Concept explainers

Inventory Write-Down and Recovery

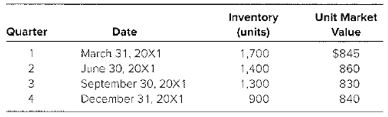

Cub Company, a calendar−year entity, had 2,100 geothermal healing pumps in its beginning inventory for 20X1. On December 31, 20X0, the heating pumps had been adjusted down to $850 per unit from an actual cost of $920 per unit. It was the lower of cost or market. Cub purchased no additional units during 20X1. The following additional information is provided for 20X1:

Required

Respond to the following two independent as requested.

- Case 1: The company does not have sufficient experience with the seasonal market for geo thermal pumps and assumes that any reductions in market value during the year will he permanent.( (1) Determine the cost of goods sold for each quarter.

(2) Verify the total cost of goods sold by computing annual cost of goods sold on a lower-of-cost-or-market bush.

b. Case 2: The company has prior experience with the seasonal market for geothermal pumps and expects that any reductions in market value during the year will be only temporary andwill recover by year end.

(1) Determine the cost of goods sold for each quarter.

(2) Verily the total cost of goods sold by computing annual cost of goods sold on a lower-of-cost-or-market basic.

a

Introduction: The losses in inventory due to a decrease in market value is recognized in the period of decline, and recoveries in the subsequent period must also be recognized as recoveries of losses in the prior period of the fiscal year, any gain in market value is not recognized. In addition to that, the temporary decline in market price which is expected to be recovered is also not recognized.

The cost of goods sold in each quarter and verify total cost of goods sold by computation of annual cost of goods sold on a lower of cost or market value basis when company does not have prior experience with seasonal market.

Answer to Problem 13.5E

Cost of goods sold quarterly

- $348,500

- $246,500

- $111,000

- $323,000

Annual basis $1,029,000

Explanation of Solution

Case 1 Market reduction

| Qtr. | Cost of units sold | Adjustment +/(-) | Cost of goods sold |

| 1 | Write down to $840 | $348,500 | |

| 2 | Recovery to $850 | $246,500 | |

| 3 | Write down to $830 | $111,000 | |

| 4 | Recovery to $840 | $323,000 | |

| Total | $1,029,000 | ||

| Annual basis | Write down to $840 | $1,029,000 |

b

Introduction: The losses in inventory due to a decrease in market value is recognized in the period of decline, and recoveries in the subsequent period must also be recognized as recoveries of losses in the prior period of the fiscal year, any gain in market value is not recognized. In addition to that, the temporary decline in market price which is expected to be recovered is also not recognized.

The cost of goods sold in each quarter and verify total cost of goods sold by computation of annual cost of goods sold on a lower of cost or market value basis when company have prior experience with seasonal market.

Answer to Problem 13.5E

Cost of goods sold quarterly

1. $340,000

2. $255,000

3. $85,000

4. $340,000

Annual basis $1,029,000

Explanation of Solution

Case 2 Market reduction

| Qtr. | Cost of units sold | Adjustment +/(-) | Cost of goods sold |

| 1 | $340,000 | ||

| 2 | $255,000 | ||

| 3 | $85,000 | ||

| 4 | Write down to $840 | $340,000 | |

| Total | $1,020,000 | ||

| Annual basis | Write down to $840

| $1,029,000 |

Want to see more full solutions like this?

Chapter 13 Solutions

Advanced Financial Accounting

- Required information [The following information applies to the questions displayed below.] A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 430 units. Ending inventory at January 31 totals 170 units. Units Unit Cost $ 3.80 Beginning inventory on January 1 Purchase on January 9 Purchase on January 25 390 90 4.00 120 4.10 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. Perpetual FIFO: Goods purchased Cost of Goods Sold In # of Date Cost per Cost of Goods unit Cost per # of units units sold # of units unit Sold January 1 January 9 Total January 9 January 25 Total January 25 January 26 Total January 26arrow_forwardSanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31, current year. Ending Inventory Information about the four major Items stocked for regular sale follows: ENDING INVENTORY , CURRENT YEAR Quantity on Hand 34 69 Unit Cot When Acquired (FIFO) $ 19 48 Net Realizable Value (Market) at Year-End $ 14 44 49 24 59 36 61 31 Required: 1. Compute the valuation that should be used for the current year ending Inventory using lower of cost or net realizable value applied on an Item-by-Item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31, current year? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the valuation that should be used for the current year ending Inventory using lower of cost or net realizable value applied on an item-by-item basis. Total Net Realizable…arrow_forwardSandals Company is preparing the annual financial statements dated December 31. Ending inventory is presently recorded at its total cost of $10,250. Information about its inventory items follows: Unit Cost When Acquired (FIFO) Quantity Product Line on Hand Value at Year-End Air Flow 25 $ 90 $ 92 Blister 15 80 76 Buster Coolonite 70 Dudesly 60 20 20 13 90 96 Required: 1. Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute the total overall write-down for all items. 2. How will the write-down of inventory to lower of cost or market/net realizable value affect the company's expenses reported for the year ended December 31? 3. Compute the amount that should be reported for the inventory on December 31, after the LCM/NRV rule has been applied to each item. Complete this question by entering your answers in the tabs below. Required Required Required 1 2 3 Compute the LCM/NRV write-down per unit and in total for each item in the table. Also compute…arrow_forward

- Sandals Company is preparing the annual financial statements dated December 31. Ending inventory is presently recorded at its total cost of $18,075. Information about its inventory items follows: Product Line Quantity on Hand Unit Cost When Acquired (FIFO) Value at Year-End Air Flow 65 $ 60 $ 64 Blister Buster 45 80 72 Coolonite 70 100 98 Dudesly 65 55 59 Required: Compute the LCM/NRV write down per unit and in total for each item in the table. Also compute the total overall write-down for all items. How will the write-down of inventory to lower of cost or market/net realizable value affect the company's expenses reported for the year ended December 31? Compute the amount that should be reported for the inventory on December 31, after the LCM/NRV rule has been applied to each item Compute the LCM /NRV write-down per unit and in total for each item in the table. Also compute the total overall write - down for all items. Product Line Quantity on Hand Write-down per item Total Write-down…arrow_forwardRequired information [The following information applies to the questions displayed below.] During the year, Trombley Incorporated has the following inventory transactions. Date Transaction Numberof Units UnitCost Total Cost Jan. 1 Beginning inventory 10 $ 12 $ 120 Mar. 4 Purchase 15 11 165 Jun. 9 Purchase 20 10 200 Nov. 11 Purchase 20 8 160 65 $ 645 For the entire year, the company sells 50 units of inventory for $20 each. 2. Using LIFO, calculate ending inventory, cost of goods sold, sales revenue, and gross profit.arrow_forwardRequired Informatlon Use the following Informatlon for the Exercises 3-7 below. (Algo) [The following information applles to the questions displayed below.] Laker Company reported the following January purchases and sales data for Its only product. The Company uses a perpetual Inventory system. For specific Identification, ending Inventory consists of 250 units from the January 30 purchase, 5 units from the January 20 purchase, and 20 units from beginning Inventory. Date Activities Units Acquired at Cost 165 units @ Units sold at Retail $ 9.e0 = $ 1,485 January 1 January 10 Beginning inventory Sales 125 units $ 18.00 110 units @ $ 8.00 = January 20 January 25 Purchase Sales 88e 125 units $ 18.e0 250 units @ $ 7.50 = 1,875 $ 4, 248 January 30 Purchase Totals 525 units 250 units Exercise 5-3 (Algo) Perpetual: Inventory costing methods LO P1 Requlred: 1. Complete the table to determine the cost assigned to ending inventory and cost of goods sold using specific identification. 2. Determine…arrow_forward

- H.T. Tan Company is preparing the annual financial statements dated December 31 of the current year. Ending inventory information about the five major items stocked for regular sale follows: ENDING INVENTORY, CURRENT YEAR Item Quantity on Hand ABCDE 68 98 28 88 368 Unit Cost When Acquired (FIFO) Net Realizable Value (Market) at Year-End $ 19 $ 22 47 37 59 55 37 32 12 17 Required: Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. Total Net Value Lower of Cost or NRV Item Quantity Total Cost Realizable A 68 B 98 C 28 DE 88 368 Total $ 0 $ $ 0 0arrow_forwardSanchez Company was formed on January 1 of the current year and is preparing the annual financial statements dated December 31, current year. Ending inventory information about the four major items stocked for regular sale follows: Item ABUD A ENDING INVENTORY, CURRENT YEAR Quantity Unit Cost When on Hand Acquired (FIF0) Required: 1. Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. 2. What will be the effect of the write-down of inventory to lower of cost or net realizable value on cost of goods sold for the year ended December 31, current year? Complete this question by entering your answers in the tabs below. Total Net tem Quantity Total Cost Realizable Value D Required 1 Required 2 Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. C D 31 31 66 46 21 $16 45 56 33 66 DE $…arrow_forwardLower of Cost or Market Garcia Company's inventory at the end of the year was recorded in its accounting records at $17,800. Due to technological changes in the market, Garcia would be able to replace its inventory for $16,500. Required: 1. Using the lower of cost or market method, what amount should Garcia report for inventory on its balance sheet at the end of the year?$ Hide 2. Prepare the journal entry required to value the inventory at the lower of cost or market. Dec. 31 (Reduced inventory to market value)arrow_forward

- Required information [The following information applies to the questions displayed below] The following information pertains to the inventory of Parvin Company for Year 3: Jan. 1 Beginning inventory Apr, 1 Oct. 1 Purchased Purchased 400 units # $17 2,900 units # $22 1,200 units # $23 During Year 3, Parvin sold 3,825 units of inventory at $43 per unit and incurred $18,30% of operating expenses. Parvin currently uses the FIFO method but is considering a change to LIFO. All transactions are cash transactions. Assume a 30 percent income tax rate. Parvin started the period with cash of $148,700, inventory of $6,800, common stock of $131,000, and retained earnings of $24,500. Required a. Prepare income statements using FIFO and LIFO. (Round intermediate calculations and final answers to the nearest whole dollar amount.) PARVIN COMPANY Income Statements For the Year Ended December 31, Year 3 FIFO Sales $ 164,475 Cost of goods sold Gross margin Operating expenses Income before tax 0 0 Income…arrow_forwardH.T. Tan Company is preparing the annual financial statements dated December 31 of the current year. Ending İnventory Information about the five major items stocked for regular sale follows: ENDING INVENTORY, CURRENT YEAR Net Realizable Value (Market) at Year-End $ 15 43 55 Unit Cost When Quantity on Hand 53 83 13 73 Acquired (FIFO) $ 18 33 51 Item A 28 33 353 13 8. Required: Compute the valuation that should be used for the current year ending inventory using lower of cost or net realizable value applied on an item-by-item basis. Total Net Lower of Cost or NRV Item Quantity Total Cost Realizable 53 B 83 13 73 353 Total S. 0. 0 S 0. < Prev 2 of 2 Next 4A0AA m.arrow_forwardRequired information [The following information applies to the questions displayed below.] A company reports the following beginning inventory and two purchases for the month of January. On January 26, the company sells 440 units. Ending inventory at January 31 totals 170 units. Beginning inventory on January 1 Units 400 Unit Cost $ 3.90 Purchase on January 9 90 Purchase on January 25 120 4.10 4.20 Required: Assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. Perpetual FIFO: Goods purchased Cost of Goods Sold Inventory Balance Date # of units Cost per unit # of units sold Cost per Cost of Goods unit Sold # of units Cost per unit Inventory Balance January 1 January 9 Total January 9 January 25 Total January 25 January 26 Total January 26arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT