College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 2PB

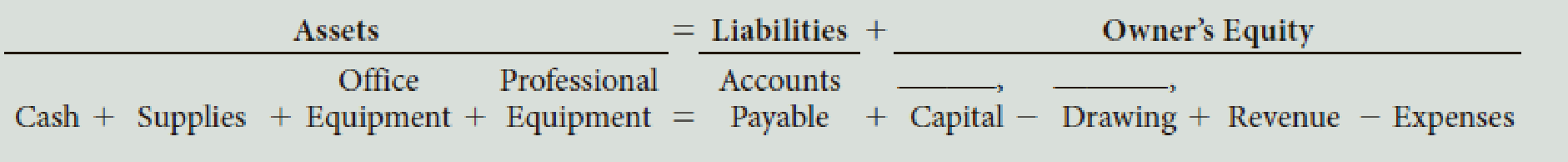

In March, K. Haas, M.D., established the Haas Sports Injury Clinic. The clinic’s account headings are presented below. Transactions completed during the month of March follow.

- a. Haas deposited $48,000 in a bank account in the name of the business.

- b. Paid the rent for the month, $2,200, Ck. No. 1000.

- c. Bought supplies for cash from Medco Co., $2,138.

- d. Bought professional equipment on account from Med-Tech Company, $18,000.

- e. Bought office equipment on account from Equipment Depot, $1,955.

- f. Sold professional services for cash, $8,960.

- g. Paid on account to Med-Tech Company, $3,000, Ck. No. 1001.

- h. Received and paid the bill for utilities, $472, Ck. No. 1002.

- i. Paid the salary of the assistant, $1,738, Ck. No. 1003.

- j. Sold professional services for cash, $10,196.

- k. Haas withdrew cash for personal use, $3,500, Ck. No. 1004

Required

- 1. Record the transactions and the balance after each transaction.

- 2. Total the left side of the

accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Catherine’s Cookies has a beginning balance in the Accounts Payable control total account of $8,200. In the cash disbursements journal, the Accounts Payable column has total debits of $6,800 for November. The Accounts Payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information, what is the ending balance in the Accounts Payable account in the general ledger?

Record the following transactions in the sales journal:

Jan. 15

Invoice # 325, sold goods on credit for $2,400, to Maroon 4, account # 4501

Jan. 22

Invoice #326, sold goods on credit for $3,500 to BTS, account # 5032

Jan. 27

Invoice #327, sold goods on credit for $1,250 to Imagine Fireflies, account # 3896

Prepare the following journal entry, all transactions that occurred in January:

The Corporation purchased a Delivery Van for customer deliveries. The Delivery Van cost $21,400.

A down payment of cash in the amount of $5,000 was paid to the Car Dealership, and a promissory note was signed for the remaining amount owed.

Rick Rambis operates a ski lodge center at Bull Mountain in Alaska. He has just received the monthly bank statement at October 31 from Bull National Bank. The bank statement shows an ending balance at October 31 of $750. The following items are listed on the statement:1. The bank collected rent revenue for Rick in the amount of $330.2. Service charge of $10.3. Two NSF checks from customers totaling $110.4. Printing check charge of $11.In reviewing his cash records and the bank statement, Rick identifies the following:1. Outstanding checks totaling $603.2. Deposit in transit on October 31 of $1,770.3. An error made by Rick: Rick recorded a salary check for $31 but it cleared the bank at $310.Rick’s cash records show a balance on October 31 of $1,997.Requireda) Reconcile the bank account.b) Prepare journal entries that should be made as a result of the bank reconciliation.c) What should the balance in Rick’s Cash account be after the reconciliation?d) What total amount of cash should the…

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - In July of this year, M. Wallace established a...Ch. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - P. Schwartz, Attorney at Law, opened his office on...Ch. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

This year, Prewer Inc. received a 160,000 dividend on its investment consisting of 16 percent of the outstandin...

Principles Of Taxation For Business And Investment Planning 2020 Edition

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

Dave Nelson recently retired at age 48, courtesy of the numerous stock options he had been granted while presid...

Managerial Accounting: Creating Value in a Dynamic Business Environment

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

How would the decision to dispose of a segment of operations using a split-off rather than a spin-off impact th...

Advanced Financial Accounting

The managers of an organization are responsible for performing several broad functions. They are ______________...

Principles of Accounting Volume 2

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Elijah started the month with cash at bank of $1,780. What was the balance carried forward after accounting for the following transactions in June? (1) Elijah withdrew $200 per week to cover living expenses. (2) A customer paid for goods with a list price of $600, less trade discount of 5%. (3) An amount of $400 was received from a credit customer. (4) Bankings of $1,200 from canteen vending machines.arrow_forwardJohn Grey owns Grey's Snow Plowing. In October, Grey's collects $12,000 cash for 6 commercial accounts for which he will provide snowplowing for the entire season. To record this transaction, Grey will enter which of the following entries? (Check all that apply.) Debit to Unearned Plowing Revenue Debit to Plowing Revenue Credit to Cash Credit to Unearned Plowing Revenue Debit to Cash Check all that apply. Credit to Plowing Revenuearrow_forwardSunrise Coffee Shop, in an effort to streamline its accounting system, has decided to utilize a cash receipts journal. Record the following transactions for the first two weeks in March, total the columns, and include the posting references. A partial chart of accounts is given below. After recording the transactions, indicate if there are any additional columns you would add to this journal. March 1 Cash received for beverages, $375. Cash received for food, $250. Cash received for customer sales of Sunrise's signature coffee mugs, $130. Cash received for beverages, $480. Cash received for food, $325. Cash received for customer sales of Sunrise's signature coffee mugs, $115. 10 Cash received on account from Central.com, $900. Chart of Accounts (Partial) 10 Cash 41 Beverage Revenue 12 Accounts Receivable 42 Food Revenue 15 Retail Items 43 Retail Revenue MacBook Air DII 80 F10 F11 F12 esc F6 F7 F8 F9 F1 F2 F3 F4 F5 23 & 3 4 5 8 тarrow_forward

- Catherine's cookies has a beginning balance in the account payable control total account of $8,200. In the cash disbursements journal, the account payable column has total debits of $6,800 for November. The accounts payable credit column in the purchases journal reveals a total of $10,500 for the current month. Based on this information what is the ending balance in the accounts payable account in the general ledger?arrow_forwardFollowing are some transactions and events of Business Solutions. Feb. 26 The company paid cash to Lyn Addie for eight days' work at $130 per day. Mar. 25 The company sold merchandise with a $2,200 cost for $2,900 on credit to Wildcat Services, invoice dated March 25. Required:1. Assume that Lyn Addie is an unmarried employee. Her $1,040 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $104. Compute her net pay for the eight days' work paid on February 26. (Round your answer to 2 decimal places. Do not round intermediate calculations.)2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. (Round your answers to 2 decimal places. Do not round intermediate calculations.)3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits…arrow_forwardKathy Concepcion operates KC, a perfume and soap store. The company uses special journals. KC provides a special column for 12% VAT in its sales and purchases journal. VAT is included in the purchases, freight and sales amounts. All collections are immediately deposited. All payments amounting to $5,000 and above are made by checks. During May, the following transactions were completed: May 1 – Invested cash of $250,000 and merchandise of $50,000 to open the business. Deposited $200,000 of the cash investment with Citibank May 2 – Signed a contract of lease with Robinson’s Landholdings and made an advance payment for two month’s rent, $18,000. Check no. 201. Voucher 101. Paid for taxes and licenses to the BIR, $1,200 May 3 – Purchased merchandise on account from Subic, $ 13,440 Terms: 2/10, n/30. Purchase Invoice 422 May 5 – Purchased store supplies on account from Goodwill Bookstore, $1,792. Terms: 1/10, n/30. Purchase Invoice 422 May 8 – Sold merchandise on account to Rustan, $11,760…arrow_forward

- You are the assistant controller in charge of general ledger accounting at Linebarger Bottling Company. Your company has a large loan from an insurance company. The loan agreement requires that the company's cash account balance be maintained at $200,000 or more, as reported monthly. On June 30, the cash balance is $80,000, which you report to Lisa Infante, the financial vice president. Lisa excitedly instructs you to keep the cash receipts book open for one additional day for purposes of the June 30 report to the insurance company. Lisa says, “If we don't get that cash balance over $200,000, we'll default on our loan agreement. They could close us down, put us all out of our jobs!” Lisa continues, “I talked to Oconto Distributors (one of Linbarger's largest customers) this morning. They said they sent us a check for $150,000 yesterday. We should receive it tomorrow. If we include just that one check in our cash balance, we'll be in the clear. It's in the mail!” a. Who will suffer…arrow_forwardIn July of this year, M. Wallace established a business called Wallace Realty. The account headings are presented below. Transactions completed during the month follow. a. Wallace deposited 24,000 in a bank account in the name of the business. b. Paid the office rent for the current month, 650, Ck. No. 1000. c. Bought office supplies for cash, 375, Ck. No. 1001. d. Bought office equipment on account from Dellos Computers, 6,300. e. Received a bill from the City Crier for advertising, 455. f. Sold services for cash, 3,944. g. Paid on account to Dellos Computers, 1,500, Ck. No. 1002. h. Received and paid the bill for utilities, 340, Ck. No. 1003. i. Paid on account to the City Crier, 455, Ck. No. 1004. j. Paid truck expenses, 435, Ck. No. 1005. k. Wallace withdrew cash for personal use, 1,500, Ck. No. 1006. Required 1. Record the transactions and the balance after each transaction. 2. Total the left side of the accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.arrow_forwardOmega Company sells computers. The total cash count for March 15 was $875. Omega maintains a Change Fund of $100. Which of the following is the journal entry to record the day's receipts? a.Debit Cash by $875 and credit Sales by $875 b.Debit Cash by $775 and credit Sales by $775 c.Debit Sales by $875 and credit Cash by $875 d.Debit sales by $775 and credit Cash by $775arrow_forward

- You have the following transactions the last few days of April. You stop by your uncle's gas station to refill both gas cans for your company, Watson's Landscaping. Your uncle adds the total of $28 to your account. Apr. 25 You record another week's revenue for the lawns mowed over the past week. You earned $1,200. You received cash equal to 75% of your revenue. Apr. 26 You pay your local newspaper $35 to run an advertisement in this week's paper. You make a $25 payment on account. Apr. 27 Apr. 29 A. Prepare the necessary journal entries for these four transactions. B. Explain why you debited and credited the accounts you did. C. What will be the new balance in each account used in these entries?arrow_forwardFollowing are some transactions and events of Business Solutions. February 26 The company paid cash to Lyn Addie for eight days' work at $120 per day. March 25 The company sold merchandise with a $2,100 cost for $3,300 on credit to Wildcat Services, invoice dated March 25. Required: 1. Assume that Lyn Addie is an unmarried employee. Her $960 of wages have deductions for FICA Social Security taxes, FICA Medicare taxes, and federal income taxes. Her federal income taxes for this pay period total $96. Compute her net pay for the eight days' work paid on February 26. 2. Record the journal entry to reflect the payroll payment to Lyn Addie as computed in part 1. 3. Record the journal entry to reflect the (employer) payroll tax expenses for the February 26 payroll payment. Assume Lyn Addie has not met earnings limits for FUTA and SUTA (the FUTA rate is 0.6% and the SUTA rate is 5.4% for the company). 4. Record the entries for the merchandise sold on March 25 if a 4% sales tax rate applies.…arrow_forwardHome Office collected 100,000 from Branch’s customers on account. Requirements:a. Prepare the journal entries for both the Home Office and Branch books based on theabove transactions.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY