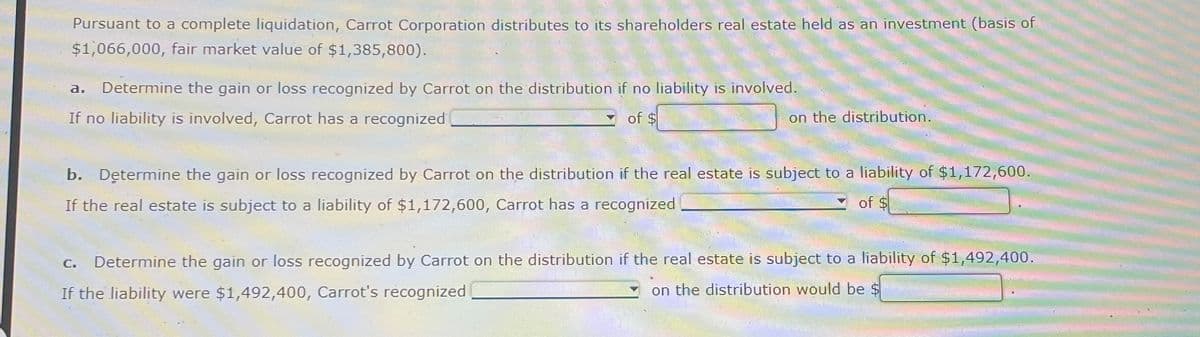

Pursuant to a complete liquidation, Carrot Corporation distributes to its shareholders real estate held as an investment (basis of $1,066,000, fair market value of $1,385,800). a. Determine the gain or loss recognized by Carrot on the distribution if no liability is involved. If no liability is involved, Carrot has a recognized of $ on the distribution. b. Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liability of $1,172,600. If the real estate is subject to a liability of $1,172,600, Carrot has a recognized of $ C. Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liability of $1,492,400. If the liability were $1,492,400, Carrot's recognized on the distribution would be

Pursuant to a complete liquidation, Carrot Corporation distributes to its shareholders real estate held as an investment (basis of $1,066,000, fair market value of $1,385,800). a. Determine the gain or loss recognized by Carrot on the distribution if no liability is involved. If no liability is involved, Carrot has a recognized of $ on the distribution. b. Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liability of $1,172,600. If the real estate is subject to a liability of $1,172,600, Carrot has a recognized of $ C. Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liability of $1,492,400. If the liability were $1,492,400, Carrot's recognized on the distribution would be

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 24P

Related questions

Question

Transcribed Image Text:Pursuant to a complete liquidation, Carrot Corporation distributes to its shareholders real estate held as an investment (basis of

$1,066,000, fair market value of $1,385,800).

a. Determine the gain or loss recognized by Carrot on the distribution if no liability is involved.

If no liability is involved, Carrot has a recognized

of $

on the distribution.

b. Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liability of $1,172,600.

If the real estate is subject to a liability of $1,172,600, Carrot has a recognized

of $

C.

Determine the gain or loss recognized by Carrot on the distribution if the real estate is subject to a liability of $1,492,400.

If the liability were $1,492,400, Carrot's recognized

on the distribution would be

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you