(a) What gross margin percentage was Donald originally expecting to earn on each product, per the information provided above? (Round answers to 2 decimal places, e.g. 52.75%.) Gross margin percentage eTextbook and Media Save for Later Office chair Sit-to-stand desk do % Printer stand do % % Attempts: 0 of 2 used Submit Answer (b) How much of a reduction in gross margin did each product sustain after recognizing the higher costs? (Round answers to 2 decimal places, e.g. 52.75%.) The bill of materials for each product at Donald's Office Supply is very specific, right down to the number of casters needed for each office chair. Donald recognizes how important these documents are for planning purposes, but his operations managers appreciate them as well since they use this information to guide their material requisitions when it's time for production. Here are the budgeted product costs and selling prices, respectively, for the company's three key products: Product Cost Selling Price Office chair $130 $229 Sit-to-stand desk 215 365 Printer stand 110 205 Donald has fine-tuned all cost expectations for his products, and his selling prices are quite stable for each product, as well. So, to say Donald was surprised when his accountant reported significantly less profit margin than what he was expecting is the understatement of the year. According to the accountant, the difference is almost entirely attributable to the significant and recent increase in shipping costs for the company's raw materials. These higher freight costs caused a 20% increase to the budgeted product costs presented above.

(a) What gross margin percentage was Donald originally expecting to earn on each product, per the information provided above? (Round answers to 2 decimal places, e.g. 52.75%.) Gross margin percentage eTextbook and Media Save for Later Office chair Sit-to-stand desk do % Printer stand do % % Attempts: 0 of 2 used Submit Answer (b) How much of a reduction in gross margin did each product sustain after recognizing the higher costs? (Round answers to 2 decimal places, e.g. 52.75%.) The bill of materials for each product at Donald's Office Supply is very specific, right down to the number of casters needed for each office chair. Donald recognizes how important these documents are for planning purposes, but his operations managers appreciate them as well since they use this information to guide their material requisitions when it's time for production. Here are the budgeted product costs and selling prices, respectively, for the company's three key products: Product Cost Selling Price Office chair $130 $229 Sit-to-stand desk 215 365 Printer stand 110 205 Donald has fine-tuned all cost expectations for his products, and his selling prices are quite stable for each product, as well. So, to say Donald was surprised when his accountant reported significantly less profit margin than what he was expecting is the understatement of the year. According to the accountant, the difference is almost entirely attributable to the significant and recent increase in shipping costs for the company's raw materials. These higher freight costs caused a 20% increase to the budgeted product costs presented above.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter4: Activity-based Costing

Section: Chapter Questions

Problem 6E: Eclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a...

Related questions

Question

100%

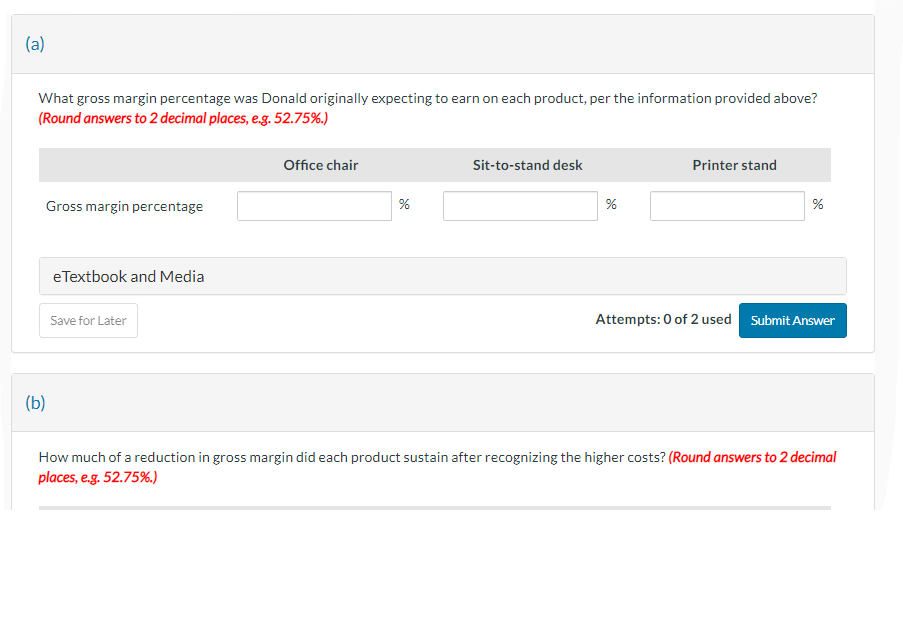

Transcribed Image Text:(a)

What gross margin percentage was Donald originally expecting to earn on each product, per the information provided above?

(Round answers to 2 decimal places, e.g. 52.75%.)

Gross margin percentage

eTextbook and Media

Save for Later

Office chair

Sit-to-stand desk

do

%

Printer stand

do

%

%

Attempts: 0 of 2 used Submit Answer

(b)

How much of a reduction in gross margin did each product sustain after recognizing the higher costs? (Round answers to 2 decimal

places, e.g. 52.75%.)

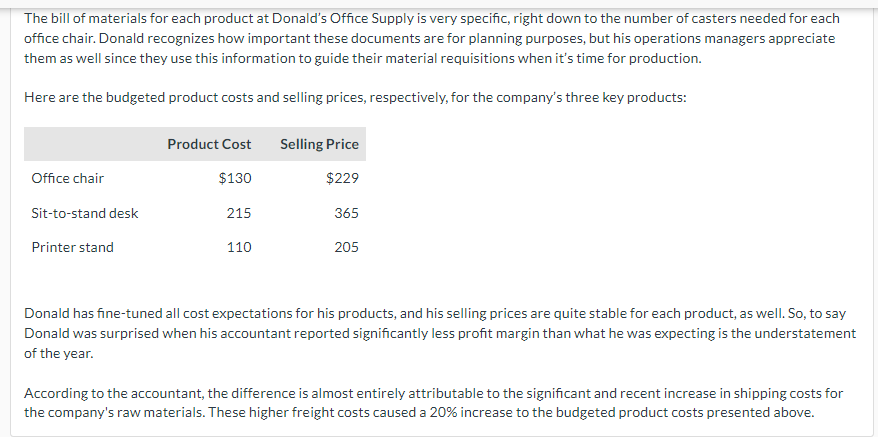

Transcribed Image Text:The bill of materials for each product at Donald's Office Supply is very specific, right down to the number of casters needed for each

office chair. Donald recognizes how important these documents are for planning purposes, but his operations managers appreciate

them as well since they use this information to guide their material requisitions when it's time for production.

Here are the budgeted product costs and selling prices, respectively, for the company's three key products:

Product Cost Selling Price

Office chair

$130

$229

Sit-to-stand desk

215

365

Printer stand

110

205

Donald has fine-tuned all cost expectations for his products, and his selling prices are quite stable for each product, as well. So, to say

Donald was surprised when his accountant reported significantly less profit margin than what he was expecting is the understatement

of the year.

According to the accountant, the difference is almost entirely attributable to the significant and recent increase in shipping costs for

the company's raw materials. These higher freight costs caused a 20% increase to the budgeted product costs presented above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 1 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College