Concept explainers

a.

To Determine: The exercise value of Company PII’s warrants if the common stock sells at $18, $21, $25 and $70.

Introduction: A warrant is securities that give the bondholder the right, yet not the obligation, to purchase a specific number of securities at a specific cost before a specific time. Warrants are not the equivalent as the call options or purchase rights of the stock.

a.

Answer to Problem 6P

The exercise value of Company PII’s warrants if the common stock sells at $18 is -$3, $21 is $0, $25 is $4 and $70 is $49.

Explanation of Solution

Determine the exercise value of company PII’s warrants

If the common stock sells at $18

If the common stock sells at $21

If the common stock sells at $25

If the common stock sells at $70

Therefore the exercise value of Company PII’s warrants if the common stock sells at $18 is -$3, $21 is $0, $25 is $4 and $70 is $49.

b.

To Determine: The approximate price and the premium implied the warrants to sell under each condition from part (a) based on guess or reasonable assumption.

b.

Explanation of Solution

Determine the approximate price, premium and warrant for each stock

Since there is no exact or approximate solutions are possible the below are the price, premium and warrant for each stock price which are purely based on reasonable assumption.

If the common stock sells at $18:

The approximate price will be $18, the premium will be $4.50 and the warrant will be $1.50.

If the common stock sells at $21:

The approximate price will be $21, the premium will be $3 and the warrant will be $3.

If the common stock sells at $25

The approximate price will be $25, the premium will be $1.50 and the warrant will be $5.50.

If the common stock sells at $70:

The approximate price will be $70, the premium will be $1 and the warrant will be $50.

c1.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the life of warrant in lengthened.

c1.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the life of warrant in lengthened is as follows:

The higher the value of warrant, the lengthier the life of the warrant.

c2.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the expected variability in stock's price decrease.

c2.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the expected variability in stock's price decrease is as follows:

The lesser the value of warrant, the lesser the variable of the stock price.

c3.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the growth rate in the stock's EPS increase.

c3.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the growth rate in the stock's EPS increase is as follows:

The greater the price of warrant, the greater the expected EPS growth rate.

c4.

To Determine: The factors that affect the estimates of the warrants' prices and premium in part b when the company paid no dividends and will pay out all earnings as dividends.

c4.

Explanation of Solution

The factors that affect the estimates of the warrants' prices and premium in part b when the company paid no dividends and will pay out all earnings as dividends is as follows:

Beginning from 0 to 100% payout would have two conceivable impacts. To start with, it may influence the price of stock creating an variation in the exercise value of the warrant, nonetheless, it is not certain that the price of stock would change, not to mention what the variations possible.

The expansion in the payout ratio would significantly bring down the expected growth rate. This would decrease the probability of the stock's cost expanding in the future. This would bring down the expected value of the warrant, consequently bring down the premium and the cost of the warrant.

d.

To Determine: The annual coupon interest rate and annual dollar coupon on the bonds.

d.

Answer to Problem 6P

The annual coupon interest rate is 9.11% and annual dollar coupon on the bonds is $91.19.

Explanation of Solution

Determine the

Therefore the value of bond is $925.

Determine the annual dollar coupon on the bonds

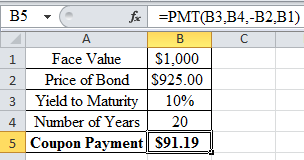

Using an excel spreadsheet and excel function =PMT, the annual dollar coupon on the bonds is calculated as $91.19.

Excel Spreadsheet:

Therefore the annual dollar coupon on the bonds is $91.19

Determine the annual coupon interest rate on the bonds

Therefore the annual coupon interest rate on the bonds is 9.11%.

Want to see more full solutions like this?

Chapter 20 Solutions

Fundamentals of Financial Management (MindTap Course List)

- Maese Industries Inc. has warrants outstanding that permit the holders to purchase 1 share of stock per warrant at a price of $28. a. Calculate the exercise value of a warrant at each of the following common stock prices: (1) $20, (2) $25, (3) $30, (4) $100. (Hint: A warrant's exercise value is the difference between the stock price and the purchase price specified by the warrant if the warrant were to be exercised.) If your answer is zero, enter "0". Round your answers to the nearest dollar. (1) $20 $ 0 (2) $25 $ 0 (3) $30 $ (4) $100 $ 2 72 b. Assume the firm's stock now sells for $20 per share. The company wants to sell some 20-year, $1,000 par value bonds with interest paid annually. Each bond will have attached 75 warrants, each exercisable into 1 share of stock at an exercise price of $25. The firm's straight bonds yield 11%. Assume that each warrant will have a market value of $2.5 when the stock sells at $20. What coupon interest rate must the company set on the bonds with…arrow_forwardJacobs Company has warrants outstanding, which are selling at a $2.50 premium above intrinsic value. Each warrant allows its owner to purchase one share of common stock at $26. If the common stock currently sells for $30, what is the warrant price? A. $6.50 B. $6.40 C. $6.75 D. $7.25arrow_forwardAnalysis and Application of Knowledge Rossiana Marie, Inc. lists a bond as Ross 9s34, and shows the price as selling for 88.875% of its face value. If your required return rate is 10%. would you buy one of these bonds in 2021? * 5 points Your answer Upload Solution: Rossiana Marie, Inc. lists a bond as Ross 9534, and shows 15 points the price as selling for 88.875% of its face value. If your required return rate is 10%, would you buy one of these bonds in 2021? 1 Add file Intal Corporation bonds have a coupon of 14%. pay interest semiannually. Spoints and mature in 7 years. Your required rate of return for such an investment is 10% annually. How much should you pay for a PHP1.000 Intal Corporation bond? Your answer Upload Solution: Intal Corporation bonds have a coupon of 14%. pay 10 points interest semiannually, and mature in 7 years. Your required rate of return for such an investment is 10% annually. How much should you pay for a PHP1.000 Intal Corporation bond?* 1 Add filearrow_forward

- An investment bank sells securities under a repurchase agreement for $800.438 million and buys them back in 7 days for $800.568 million. What is the repo's single payment yield?Report your answer in % to the nearest 0.01%;arrow_forwardWhat is the yield on a corporate bond with a $1000 face value purchased at a discount price of $875, if it pays 8% fixed interest for the duration of the bond? yield = [ ? ] % Give your answer as a percent rounded to the nearest hundredth. Hint: yield : interest paid price paid Enter at 2003 - 2021 Acellus Corporation. All Rights Reserved. MacBook 80 DD F4 F5 F6 F7 F8 F9 F10 #3 2$ & 3 4 7 9. E T Y U * 00arrow_forwardAc The Redford Investment Company bought 110 Cinema Corp. warrants one year ago and would like to exercise them today. The warrants were purchased at $30 each, and they expire when trading ends today (assume there is no speculative premium left). Cinema Corp. common stock is selling today for $58 per share. The exercise price is $34 and each warrant entitles the holder to purchase two shares of stock, each at the exercise price. a. If the warrants are exercised today, what would the Redford Investment Company's dollar profit or loss be? (Do not round intermediate calculations. Input your dollar answer as a positive value rounded to the nearest whole dollar.) b. What is the Redford Investment Company's percentage rate of return? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Rate of return % Prev 6 of 10 Next >arrow_forward

- Suppose that you are interested in purchasing a bond issued by the VPI Corporation. The bond is quoted in the Wall Street Journal as selling for 89.665. How much will you pay for the bond if you purchase it at the quoted price? Assuming you hold the bond until maturity, how much will you receive at that time? If you purchase the bond at the quoted price, you would pay $. (Round to the nearest cent) Assuming you hold the bond until maturity, you would receive $ (Round to the nearest dollar)arrow_forwardSuppose you work as a broker in an investment company, and there is an expectation that the market interest rate will be 0.029. based on this expectation you are required to calculate the market price for the following CD;Issue date: 1 January 2021 Maturity date:10 May 2021. The face value OMR 10000. Interest on CD: 5 percent. Select one: a. 15942.02 b. 15574.10 c. 15677.97 d. All the given choices are not correct e. 15572.50arrow_forwardSuppose a bank enters a repurchase agreerment in which it agrees to sell Treasury securities to a correspondent bank at a price of $9.99,838 with the promise to buy them back at a price of $10.000,073. Calculate the yield on the repo if it has a 6-day maturity. (write your answer in percentage and round it to 2 decimal places)arrow_forward

- 13. An investor purchases bonds with a face value of $100,000. Payment for thebonds includes (a) a premium (b) accrued interest rate and (c) brokeragefees. How would each of these charges be recorded and what dispositionwould ultimately be made of each of these charges??arrow_forwardH5. Which of the following is the name of the semiannual payment of $20 that you receive on a bond you own? a. Face Value b. Discount c. Yield d. Call Premium e. Coupon Explain with details and also explain wrong optionsarrow_forwardaa.2 Assumes Venture Healthcare sold bonds that have a ten-year maturity, a 12 percent coupon rate with annual payments, and a $1,000 par value. What would be the bonds value? Hint: Watch the Homework Hint video to figure out how to calculate this using Excel. Choice: $750 Choice: $1,000 Choice: $1,500 Choice: $2,000arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT