakes income statement for the year ended September 30, 2020 A supporting schedule computing the numbers of shares to be used in these computations should also be prepared. Assume an income tax rate of 30%.arrow_forwardChen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.arrow_forward

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.arrow_forwardAnoka Company reported the following selected items in the shareholders equity section of its balance sheet on December 31, 2019, and 2020: In addition, it listed the following selected pretax items as a December 31, 2019 and 2020: The preferred shares were outstanding during all of 2019 and 2020; annual dividends were declared and paid in each year. During 2019, 2,000 common shares were sold for cash on October 4. During 2020, a 20% stock dividend was declared and issued in early May. At the end of 2019 and 2020, the common stock was selling for 25.75 and 32.20, respectively. The company is subject to a 30% income tax rate. Required: 1. Prepare the comparative 2019 and 2020 income statements (multiple-step), and the related note that would appear in Anokas 2020 annual report. 2. Next Level Compute the price/earnings ratio for 2020. How does this compare to 2019? Why is it different?arrow_forwardClothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders' equity. January 1 Issues 700 shares of common stock for $34 per share. April 1 Issues 110 additional shares of common stock for $38 per share. Required: 1. Record the transactions, assuming Clothing Frontiers has no-par common stock. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1. Record the issuance of 700 shares of common stock for $34 per share. Note: Enter debits before credits. Date General Journal Debit Credit January 01arrow_forward

- Clothing Frontiers began operations on January 1 and engages in the following transactions during the year related to stockholders’ equity. January 1 Issues 700 shares of common stock for $50 per share. April 1 Issues 110 additional shares of common stock for $54 per share. Required:1. Record the transactions, assuming Clothing Frontiers has no-par common stock. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardThe stockholders’ equity accounts of Pearl Company have the following balances on December 31, 2017. Common stock, $3 par, 1,000,000 shares issued and outstanding $3,000,000 Paid-in-capital in excess of par – common stock 5,800,000 Retained earnings 7,916,000 Shares of Pearl Company stock are currently selling on the Midwest Stock Exchange at $20.Prepare the appropriate journal entries for each of the following independent cases. A stock dividend of 10% is declared and issued.arrow_forwardThe following transactions occurred for Villegas Company. 1. Villegas Company was formed on July 1, 2022 by issuing 10,000 shares of its $10 par value common stock for $30 per share. 100,000 shares were authorized by the charter. The company has a fiscal year ending June 30. 2. The company reported a net income of $40,000 during the year ended June 30, 2023. There were no other transactions affecting stockholders' equity for the year ending June 30, 2023. 3. On July 31, 2023, the company purchased on the open market 1,000 of its own shares at a cost of $28 per share. Treasury shares are accounted for under the cost method. 4. A cash dividend of 50 cents per common share was declared on Oct. 15, 2023, and paid on Nov. 15, 2023 to stockholders of record on Nov. 1, 2023. 5. On June 10, 2024, 500 new shares of company common stock were sold at a price of $28 per share. 6. The next day, on June 11, 2024, 600 shares of treasury stock were sold at a price of $29 per share. 7. Net earnings for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Earnings per share (EPS), basic and diluted; Author: Bionic Turtle;https://www.youtube.com/watch?v=i2IJTpvZmH4;License: Standard Youtube License