Concept explainers

a.

To calculate: The PV of total outflows of The Bowman Corporation.

Introduction:

The current value of an investment or an asset is termed as its present value. It is evaluated by discounting the

a.

Answer to Problem 17P

The PV of total outflow of The Bowman Corporation is $1,458,528.

Explanation of Solution

Calculation of PV of outflows:

Working Notes:

Calculation of payment of call premium:

Calculation of tax saving per year:

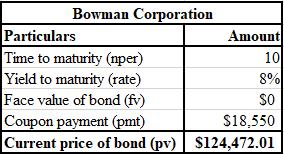

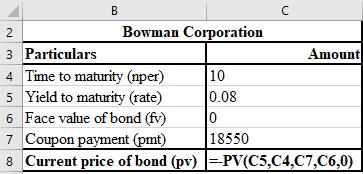

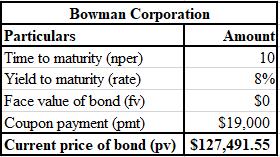

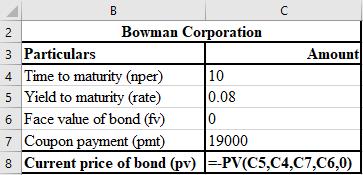

The calculation of current price of bond, that is, PV of future tax savings is shown below.

The formula used for the calculation of current price of bond, that is, PV of future tax savings is shown below.

Calculation of underwriting cost of new issue:

b.

To calculate: The PV of the total inflow of The Bowman Corporation.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is evaluated by discounting the future value of the investment or asset.Â

b.

Answer to Problem 17P

The PV of the total inflow of Bowman Corporation is $1,199,484.

Explanation of Solution

Calculation of PV of inflows:

Working Notes:

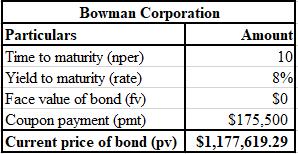

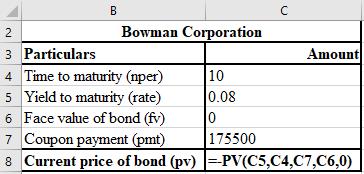

The calculation of PV of future tax savings is shown below.

The formula used for the calculation of PV of future tax savings is shown below.

The calculation of PV of deferred future write off is shown below.

The formula used for the calculation of PV of deferred future write off is shown below.

Calculation of gain in old underwriting cost write-off:

Calculation of Underwriting cost write-off:

c.

To calculate: The NPV of The Bowman Corporation.

Introduction:

A project’s NPV profile is the representation done graphically of the project’s NPV corresponding to different values of the rate of discount. It shows the changes that take place in NPV as a result of the changes in the cost of capital.

c.

Answer to Problem 17P

The NPV of The Bowman Corporation is ($259,045).

Explanation of Solution

Calculation of NPV:

d.

To determine: Whether the old issue shall be refunded with The Bowman Corporation’s new debt.

Introduction:

Present value (PV):

The current value of an investment or an asset is termed as its present value. It is evaluated by discounting the future value of the investment or asset.Â

d.

Answer to Problem 17P

No, the old issue of The Bowman Corporation shall not be refunded.

Explanation of Solution

The Bowman’s Corporation’s old issue shall not be refunded, especially if there exists a chance that the rate of interest will further go down, as the NPV calculated in part (c) is negative.

Want to see more full solutions like this?

Chapter 16 Solutions

Loose Leaf for Foundations of Financial Management Format: Loose-leaf

- Appendix D Present value of an annuity of $1, PVa PV-A1- (1+ i Percent Period 1% 2% 3% 4% 5% 6% 7% 9% 10% 11% 12% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 2. 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 1.713 1.690 2.941 2.884 2.829 2.775 2.723 2673 2.624 2.577 2.531 2487 2.444 2.402 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 ... 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 10 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 11. 16 .. 11.255 10.575 9.954 9.385 B.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194…arrow_forwardThe Latham Corporation is planning on issuing bonds that pay no interest but can be converted into $1,000 at maturity, 7 years from their purchase. To price these bonds competitively with other bonds of equal risk, it is determined that they should yield 6 percent, compounded annually. At what price should the Latham Corporation sell these bonds?arrow_forwardIf a company issues $100,000 Face Value, 10 year bonds with a contractural interest rate of 6%, which of the following situations could occur?a. Bonds will be sold at a premium when the market rate of interest is 7%b. Bonds will be sold at a discount when market rate is of interest 7%c. Bonds will be sold at face value when market rate of interest is 7%d. The issue of bonds cannot be sold when market rate is 7%arrow_forward

- The Wagner Corporation has a $29 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 16 percent, the interest rates on similar issues have declined to 13.3 percent. The bonds were originally issued for 25 years and have 21 years remaining. The new issue would be for 21 years. There is a 8 percent call premium on the old issue. The underwriting cost on the new $29 million issue is $640,000, and the underwriting cost on the old issue was $490,000. The company is in a 40 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 5 percent. (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest whole dollar.) a Calculate the present value of total outflows. Total outflows $ 3450000 b. Calculate the present value of total inflows. Total inflows $ 469800 c. Calculate the net present value. Net…arrow_forwardOn April 1, 20-1, Rebound Co. issued $300,000 of 10%, 10-year bonds, callable at 105 after three years, at face value. On April 1, 20-4, after completing three years of interest payments on the bonds, Rebound is considering calling the bonds and issuing $300,000 of new 8%, 10-year bonds at face value. The current market interest rate is only 8%, so Rebound thinks it might save money by taking this action.arrow_forwardMarysa Corp. issued a 30-year, 5 percent semiannual bond 4 years ago. The bond currently sells for 94 percent of its face value. The company’s tax rate is 25 percent. a. What is the pretax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the aftertax cost of debt? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) c. Which is more relevant, the pretax or the aftertax cost of debt? multiple choice Aftertax cost of debt Pretax cost of debtarrow_forward

- The Wagner Corporation has a $21 million bond obligation outstanding, which it is considering refunding. Though the bonds were initially issued at 16 percent, the interest rates on similar issues have declined to 13.3 percent. The bonds were originally issued for 20 years and have 16 years remaining. The new issue would be for 16 years. There is a 10 percent call premium on the old issue. The underwriting cost on the new $21 million issue is $670,000, and the underwriting cost on the old issue was $520,000. The company is in a 40 percent tax bracket, and it will allow an overlap period of one month (1/12 of the year). Treasury bills currently yield 5 percent. (Do not round intermediate calculations. Enter the answers in whole dollars, not in millions. Round the final answers to nearest whole dollar.) a. Calculate the present value of total outflows. Total outflows $ b. Calculate the present value of total inflows. Total inflows $ c. Calculate the net present value. Net present value $…arrow_forwardPearce's Cricket Farm issued a 30-year, 9% semiannual bond 4 years ago. The bond currently sells for 93% of its face value. The company's tax rate is 30%. Assume the par value of the bond is $1,000. a. What is the pre-tax cost of debt? (Do not round intermediate calculations. Round the final answer to 3 decimal places.) Pre-tax cost of debt b. What is the after-tax cost of debt? (Do not round intermediate calculations. Round the final answer to 3 decimal places.) After-tax cost of debt % c. Which is more relevant, the pre-tax or the after-tax cost of debt? After-tax cost of debt O Pre-tax cost of debtarrow_forward2. DEF Company will issue $8,000,000 in 10%, 10-year bonds when the market rate of interest is 7%. Interest is paid semiannually. Required: a. Will this interest structure result in a Premium for DEF company or a Discount? b. How much cash will be received from the issuance of the bond? c. How much will the semi-annual interest payment be on the bond?arrow_forward

- ABC company will contract a new loan in the sum of $2,000,000 that is secured by machinery and the loan has an interest rate of 6 percent. The company has also issued 4,000 new bond issues with an 8 percent coupon, paid semi-annually, and matures in 10 years. The bonds were sold at par and incurred a floatation cost of 2 percent per issue. 1. Does the New loan have anything to do with calculating the cost of debt? 2. Should the new loan be considered in the calculation of the weighted average cost of capital (WACC) of the company? if so how should it be added to the WACC formula.arrow_forwardMassers Company is issuing long-term bonds to raise money for a planned acquisition. The face value of the bonds is $10,000,000. The stated interest rate is 8% payable semiannually for the 10-year term. The current market rate for similar bonds is 10%. What amount of proceeds will Massers receive from this bond issue? If needed, you can access the interest tables here. $10,000,000 $8,753,779 $11,359,065 $11,951,190arrow_forwardThe Garraty Company has two bond issues outstanding. Both bonds pay$100 annual interest plus $1,000 at maturity. Bond L has a maturity of15 years, and Bond S has a maturity of 1 year.a. What will be the value of each of these bonds when the going rate ofinterest is (1) 5%, (2) 8%, and (3) 12%? Assume that there is only onemore interest payment to be made on Bond S.b. Why does the longer-term (15-year) bond fluctuate more when interestrates change than does the shorter-term bond (1 year)?arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education