FORECASTING THE FUTURE PERFORMANCE OF ABERCROMBIE & FITCH

Use online resources to work on this chapter’s questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions.

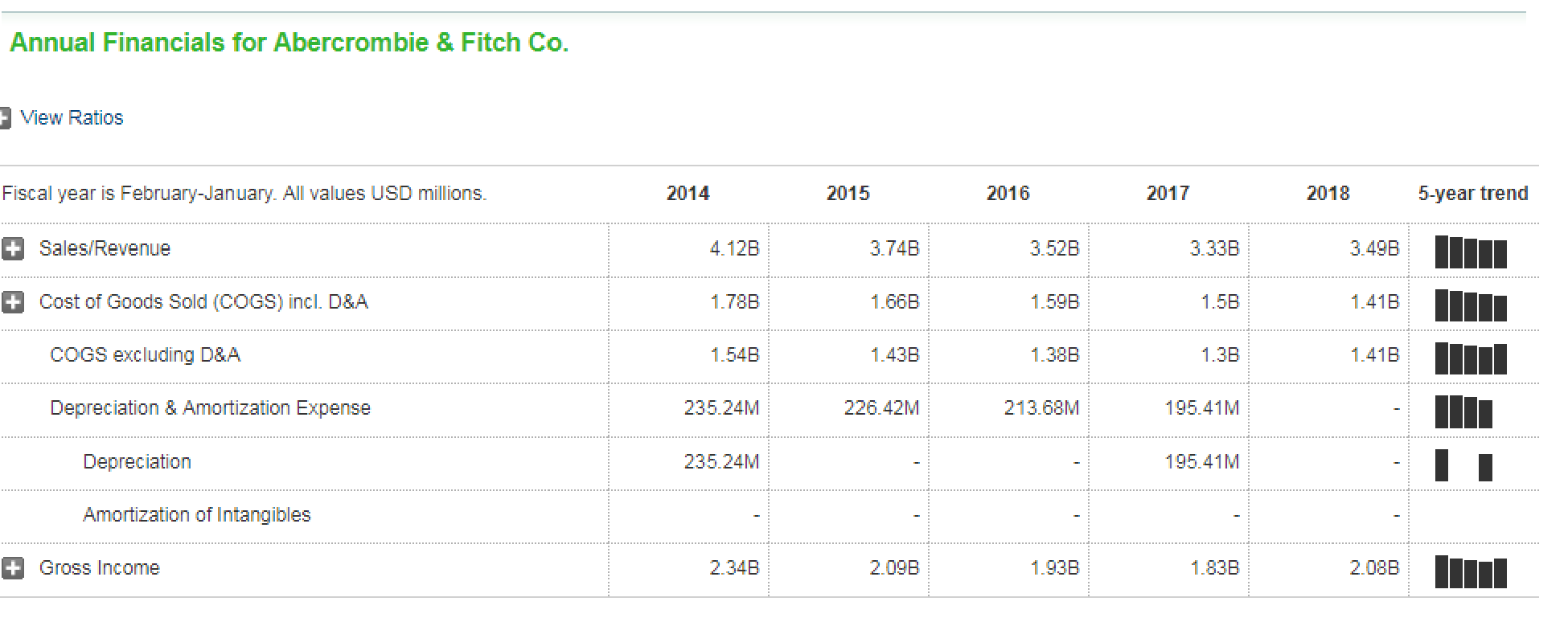

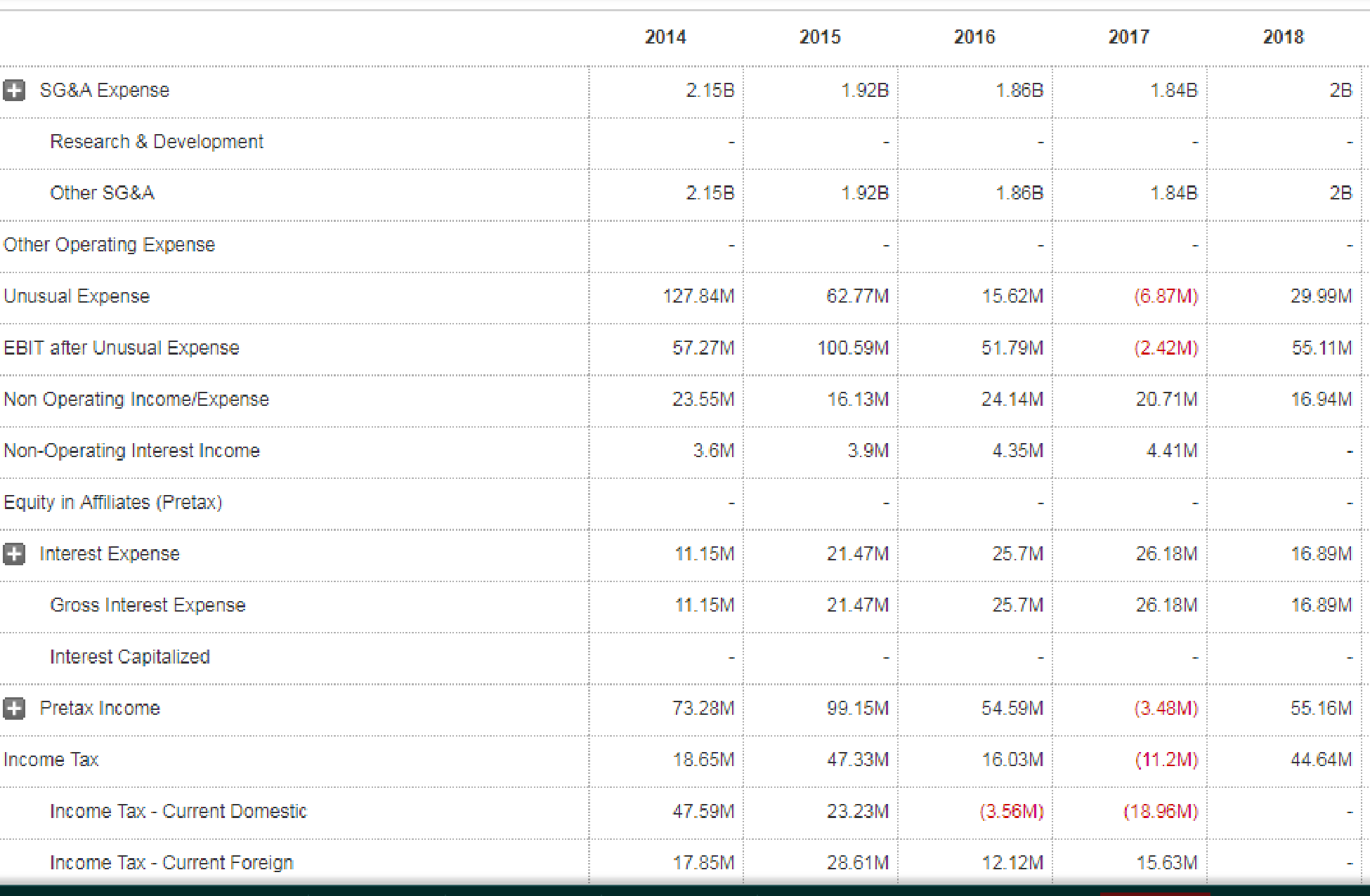

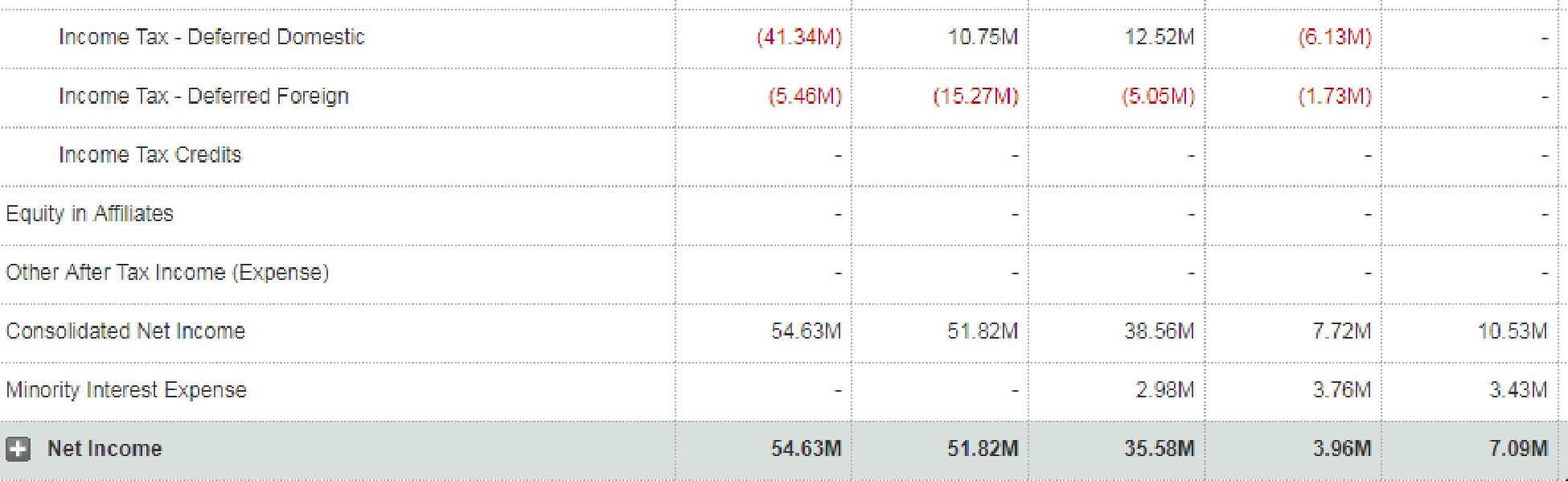

Clothing retailer Abercrombie & Fitch enjoyed phenomenal success in the late 1990s. Between 1996 and 2000, its sales grew almost fourfold—from $335 million to more than $1.2 billion—and its stock price soared by more than 500%. However, in 2002, its growth rate had begun to slow down, and Abercrombie had a hard time meeting its quarterly earnings targets. As a result, the stock price in late 2002 was about half of what it was 3 years earlier. Abercrombie’s struggles resulted from increased competition, a sluggish economy, and the challenges of staying ahead of the fashion curve. From late 2002 until November 2007, the company’s stock rebounded strongly; however, its stock price declined during the 2008 economic downturn. Its stock price rebounded until late October 2011, when it began a downward trend again. Questions remain about the firm’s long-term growth prospects. However the company has been cutting costs and trying to improve productivity with its focus on the supply chain. In addition, it has been actively repurchasing shares, indicating that management believes its shares are undervalued. The company continues to steadily expand stores abroad while closing under-performing domestic stores.

Given the questions about Abercrombie’s future growth rate, analysts have focused on the company’s earnings reports. Financial websites such as Yahoo! Finance, Morningstar, and MSN Money (www.msn.com/en-us/

DISCUSSION QUESTIONS

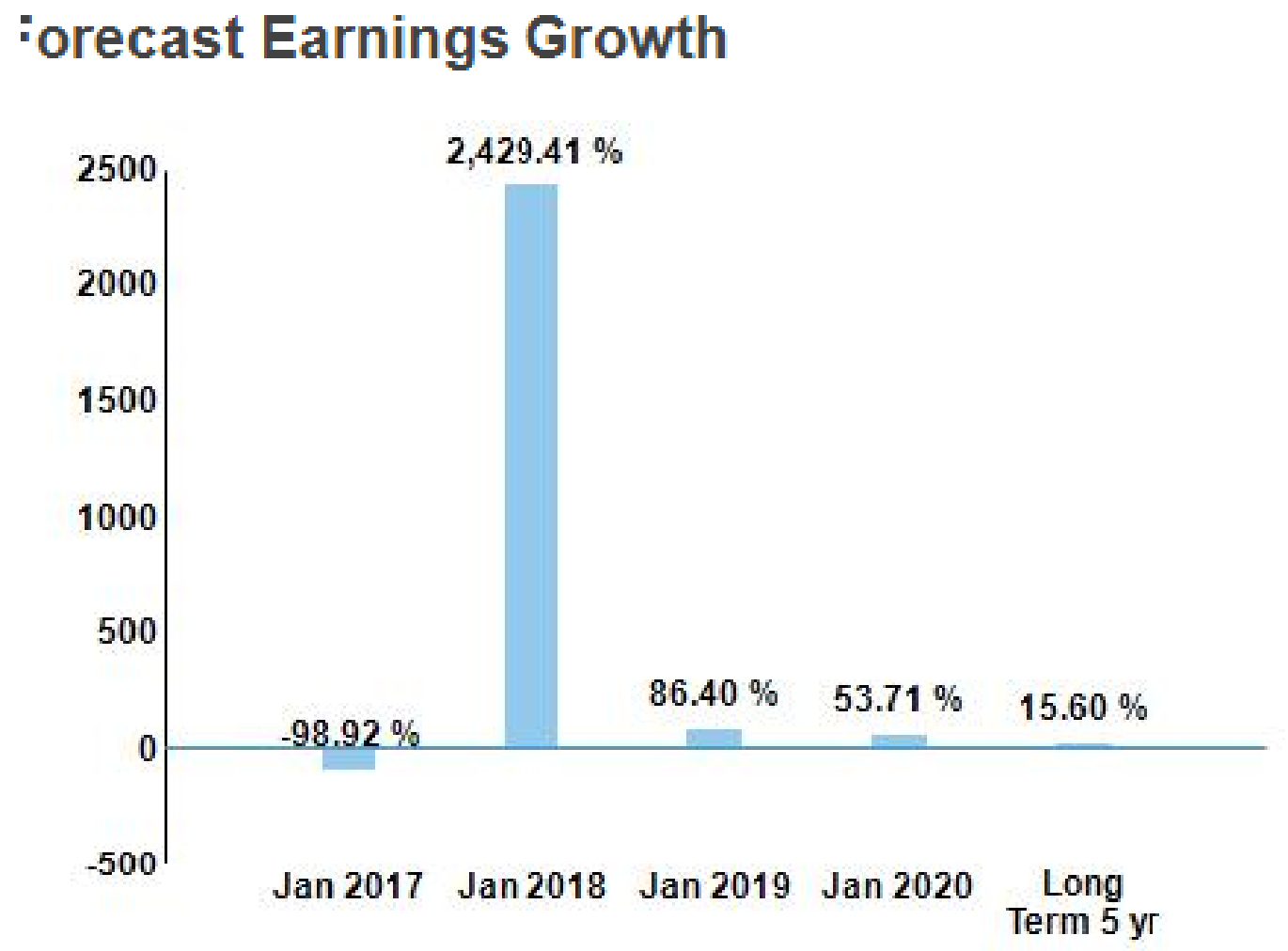

Based on analysts’ forecasts, what is the expected long-term (5-year) growth rate in earnings?

Want to see the full answer?

Check out a sample textbook solution

Chapter 16 Solutions

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

- With the 2013 data still on the screen, click the Chart sheet tab. The chart presented shows the rates of return for Global Technology for the last five years. Answer the following questions: a. In 2009, the rate of return on assets exceeded the rate of return on common stockholders equity. Why might this have occurred? Be as specific as possible. b. Is the company better off in 2013 than it was in 2009? Why or why not? When the assignment is complete, close the file without saving it again. Worksheet. Modify the RATIOA4 worksheet to have it compute two additional activity ratios: number of days sales in receivables and number of days sales in merchandise inventory. Use the 2012 and 2013 data and assume a 365-day year. Write out the formulas for your ratios in the spaces provided. Days sales in receivables (average collection period) ________________ Days sales in inventory (average sales period) ________________ Preview the printout to make sure that the worksheet will print neatly, and then print the worksheet. Save the completed file as RATIOAT. Chart. Using the RATIOA4 file, prepare a column chart that compares the acid test and current ratios for Global Technology for 2012 and 2013. Complete the Chart Tickler Data Table and use it as a basis for preparing the chart. Enter all appropriate titles, legends, and formats. Enter your name somewhere on the chart. Save the file again as RATIOA4. Print the chart.arrow_forward1. Assume that $1,000 is to be received 30 years from today. Compare the present values obtained using 0.05 and 0.20 as rates of discount. 2. The ABC Company has opened 10 new stores. It has incurred a great deal of expenses associated with opening the stores, and the stores have not yet built up enough clientele to be profitable. On the other hand, the stores are operating at profit levels exceeding expectations, and there are indications that they will be very profitable in the future. It is obvious that the stock market has not yet digested this latter fact, and the additional 50 stores this year, but to do so will require new stockholder capital acquired from the market (it has borrowed all it feels it is prudent to borrow and cannot obtain more capital from its current stockholders). Without the new capital, the stockholders can expect to earn an equivalent annual return of 0.15 on the current market value of their investment (assume there is $100 million or 1 million shares of…arrow_forwardQuyox Sdn Bhd manufactures a special toy called Omma that are sold through a network of sales agents throughout Malaysia. The company sold 67,500 units of Omma in 2022 with equivalent to sales amounting to RM1,350,000. The sales agents are currently paid at 15% commission on sales. The following is the pro forma (projected) statement of profit or loss and other comprehensive income for the year ended 31 December 2022. Qu Yox Sdn Bhd Pro Forma Statement of Profit or Loss and Other Comprehensive Income For the Year Ended 31 December 2022 Sales Cost of Goods Sold: Variable Fixed Gross Profit Operating expenses: Sales Commision Fixed Advertising Expenses General and Administrative Expenses: Rental expenses Administrative Salaries Expenses Insurance Expenses Net Income 675,000 135,000 202,500 33,750 27,000 67,500 20,250 1,350,000 810,000 540,000 351,000 189,000arrow_forward

- This case explores Alibaba’s record setting IPO. Alibaba, China’s largest e-commerce company, was founded in 1999 with a $60,000 investment from entrepreneur Jack Ma. The company has since grown to be one of the world’s largest online e-commerce companies with transactions exceeding those of Amazon and eBay combined. In 2013, Alibaba’s leaders decided it was time to take the company public. Alibaba hoped that by going public, it would raise the cash necessary to finance improvements to its infrastructure that would allow the company to continue its rapid growth. Alibaba also felt that an IPO would put it in a better position to implement an acquisition strategy. In addition, an IPO would give employees an option to sell their shares in the company. Following the decision to go public, Alibaba explored where to hold its IPO. Initially, Hong Kong looked to be a strong choice, however it was later rejected when it became clear that local regulations could effectively cause Alibaba to…arrow_forwardPlease help answer these questions below for the company APPLE with the latest DATA. How would you assess the company's market and industry performance based on its five-year revenues and earnings results? How does the company's five-year performance compare to its industry peers over the same time period? What portfolio recommendations or asset allocation strategies might you consider to improve investment performance?arrow_forwardThis case explores Alibaba’s record setting IPO. Alibaba, China’s largest e-commerce company, was founded in 1999 with a $60,000 investment from entrepreneur Jack Ma. The company has since grown to be one of the world’s largest online e-commerce companies with transactions exceeding those of Amazon and eBay combined. In 2013, Alibaba’s leaders decided it was time to take the company public. Alibaba hoped that by going public, it would raise the cash necessary to finance improvements to its infrastructure that would allow the company to continue its rapid growth. Alibaba also felt that an IPO would put it in a better position to implement an acquisition strategy. In addition, an IPO would give employees an option to sell their shares in the company. Following the decision to go public, Alibaba explored where to hold its IPO. Initially, Hong Kong looked to be a strong choice, however it was later rejected when it became clear that local regulations could effectively cause Alibaba to…arrow_forward

- The following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015). “There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges, society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive return for society at large, not just for investors. This will be part of the implicit contract or license to operate”. Now a) Explain the above statement in the context of corporate social responsibility. b) Further, do you think such a statement would impact the perceived ‘legitimacy’ of companies? Explain.arrow_forwardThe following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015). “There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges, society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive return for society at large, not just for investors. This will be part of the implicit contract or license to operate”. Required: a) Explain the above statement in the context of corporate social responsibility.b) Further, do you think such a statement would impact the perceived ‘legitimacy’ of companies? Explain.arrow_forwardThe following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015).“There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges, society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive returnfor society at large, not just for investors. This will be part of the implicit contract or license to operate”.Required:a) Explain the above statement in the context of corporate social responsibility.b) Further, do you think such a statement would impact the perceived ‘legitimacy’ of companies? Explain.arrow_forward

- The following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015).“There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges,society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive return for society at large, not just for investors. This will be part of the implicit contract or license to operate”.Required:a) Explain the above statement in the context of corporate social responsibility. [Word limit 150-200words] b) Further, do you think such a statement would impact the perceived ‘legitimacy’ of companies?Explain. [Word limit 200 – 250]arrow_forwardThe following quote appeared in an article entitled ‘Business and society in the coming decades’, which was available on the website of McKinsey & Company (accessed in October 2015). “There are compelling reasons companies should seize the initiative to drive social and business benefits. First, in an interconnected world facing unprecedented environmental and social challenges, society will demand it. Increasingly, a basic expectation among customers, governments, and communities will be that the companies they do business with provide a significant net positive return for society at large, not just for investors. This will be part of the implicit contract or license to operate”. Required: a) Explain the above statement in the context of corporate social responsibilityarrow_forwardBased on the quarter ended March 2023 financial results on investor.siriusxm.com, as per attached image and discuss whether Sirius XM's recent financial reports indicate that its business model is working. (i) Are its subscription fees increasing or declining? (ii) Are its revenue stream advertising and equipment sales growing or declining? (iii)Does its cost structure allow for acceptable profit marginsarrow_forward

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781285867977Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning