Cortalo, Inc., manufactures riding lawn mowers. Cortalo uses JIT manufacturing and carries insignificant levels of inventory. Cortalo manufactures everything needed for the riding lawn mowers except for the engines. Several sizes of mowers are produced. The most popular line is the small mower line. The engines for the small mower line are purchased from two sources: Verity Engines and Villa Machining. The Verity engine is the more expensive of the two sources and has a price of $330. The Villa engine is $297 per unit. Cortalo produces and sells 13,200 units of the small mower. Of the 13,200 engines purchased, 2,400 are purchased from Verity Engines, and 10,800 are purchased from Villa Machining. Although Linda Vasquez, production manager, prefers the Verity engine, Mark Shorts, purchasing manager, maintains that the price difference is too great to buy more than the 2,400 units currently purchased. Mark, however, does want to maintain a significant connection with Verity just in case the less expensive source cannot supply the needed quantities. Even though Linda understands the price argument, she has argued in many meetings that the quality of the Verity engine is worth the price difference. Mark remains unconvinced.

Li Sun, controller, has recently overseen the implementation of an activity-based costing system. He has indicated that an ABC analysis would shed some light on the conflict between production and purchasing. To support this position, the following data have been collected:

- I. Activity cost data:

aAll units are tested after assembly, and a certain percentage are rejected because of engine failure.

bDefective engines are removed, replaced (supplier will replace any failed engine), and retested before being sold to customers. Engine failure often causes collateral damage, and other parts need to be remanufactured and replaced before the unit is again functional.

cDue to late or failed delivery of engines.

dRepair work is for units under warranty and almost invariably is due to engine failure. Repair usually means replacing the engine. This cost plus labor, transportation, and other costs make warranty work very expensive.

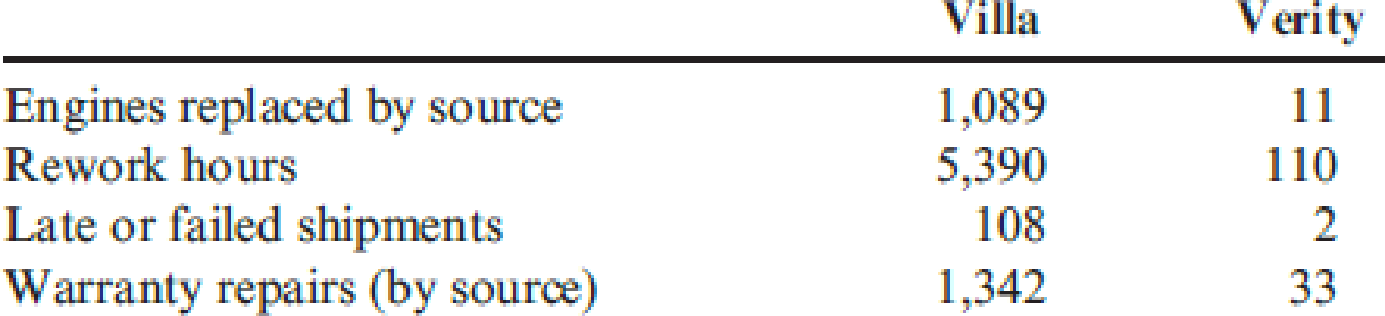

- II. Supplier data:

Upon hearing of the proposed ABC analysis, Linda and Mark were both supportive. Mark, however, noted that even if the analysis revealed that the Verity engine was actually less expensive, it would be unwise to completely abandon Villa. He argued that Verity may be hard pressed to meet the entire demand. Its productive capacity was not sufficient to handle the kind of increased demand that would be imposed. Additionally, having only one supplier was simply too risky.

Required:

- 1. Calculate the total supplier cost (acquisition cost plus supplier-related activity costs). Convert this to a per-engine cost to find out how much the company is paying for the engines. Which of the two suppliers is the low-cost supplier? Explain why this is a better measure of engine cost than the usual purchase costs assigned to the engines.

- 2. Consider the supplier cost information obtained in Requirement 1. Suppose further that Verity can supply only a total of 6,000 units. What actions would you advise Cortalo to undertake with its suppliers? Comment on the strategic value of activity-based supplier costing.

Trending nowThis is a popular solution!

Chapter 11 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Munoz Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Munoz produces and sells only 7,900 bikes each year. Due to the low volume of activity, Munoz is unable to obtain the economies of scale that larger producers achieve. For example, Munoz could buy the handlebars for $37 each; they cost $40 each to make. The following is a detailed breakdown of current production costs: Item Unit Cost Total Unit-level costs Materials $ 14 $ 110,600 Labor 9 71,100 Overhead 2 15,800 Allocated facility-level costs 15 118,500 Total $ 40 $ 316,000 After seeing these figures, Munoz’s president remarked that it would be foolish for the company to continue to produce the handlebars at $40 each when it can buy them for $37 each. Required Calculate the total relevant cost. Do you agree with the president’s…arrow_forwardCampbell Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high- quality racing bikes with limited sales. Campbell produces and sells only 7,700 bikes each year. Due to the low volume of activity, Campbell is unable to obtain the economies of scale that larger producers achieve. For example, Campbell could buy the handlebars for $33 each; they cost $36 each to make. The following is a detailed breakdown of current production costs. Item Unit Cost Total Unit-level costs $13 $100, 100 92,400 23,100 61,600 Materials Labor 12 Overhead Allocated facility-level costs 8 Total $36 $277,200 After seeing these figures, Campbell's president remarked that it would be foolish for the company to continue to produce the handlebars at $36 each when it can buy them for $33 each. Required Calculate the total relevant cost. Do you agree with the president's conclusion? Per Unit Total Total relevant cost Do you agree with the president's…arrow_forwardBenson Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Benson produces and sells only 7,400 bikes each year. Due to the low volume of activity, Benson is unable to obtain the economies of scale that larger producers achieve. For example, Benson could buy the handlebars for $29 each; they cost $32 each to make. The following is a detailed breakdown of current production costs. Item Unit-level costs Unit Cost Total Materials Labor Overhead $ 13 9 $ 96,200 66,600 Allocated facility-level costs Total 2 8 14,800 59,200 $ 32 $ 236,800 After seeing these figures, Benson's president remarked that it would be foolish for the company to continue to produce the handlebars at $32 each when it can buy them for $29 each. Required Calculate the total relevant cost. Do you agree with the president's conclusion? Per Unit Total Total relevant cost Do you agree with the president's conclusion? No Iarrow_forward

- Adams Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Adams produces and sells only 6,200 bikes each year. Due to the low volume of activity, Adams is unable to obtain the economies of scale that larger producers achieve. For example, Adams could buy the handlebars for $30 each; they cost $33 each to make. The following is a detailed breakdown of current production costs. Item Unit-level costs Materials Labor Overhead Allocated facility-level costs Total Unit Cost $15 9 2 7 $33 Total $ 93,000 55,800 12,400 43,400 $204,600 After seeing these figures, Adams's president remarked that it would be foolish for the company to continue to produce the handlebars at $33 each when it can buy them for $30 each. Required Calculate the total relevant cost. Do you agree with the president's conclusion? Answer is complete but not entirely correct. Per Unit Totalarrow_forwardAZChen Company manufactures one particular type of washing machine and has two divisions, the Compressor Division, and the Fabrication Division. The Compressor Division manufactures compressors for the Fabrication Division, which completes the washing machine and sells it to retailers. The Compressor Division "sells" compressors to the Fabrication Division. The market price for the Fabrication Division to purchase a compressor is $40.00. (Ignore changes in inventory.) The fixed costs for the Compressor and Fabrication Divisions are assumed to be the same over the range of 1,000 - 5,000 units. Compressor's costs per compressor are: Direct materials $15 Direct labour $7.30 Variable overhead $2.69 Division fixed costs $7.48 Fabrication's costs per completed washing machine are: Direct materials $140.00 (excluding the transfer price of the compressor) Direct labour $57.50 Variable overhead $23.00 Division fixed costs $8.00 Assume the transfer price for a compressor is 149% of total costs…arrow_forwardSilven Industries, which manufactures and sells a highly successful line of summer lotions and insect repellents, has decided to diversify in order to stabilize sales throughout the year. A natural area for the company to consider is the production of winter lotions and creams to prevent dry and chapped skin. After considerable research, a winter products line has been developed. However, Silven's president has decided to introduce only one of the new products for this coming winter. If the product is a success, further expansion in future years will be initiated. The product selected (called Chap-Off) is a lip balm that will be sold in a lipstick-type tube. The product will be sold to wholesalers in boxes of 24 tubes for $13 per box. Because of excess capacity, no additional fixed manufacturing overhead costs will be incurred to produce the product. However, a $96,000 charge for fixed manufacturing overhead will be absorbed by the product under the company's absorption costing system.…arrow_forward

- Jordan Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Jordan produces and sells only 6,200 bikes each year. Due to the low volume of activity, Jordan is unable to obtain the economies of scale that larger producers achieve. For example, Jordan could buy the handlebars for $32 each; they cost $35 each to make. The following is a detailed breakdown of current production costs Unit Cost Total Item Unit-level costs 16 99,200 62,000 18,600 Materials Labor 10 Overhead 3 Allocated facility-level 6 37,200 Costs $35 $217,000 Total After seeing these figures, Jordan's president remarked that it would be foolish for the company to continue to produce the handlebars at $35 each when it can buy them for $32 each Required: a. Calculate the total relevant cost. Per Unit Total Total relevant cost b. Do you agree with the president's conclusion? Yes ONo ооarrow_forwardJordan Bicycle Manufacturing Company currently produces the handlebars used in manufacturing its bicycles, which are high-quality racing bikes with limited sales. Jordan produces and sells only 6,200 bikes each year. Due to the low volume of activity, Jordan is unable to obtain the economies of scale that larger producers achieve. For example, Jordan could buy the handlebars for $37 each; they cost $40 each to make. The following is a detailed breakdown of current production costs. Unit Total Item Cost Unit-level costs Materials $17 $105,400 55,800 12,400 Labor Overhead 2 Allocated facility-level 74,400 12 costs $40 $248,000 Total After seeing these figures, Jordan's president remarked that it would be foolish for the company to continue to produce the handlebars at $40 each when it can buy them for $37 each Required: a. Calculate the total relevant cost. Total Per Unit Total relevant cost b. Do you agree with the president's conclusion? Yes No O Oarrow_forwardAsbury Coffee Enterprises (ACE) manufactures two models of coffee grinders: Personal and Commercial. The Personal grinders have a smaller capacity and are less durable than the Commercial grinders. ACE only recently began producing the Commercial model. Since the Introduction of the new product, profits have been steadily declining, although sales have been increasing. The management at ACE belleves that the problem might be in how the accounting system allocates costs to products. The current system at ACE allocates manufacturing overhead to products based on direct labor costs. For the most recent year, which Is representative, manufacturing overhead totaled $2,091,000 based on production of 30,000 Personal grinders and 10,000 Commercial grinders. Direct costs were as follows: Direct materials Direct labor Personal $ 1,448,200 1,034,000 Commercial $ 661,000 708,500 Total $ 2,109,200 1,742,500 Management has determined that overhead costs are caused by three cost drivers. These…arrow_forward

- Bradley Nowell works as a purchaser at Louie Dog Industries. He is in charge of purchasing dog beds from manufacturers. Bradley's mother, seeing an opportunity, starts a dog bed manufacturing company and quickly receives almost all of Louie Dog's orders. In order to fill the orders, Bradley's mother buys low-quality beds from another dog bed supplier and sells those to Louie Dog for a substantial markup. In fact, the price charged to Louie Dog is twice what other manufactures would charge the company. What type of scheme is this? Pay-and-return Non-accomplice vendor Pass-through Inventory-markuparrow_forwardBranded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $52. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-103,000 units. The fixed costs for the Polishing Division are assumed to be $24 per pair at 103,000 units. Stitching's costs per pair of shoes are: Direct materials $20 Direct labor $18 Variable overhead $16 Division fixed costs $14 Polishing's costs per completed pair of shoes are: Direct…arrow_forwardBranded Shoe Company manufactures only one type of shoe and has two divisions, the Stitching Division and the Polishing Division. The Stitching Division manufactures shoes for the Polishing Division, which completes the shoes and sells them to retailers. The Stitching Division "sells" shoes to the Polishing Division. The market price for the Polishing Division to purchase a pair of shoes is $52. (Ignore changes in inventory.) The fixed costs for the Stitching Division are assumed to be the same over the range of 40,000-101,000 units. The fixed costs for the Polishing Division are assumed to be $22 per pair at 101,000 units. Stitching's costs per pair of shoes are: Direct materials $18 Direct labor $16 Variable overhead $14 Division fixed costs $12 Polishing's costs per completed pair of shoes are: Direct materials $14 Direct labor $7 Variable overhead $8 Division fixed costs $16 What is the transfer price per pair of shoes from the Stitching Division to the Polishing Division if the…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning