Concept explainers

Income Statement and

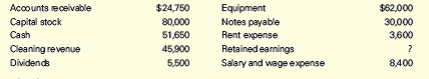

Fort Worth Corporation began business in January 2016 as a commercial carpet-cleaning and drying service. Shares of stock were issued to the owners in exchange for cash. Equipment was purchased by making a down payment in cash and signing a note payable for the balance. Services are performed for local restaurants and office buildings on open account, and customers are given 15 days to pay their accounts. Rent for office and storage facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Fort Worth Corporation at the end of its first month of operations:

Required

- Prepare an income statement for the month ended January 31, 2016.

- Prepare a balance sheet at January 31, 2016.

- What information would you need about Notes Payable to fully assess Fort Worth’s longterm viability? Explain your answer.

Trending nowThis is a popular solution!

Chapter 1 Solutions

Financial Accounting: The Impact on Decision Makers

- Income Statement and Balance Sheet Green Bay Corporation began business in July 2016 as a commercial fishing operation and a passenger service between islands. Shares of stock were issued to the owners in exchange for cash. Boats were purchased by making a down payment in cash and signing a note payable for the balance. Fish are sold to local restaurants on open account, and customers are given 15 days to pay their account. Cash fares are collected for all passenger traffic. Rent for the dock facilities is paid at the beginning of each month. Salaries and wages are paid at the end of the month. The following amounts are from the records of Green Bay Corporation at the end of its first month of operations: Required Prepare an income statement for the month ended July 31, 2016. Prepare a balance sheet at July 31, 2016. What information would you need about Notes Payable to fully assess Green Bays long-term viability? Explain your answer.arrow_forwardStatsen Company, which prepares financial reports at the end of the calendar year, established a branch on July 1, 2020. The following transactions occurred during the formation of the branch and its first six months of operations, ending December 31, 2020. 1. The Home Office sent $35,000 cash to the branch to begin operations. 2. The Home Office shipped inventory to the branch. Intercompany billings totaled $75,000, which was the Home Office's cost. 3. The branch acquired merchandise display equipment which cost $15,000 on July 1, 2020. (Assume that branch fixed assets are carried on the home office books). 4. The branch purchased inventory costing $53,750 from outside vendors on account. 5. The branch had credit sales of $106,250 and cash sales of $43,750. Requirements: 1. Prepare journal entries in the books of the home office and in the books of the branch office for the above transactionarrow_forwardEverything You Need Warehouse Company recognizes membership fee revenues over the term of the membership, which is 12 months. If their Unearned Membership Fee Revenue account had a balance of $2,400 million on January 31, 2016, and $2,200 million on January 31, 2017 and the company received membership fees in cash of $4,400 million during the year, what amount was recognized as Membership Fee Revenue for the fiscal year? Select one: A. $4,600 million B. $4,280 million C. $4,216 million D. $8,560 millionarrow_forward

- GJ started operating his new salon business (Sir George Salon) during 2017. He provides services for corporate accounts with 60-day payment term. He submits the following data in 2018: Supplies inventory, 1/1/2018 50,000 Supplies inventory, 12/31/2018 80,000 Revenues 3,000,000 Accounts receivable, Jan. 1, 2018 500,000 Accounts receivable, Dec. 31, 2018 700,000 Purchase of supplies from VAT registered entities (net) 100,000 Purchase of supplies from non-VAT registered entities 50,000 Determine the following: What is the applicable business tax for the taxpayer? How much is the correct business tax due? Assume the taxpayer is non-VAT registered, how much is the VAT payable for the year? Assume the taxpayer is VAT registered, how much is the VAT payable for the year?arrow_forwardIn providing accounting services to small businesses, you encounter the following situations. 1. Grainger Corporation rings up cash sales and sales taxes separately on its cash register. On April 10, the register totals are pre-tax sales of sales $5,200 plus GST of $300 and PST of $400. 2. Darby Corporation receives its annual property tax bill in the amount of $8,100 on May 31. 3. (i) During the month of March, Neufeld Corporation’s employees earned gross salaries of $60,400. Withholdings deducted from employee earnings related to these salaries were $2,950 for CPP, $1,068 for EI, $7,780 for income taxes, and $370 for union dues. (ii) Neufeld’s payroll costs for the week were $2,950 for CPP and $1,495 for EI. Prepare the journal entries to record the above transactions. (Round answers to 0 decimal places, e.g. 5,275.) Sr no. Account Titles and Explanation Debit Credit 1. 2. 3…arrow_forwardstatements The following events apply to The Pizza Factory for the 2011 fiscal year: 1. The company started when it acquired $18,000 cash from the issue of common stock. 2. Purchased a new pizza oven that cost $15,000 cash. 3. Earned $26,000 in cash revenue. 4. Paid $13,000 cash for salaries expense. 5. Paid $6,000 cash for operating expenses. 6. Adjusted the records to reflect the use of the pizza oven. The oven, purchased on January 1, 2011, has an expected useful life of five years and an estimated salvage value of $3,000. Use straight-line depreciation. The adjusting entry was made as of December 31, 2011. Required a. Record the events in general journal format and post to T-accounts. b. What amount of depreciation expense would The Pizza Factory report on the 2012 income statement? c. What amount of accumulated depreciation would The Pizza Factory report on the December 31, 2012, balance sheet? d. Would the cash flow from operating activities be affected by depreciation in 2012?arrow_forward

- In providing accounting services to small businesses, you encounter the following situations. Sunland Corporation rings up cash sales and sales taxes separately on its cash register. On April 10, the register totals are pre-tax sales of sales $6,100 plus GST of $305 and PST of $488. 2. Jennifer Corporation receives its annual property tax bill in the amount of $8,400 on May 31. (i) During the month of March, Ayayai Corporation's employees earned gross salaries of $60,000. Withholdings deducted from employee earnings related to these salaries were $3,254 for CPP, $948 for El, $7,820 for income taxes. (ii) Ayayai's employer portions were $3,254 for CPP and $1,327 for El for the month. 1. 3. Prepare the journal entries to record the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit…arrow_forwardThe accounting records and bank statement of Orison Supply Store provide the following information at the end of April. The closing 'Cash' account balance was $28,560, and the bank statement shows a closing balance of $32,000. On reviewing the bank statement it is found an account customer has deposited $2,000 into the bank account for a March sale and the monthly insurance premium of $4,500 was automatically charged to the account. Interest of $5,10 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $1,500 to a supplier has been recorded twice in the accounts. After the ,calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?arrow_forwardPrepare the JOURNAL ENTRY to record the transactions of DALISAY Tailoring Shop for the month of January 2017 and POST IT TO THE LEDGER. 1 Mr. Dalisay made the following investment: i. Cash ii. SEWING Machine P80,000 20,000 Purchased furniture for cash , P10,000. Purchased supplies for cash,P3,000. Paid the January 2017 rent, P2,000. Acquired additional equipment (two sewing machine @ P15,000 each). Terms: P10,000 down,the balance 3 5 7 8 On six monthly installment. 15 Paid the semi-monthly payroll,P2,000 with the following deductions; SSS Premium Payable,P66.00, Medicare Payable,P12,00, With holding Taxes Payable,P14.00. 15 Received cash for services rendered,P15,000. 20 Sent a bill to customer for services rendered,P5,000. 22 Received a note for a customer for services rendered,P5,000. 27 Purchased supplies for cash,P500. 31 Paid salaries for two weeks,P2,000. (use same deductions on January 15,2017) 31 Withdrew cash for personal use, P500.00.arrow_forward

- Indicate for each transaction the account(s) and amount(s) that should be debited and credited. Factory superintendent's salary for 2015 was P240,000. During 2015, the superintendent spent the first six months supervising construction of the new building; the next three months supervising the installation of productive machinery in the new building, and the last three months supervising operations in the new building. Paid P36,000 interest on cash borrowed during construction. The Cash was used in payment for the new building. Cost of grading and paving parking space and walks behind new building, P95,000. Paid P9,000 insurance premium for "protection" during construction of the building.arrow_forwardThe following transactions occurred during 2021 for the Beehive Honey Corporation: Feb. 1 Borrowed $12,000 from a bank and signed a note. Principal and interest at 10% will be paid on January 31, 2022. Apr. 1 Paid $3,600 to an insurance company for a two-year fire insurance policy. July 17 Purchased supplies costing $2,800 on account. The company records supplies purchased in an asset account. At the year-end on December 31, 2021, supplies costing $1,250 remained on hand. Nov. 1 A customer borrowed $6,000 and signed a note requiring the customer to pay principal and 8% interest on April 30, 2022. Required:1. Record each transaction in general journal form.2. Prepare any necessary adjusting entries at the year-end on December 31, 2021. No adjusting entries were recorded during the year for any item.arrow_forwardThe following were selected from among the transactions completed by Caldemeyer Co. during the current year. Caldemeyer sells and installs home and business security systems. Jan. 3 Feb. 10 13 Mar. 12 14 Apr. 3 May 11 13 July 12 Aug. 1 Oct. 5 15 Loaned $18,000 cash to Trina Gelhaus, receiving a 90-day, 8% note. Sold merchandise on account to Bradford & Co., $24,000. The cost of the goods sold was $14,400. Sold merchandise on account to Dry Creek Co., $60,000. The cost of goods sold was $54,000. Accepted a 60-day, 7% note for $24,000 from Bradford & Co. on account. Accepted a 60-day, 9% note for $60,000 from Dry Creek Co. on account. Received the interest due from Trina Gelhaus and a new 120-day, 9% note as a renewal of the loan of January 3. (Record both the debit and the credit to the notes receivable account.) Received from Bradford & Co. the amount due on the note of March 12. Dry Creek Co. dishonored its note dated March 14. Received from Dry Creek Co. the amount owed on the…arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning