The sales and finance team of a car company is evaluating a new proposed luxury model of its brand that will require an investment of $1Billion in a new machine for car interior decoration. Demand for the company’s car is expected to begin at 100,000 units in year 1, with 10% annual growth thereafter. Production cost will be $40,000 per unit in the first year, and increase by a rate of either 3% or 5% per year as a result of wage increase. Selling price will start at $35,000 and increase by 5% of the production cost. The model will be phased out at the end of year 10. In addition, 0.3%, 2% and 1% of before tax profit per year will be spent on social corporate responsibility, commercial (including promotions) and recalls respectively. Assume taxes will be 30% of yearly profit and that inflation will remain at 0% per year throughout the 10 year of production. Also assume interest rate is expected to be 3% per year in the first 5 years and 5% in the last 5 years. Based on present worth analysis, is the proposed investment profitable if production cost increases by a rate of 3% per year as a result of wage increase? Justify yourBased on present worth analysis, is the proposed investment profitable if production cost increases by a rate of 5% per year as a result of wage increase? Justify your

The sales and finance team of a car company is evaluating a new proposed luxury model of its brand that will require an investment of $1Billion in a new machine for car interior decoration. Demand for the company’s car is expected to begin at 100,000 units in year 1, with 10% annual growth thereafter. Production cost will be $40,000 per unit in the first year, and increase by a rate

of either 3% or 5% per year as a result of wage increase. Selling price will start at $35,000 and increase by 5% of the production cost. The model will be phased out at the end of year 10. In addition, 0.3%, 2% and 1% of before tax profit per year will be spent on social corporate responsibility, commercial (including promotions) and recalls respectively. Assume taxes will be 30% of yearly profit and that inflation will remain at 0% per year throughout the 10 year of production. Also assume interest rate is expected to be 3% per year in the first 5 years and 5% in the last 5 years.

Based on present worth analysis, is the proposed investment profitable if production cost increases by a rate of 3% per year as a result of wage increase? Justify yourBased on present worth analysis, is the proposed investment profitable if production cost increases by a rate of 5% per year as a result of wage increase? Justify your

Present worth computes the existing value of future benefits by discounting future worth with a stated interest rate.

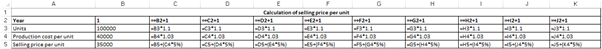

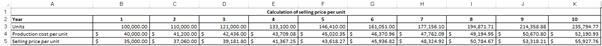

Compute selling price per unit (production cost increases by 3%) as follow:

Result:

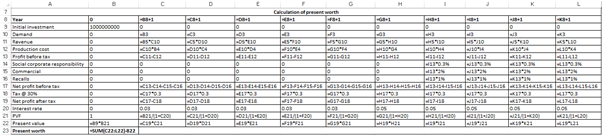

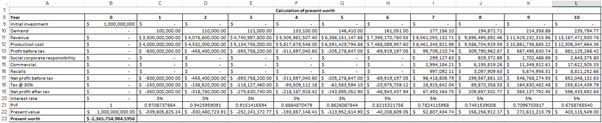

Compute present worth (production cost increases by 3%) as follow:

Result:

Since present worth is negative, proposed investment is not profitable.

Step by step

Solved in 5 steps with 8 images