Binomial model* Over the coming year, Ragwort’s stock price will halve to $50 from its current level of $100 or it will rise to $200. The one-year interest rate is 10%.

- a. What is the delta of a one-year call option on Ragwort stock with an exercise price of $100?

- b. Use the replicating-portfolio method to value this call.

- c. In a risk-neutral world, what is the probability that Ragwort stock will rise in price?

- d. Use the risk-neutral method to check your valuation of the Ragwort option.

- e. If someone told you that in reality there is a 60% chance that Ragwort’s stock price will rise to $200, would you change your view about the value of the option? Explain.

a.

To compute: The delta of one year call option on R stock with a strike price of $100.

Explanation of Solution

The formula to calculate delta is:

The calculation of delta is as follows:

b.

To discuss: Apply the replicating portfolio technique to value this call.

Explanation of Solution

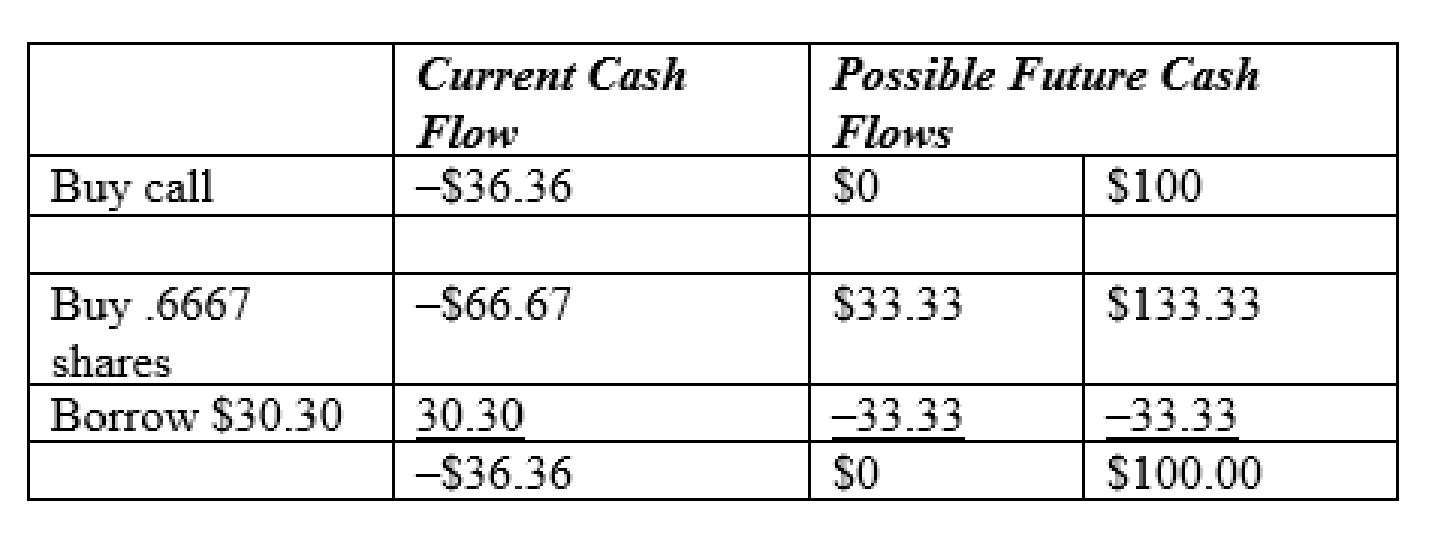

The replicating portfolio technique of valuing call is as follows.

c.

To discuss: The probability of increasing stock R price in a risk neutral world.

Explanation of Solution

The probability of increasing stock R calculated as follows:

The computation as follows:

Foot note: The probability is calculated on the basis of expected return.

d.

To compute: The value of stock R using the risk neutral method.

Explanation of Solution

The option value is calculated using the following formula:

Hence, the value of call is $36.36

e.

To discuss: Whether person X change his option regarding the value of option.

Explanation of Solution

Person X does not change his opinion regarding the value of option. The chance of price increase is most likely higher than the risk- neutral probability, but it does not aid to value the option.

Want to see more full solutions like this?

Chapter 21 Solutions

PRIN.OF CORPORATE FINANCE

Additional Business Textbook Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Corporate Finance

Foundations Of Finance

Foundations of Finance (9th Edition) (Pearson Series in Finance)

Corporate Finance (The Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- 3. A stock has a 15 percent change of moving either up or down per period and is currently priced at $25. Using a one period binomial model, and assuming that the risk-free rate is 10 percent, complete the following. a. Determine the possible stock prices at the end of the first period. b. Calculate the intrinsic values at expiration of an at-the-money European call option. c. Find the value of the option today. d. Construct a hedge by combining a position in stock with a position in the call. Show that the return on the hedge is the risk-free rate regardless of the outcome, assuming that the call sells for the value you obtained in c. e. Determine the rate of return from a riskless hedge if the call is selling for $3.50 when the hedge is initiated.arrow_forwardGiven a American put option, use a binomial tree with monthly steps h=1/12 that is step length. Let S(0) =100 (Stock price) K= 110 (Strike price) r= 0.03 (Risk free-rate) T=1 (year) Volatility= 20%. Constructing a binomial tree?arrow_forward11. Changesto the security market line The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC). Based on the graph, complete the table that follows. (Tool tip: Mouse over the points in the graph to see their coordinates.) REQUIRED RATE OF RETURN (Percent) 20.0 16.0 12.0 8.0 4.0 O Do 0.5 ■ 1.0 RISK (Beta) 1.5 2.0 (?)arrow_forward

- Consider a stock with a current price of $15 that will be worth either $10 or $25 1 year from now. Assume rf = 0% (annual compounding). You have invented a new derivative security called an "inverse", whose payoff in 1 year is 100 divided by the stock price, i.e., payoff =100/S1 . If the beta of the stock is 1.2, what is the beta of this new derivative?arrow_forwardConsider the following data for a certain share. Current Price = S0 = Rs. 80 Exercise Price = E = Rs. 90 Standard deviation of continuously compounded annual return = \sigma = 0.5 Expiration period of the call option = 3 months Risk – free interest rate per annum = 6 percent a. What is the value of the call option? Use the normal distribution table. b. What is the value of a put option?arrow_forwardImagine all investors are risk-neutral and we have the following binomial tree: 0 Stock: So= 80 1 100 72 2 120 90 86.4 64.8 Using the risk-neutral option valuation approach, calculate the price of a two-year put option on this stock with a strike price $92. Assume that the risk-free rate is 3% per year. Also assume the stock does not pay a dividend. Pick the closest number.arrow_forward

- Consider a XYZ stock index spot price is 69 and 7-months forward price is 70. The continuously compounded dividend yield and risk-free interest rate are 3% and 5% respectively. Market maker could take arbitrage opportunity by (long/short) forward contract and (long/short) synthetic forward contract which includes (buying/selling) stock and (borrowing / lending ) money. So the profit at expiration time will be . (Please round your answer to 4 decimal places)arrow_forwardA stock has not been fluctuating much in price. Its average price is $20/share. You expect that the stock price behaves the same way in the next year. A one-year put option is selling for $5, which has an exercise price of $20. Suppose the risk-free rate is 0.05. To make use of your expectation in the future price movement, you establish a straddle strategy to maximize your profits. If the stock price actually ends up at $20 in a year, your profit is $ . Give your answer to 2 decimal places.arrow_forwardaa.3 Consider a two-period binomial model, where each period is 6 months. Assume the stock price is $50.00, = 0.20, r = 0.06 and the dividend yield = 3.5%. What is the lowest strike price where early exercise would occur with an American put option?arrow_forward

- Consider a European call on Procter and Gamble stock (PG) that expires in one period. The current stock price is $120, the strike price is $130, and the risk-free rate is 5%. Assume that PG stock will either go up to $150 (probability = .4), or go down to $90 (probability = .6). Construct a replicating portfolio based on shares of PG stock and a position in a risk-free asset, and compute the price of the call option.arrow_forwardYou model a stock price S(t) using a stochastic process, with t measured in years. Your model implies that the risk-neutral distribution for the stock price at t = 4 has probability density function fs(4)(x) = x-40 {} 50 if 40 < x < 50 else Assume that interest is compounded continuously at nominal rate r = : 2.0%. Calculate the price of the stock at time 0 to the nearest pence. Do not enter the pound sign.arrow_forwardSuppose that Stock A has a beta of 0.7 and Stock B has a beta of 1.2. Which stock should have a higher actual return next year according to the capital asset pricing model? Please explain briefly.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781285065137Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning