FUNDAMENTALS OF CORPORATE FINANCE

10th Edition

ISBN: 9781260013962

Author: BREALEY

Publisher: RENT MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 1QP

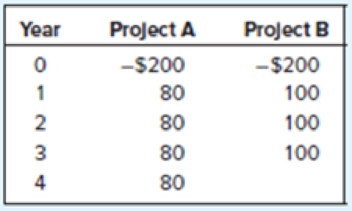

IRR/NPV. If the opportunity cost of capital is 11%. Which of these projects is worth pursuing?

Expert Solution & Answer

Summary Introduction

To find: The project that is worth pursuing if the opportunity cost of capital is 11%.

Explanation of Solution

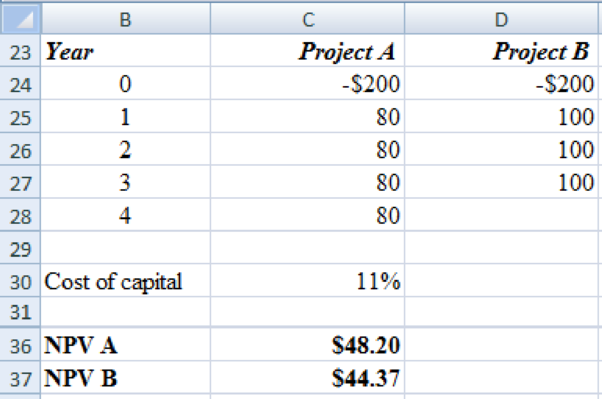

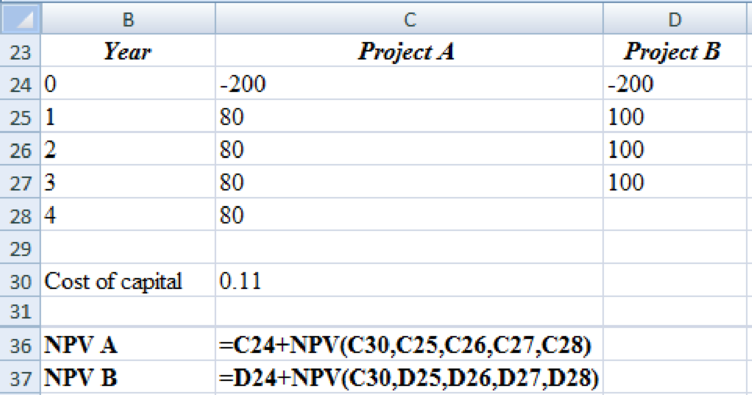

Computation of the project that is worth continuing:

Thus both the projects are worth pursuing as they are with a positive net present value.

Excel calculations:

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

A project has an investment cost of $200,000 and a profitability index of 1.6. What is the net present value of the project? NPV=

Identify the IRR's for each project. If cost of capital is 11%, which project will you choose?

Briefly explain.

NPV

N

Y

29%

46%

10

10

20

20

30

Q1) How much is the Profitability Index?

Q2) What is the Discounted Payback period of the project?

Q3) What is the NPV of the Project?

Chapter 8 Solutions

FUNDAMENTALS OF CORPORATE FINANCE

Ch. 8 - IRR/NPV. If the opportunity cost of capital is...Ch. 8 - Prob. 2QPCh. 8 - Prob. 3QPCh. 8 - Prob. 4QPCh. 8 - Prob. 5QPCh. 8 - Prob. 6QPCh. 8 - Prob. 7QPCh. 8 - Prob. 8QPCh. 8 - Prob. 9QPCh. 8 - Prob. 10QP

Ch. 8 - Prob. 11QPCh. 8 - NPV/IRR. A new computer system will require an...Ch. 8 - Prob. 13QPCh. 8 - Prob. 15QPCh. 8 - Prob. 16QPCh. 8 - Prob. 17QPCh. 8 - Prob. 18QPCh. 8 - Prob. 19QPCh. 8 - Prob. 20QPCh. 8 - Prob. 21QPCh. 8 - Prob. 22QPCh. 8 - Prob. 23QPCh. 8 - Prob. 24QPCh. 8 - Prob. 25QPCh. 8 - Prob. 26QPCh. 8 - Prob. 27QPCh. 8 - Prob. 28QPCh. 8 - Prob. 29QPCh. 8 - Prob. 31QPCh. 8 - Prob. 32QPCh. 8 - Prob. 33QPCh. 8 - Prob. 34QPCh. 8 - Prob. 35QPCh. 8 - Prob. 36QPCh. 8 - Prob. 37QPCh. 8 - Prob. 38QP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- What are the internal rates of return (IRR) on the three projects? Does the IRR rule in this case give the same decision as NPV? How do you know? If the opportunity cost of capital is 11%, what is the profitability index for each project? Please analyze if, in general, decisions based on the profitability index are consistent with decisions based on NPV. What is the most generally accepted measure to choose between the projects? Please justify your answer. Project A -5000 +1000 +1000 +3000 0 B -1000 0 +1000 +2000 +3000 C -5000 +1000 +1000 +3000 +5000 I will need full analysis (qualitative examples and references citations and examples of relative current investments of big companies.arrow_forwardCalculate internal Rate of Return of the project. Should the project be accepted? If reinvestment rate assumption of IRR is changed to cost of capital 11% , what should the modified rate of return ( MIRR)?arrow_forward3. You are considering a project that has an initial outlay of $1million. The profitability index of the project is 2.24. What is the NPV of the project?arrow_forward

- What are the internal rates of return (IRR) on the three projects? Does the IRR rule in this case give the same decision as NPV? How do you know? If the opportunity cost of capital is 11%, what is the profitability index for each project? Please analyze if, in general, decisions based on profitability index are consistent with decisions based on NPV. What is the most generally accepted measure to choose between the projects? Please justify your answer.arrow_forwardConsider an investment project with the following net cash flows: What would be the value of X if the project's IRR is 10%?arrow_forwardK Internal rate of return and modified internal rate of return For the project shown in the following table,, calculate the internal rate of return (IRR) and modified internal rate of return (MIRR). If the cost of capital is 13.04%, indicate whether the project is acceptable according to IRR and MIRR. The project's IRR is %. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Initial investment (CFO) Year (t) $80,000 Cash inflows (CF₂) 1 $10,000 2345 $25,000 $10,000 $15,000 $45,000 Print Done -arrow_forward

- a). When ε= 15% and MARR = 20% per year, determine whether the project (whose total cash flow diagram is shown below) is acceptable using ERR b). What is the IRR of the project ?arrow_forwardUsing a MARR of 12%, find the external rate of return (ERR) for the following cash flow. Is this project economically attractive?arrow_forwardWhich of the following comes closest to the net present value (NPV) of a project whose initial investment is $5 and which produces two cash flows: the first at the end of year 2 of $3 and the second at the end of year 4 of $7? The required rate of return is 13%? Select one: a. $1.84 b. $0 c. $1.64 d. $2.05 e. $2.26arrow_forward

- Profitability index. Given the discount rate and the future cash flow of each project listed in the following table, , use the PI to determine which projects the company should accept. ..... What is the Pl of project A? (Round to two decimal places.)arrow_forwardFind the external rate of return (ERR) for the following project when the external reinvestment rate is $ = 10% (equal to the MARR). Is this an acceptable project?arrow_forwardInternal rate of return and modified internal rate of return For the project shown in the following table,, calculate the internal rate of return (IRR) and modified internal rate of return (MIRR). If the cost of capital is 12.13%, indicate whether the project is acceptable according to IRR and MIRR. The project's IRR is %. (Round to two decimal places.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Initial investment (CF) Year (t) 1 2 3 4 5 Print $70,000 Cash inflows (CFt) $15,000 $25,000 $25,000 $15,000 $10,000 Done Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Working capital explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=XvHAlui-Bno;License: Standard Youtube License