Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

4th Edition

ISBN: 9780134083278

Author: Jonathan Berk, Peter DeMarzo

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3.A, Problem A.1P

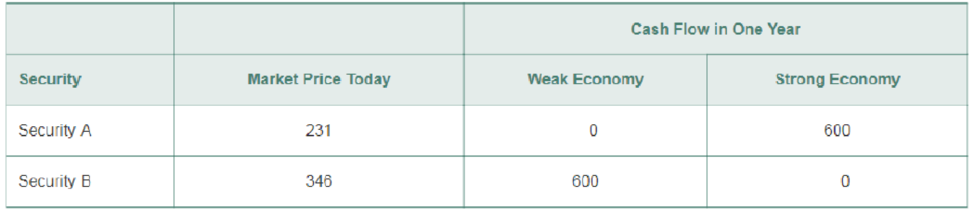

The table here shows the no-arbitrage prices of securities A and B that we calculated.

- a. What are the payoffs of a portfolio of one share of security A and one share of security B?

- b. What is the market price of this portfolio? What expected return will you earn from holding this portfolio?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the equation for the Security Market Line? Define each term. If an asset has a beta of 2.0, what type of return should it realize compared to the market portfolio?

Draw the profit diagram of the portfolio above (and clearly state any assumptions you make).Recall that the profit is equal to the difference between the payoff of the portfolio at expiry (maturity) date and the cost of the portfolio. Is the cost of the portfolio positive?

Suppose you observe the following situation on two securities:Security Beta Expected Return Pete Corp. 0.8 0.12 Repete Corp. 1.1 0.16 Assume these two securities are correctly priced. Based on the CAPM, what is the return on the market?

Chapter 3 Solutions

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Ch. 3.1 - Prob. 1CCCh. 3.1 - If crude oil trades in a competitive market, would...Ch. 3.2 - How do you compare costs at different points in...Ch. 3.2 - Prob. 2CCCh. 3.3 - What is the NPV decision rule?Ch. 3.3 - Why doesnt the NPV decision rule depend on the...Ch. 3.4 - Prob. 1CCCh. 3.4 - Prob. 2CCCh. 3.5 - If a firm makes an investment that has a positive...Ch. 3.5 - Prob. 2CC

Ch. 3.5 - Prob. 3CCCh. 3.A - The table here shows the no-arbitrage prices of...Ch. 3.A - Suppose security Chas a payoff of 600 when the...Ch. 3.A - Prob. A.3PCh. 3.A - Prob. A.4PCh. 3.A - Prob. A.5PCh. 3.A - Consider a portfolio of two securities: one share...Ch. 3.A2 - Why does the expected return of a risky security...Ch. 3.A2 - Prob. 2CCCh. 3.A3 - Prob. 1CCCh. 3.A3 - Prob. 2CCCh. 3 - Honda Motor Company is considering offering a 2000...Ch. 3 - You are an international shrimp trader. A food...Ch. 3 - Prob. 3PCh. 3 - Prob. 4PCh. 3 - You have decided to take your daughter skiing in...Ch. 3 - Suppose the risk-free interest rate is 4%. a....Ch. 3 - You have an investment opportunity in Japan. It...Ch. 3 - Your firm has a risk-free investment opportunity...Ch. 3 - You run a construction firm. You have just won a...Ch. 3 - Your firm has identified three potential...Ch. 3 - Your computer manufacturing firm must purchase...Ch. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - An American Depositary Receipt (ADR) is security...Ch. 3 - Prob. 15PCh. 3 - An Exchange-Traded Fund (ETF) is a security that...Ch. 3 - Consider two securities that pay risk-free cash...Ch. 3 - Prob. 18P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose an investor observes an upward term structure of interest rate. Answer the followingquestions. (a) According to the expectation hypothesis, what will be the investor’s forecast about futurechange of interest rate (increase, decrease or unchanged)? (b) What will the investor say about the future change of interest rate according to liquiditypreference theory? Explain your argument.arrow_forwardAn efficient capital market is best defined as a market in which security prices reflect which one of the following? Multiple Choice A Current inflation B A risk premium C All available information D The historical arithmetic rate of return E The historical geometric rate of returnarrow_forwardShow detailed steps to solve the following question. Consider a portfolio comprised of three securities in the following proportions and with the indicated security beta. a.) What is the portfolios beta? b.) Wht is the portfolios expected return?arrow_forward

- What is the Security Market Line (SML)? How isbeta related to a stock’s required rate of return?arrow_forwardWhat are the differences between stocks and bonds in terms of predicted future payments? Which sort of investment is regarded to be riskier (stocks or bonds)? Given your knowledge, which investment (stocks or bonds) do you believe is often referred to as "fixed income"?arrow_forwardIs it possible to construct a portfolio of real-world stocks that has a required return equalto the risk-free rate? Explain.arrow_forward

- What does vega measure? What can you tell from vega value? Can the vega of a derivatives portfolio be changed by taking a position in the underlying asset? Explain your answer.arrow_forwardAssume that using the Security Market Line(SML) the required rate of return(RA)on stock A is found to be halfof the required return (RB) on stock B. The risk-free rate (Rf) is one-fourthof the required return on A. Return on market portfolio is denoted by RM. Find the ratioof betaof A(A) tobeta of B(B). Thank you for your help.arrow_forwardA) What does the single index model estimate? B) What is the market risk premium? C) What does Beta show? D) What are all the possible values of Beta and what do they mean?arrow_forward

- Plot the Security Market Line (SML) b) Superimpose the CAPM’s required return on the SML c) Indicate which investments will plot on, above and below the SML? d) If an investment’s expected return (mean return) does not plot on the SML, what doesit show? Identify undervalued/overvalued investments from the graph (arrow_forwardGiven that the formula for CAPM is Expected return= risk free rate + Beta*(Return on market - risk free rate), Security A has a beta of 1.16 and an expected return of .1137 and Security B has a beta of .92 and expected return of .0984. If these securities are assumed to be correctly priced, what is their risk free rate? Based on CAPM, what is the return on the market?arrow_forwardQuestion 2 a) Plot the Security Market Line (SML).b) Superimpose the CAPM’s required return on the SML.c) Indicate which investments will plot on, above and below the SML?d) If an investment’s expected return (mean return) does not plot on the SML, what doesit show? Identify undervalued/overvalued investments from the grapharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 8 Risk and Return; Author: Michael Nugent;https://www.youtube.com/watch?v=7n0ciQ54VAI;License: Standard Youtube License