Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 3, Problem 13P

Reversing Entries Thomas Company entered into two transactions involving promissory notes and properly recorded each transaction.

- 1. On November 1, it purchased land at a cost of $8,000. It made a $2,000 down payment and signed a note payable agreeing to pay the $6,000 balance in 6 months plus interest at an annual rate of 10%.

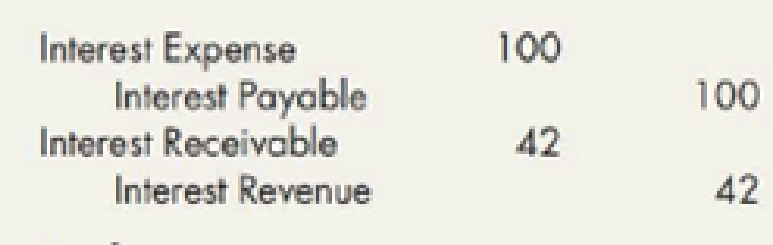

- 2. On December 1, it accepted a $4,200, 3-month, 12% (annual interest rate) note receivable from a customer for the sale of merchandise. On December 31, Thomas made the following related adjustments:

Required:

- 1. Assuming that Thomas uses reversing

entries, prepare journal entries to record:- a. the January 1, reversing entries

- b. the March 1, $4,326 collection of the note receivable

- c. the May 1, $6,300 payment of the note payable

- 2. Assuming instead that Thomas does not use reversing entries, prepare journal entries to record the collection of the note receivable and the payment of the note payable.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Leach Company borrowed $95,000 cash by issuing a note payable on June 1, Year 1. The note had an 6 percent annual rate of interest

and a one-year term to maturity.

Required:

a. What amount of interest expense will Leach recognize for the year ending December 31, Year 1?

b. Record the issue of notes payable and recognition of interest on December 31, Year 1, in the accounting equation for Year 1.

c. What amount of cash will Leach pay for interest expense in Year 1?

d. What is the amount of interest payable as of December 31, Year 1?

e. What amount of cash will Leach pay for interest expense in Year 2?

f. What amount of interest expense will Leach recognize in Year 2?

g. What is the amount of interest payable as of December 31, Year 2?

-

Anne Taylor Company borrowed cash on August 1 of Year 1, by signing a $19,980 (face amount), one-year note payable, due on July 31 of Year 2. The

accounting period of Anne Taylor ends December 31. Assume an effective interest rate of 11%.

a. How much cash should Anne Taylor Company receive from the note on August 1 of Year 1, assuming the note is an interest-bearing note?

$ 0

b. Provide the following entries and reporting amounts:

1. August 1 of Year 1, date of the loan.

2. December 31 of Year 1, adjusting entry.

3. July 31 of Year 2, payment of the note.

⚫Note: Round your answers to the nearest whole dollar.

Date

1. Aug. 1, Year 1

Account Name

Dr.

Cr.

0

0

0

0

To record issue of note.

2. Dec. 31, Year 1

0

0

To record year-end adjusting entry.

3. July 31, Year 2

0

O O

0 0

0

0

0

0

0

00

0

0

To record payment of note.

c. What liability amounts should be shown on the December 31 of Year 1 balance sheet?

Balance Sheet, Dec. 31

Year 1

Current liabilities

Note Payable

0

$

0

d. Answer (a) and…

Prefix Supply Company received a 60-day, 4% note for $46,000 dated July 12 from a customer on account.

Required:

a. Determine the due date of the note.

b. Determine the maturity value of the note. Assume a 360-day year.

c. Journalize the entry to record the receipt of the payment of the note at maturity. Refer to the Chart of Accounts for exact wording of account titles.

CHART OF ACCOUNTS

Prefix Supply Company

General Ledger

ASSETS

110

Cash

111

Petty Cash

120

Accounts Receivable

129

Allowance for Doubtful Accounts

132

Notes Receivable

141

Merchandise Inventory

145

Office Supplies

146

Store Supplies

151

Prepaid Insurance

181

Land

191

Store Equipment

192

Accumulated Depreciation-Store Equipment

193

Office Equipment

194

Accumulated Depreciation-Office Equipment

LIABILITIES

210

Accounts Payable

211

Salaries Payable

213

Sales Tax Payable

214

Interest Payable

215

Notes Payable

EQUITY…

Chapter 3 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 3 - What is the primary purpose of an accounting...Ch. 3 - What is the relationship between the accounting...Ch. 3 - Show the expanded accounting equation using the 10...Ch. 3 - Explain and distinguish between a transaction; an...Ch. 3 - Explain how the accounting equation organizes...Ch. 3 - What is the difference between a permanent and a...Ch. 3 - Prob. 7GICh. 3 - Why is it advantageous to a company to initially...Ch. 3 - What is a perpetual inventory accounting system?...Ch. 3 - Give examples of transactions that: a. Increase an...

Ch. 3 - Give examples of transactions that: a. Increase...Ch. 3 - Prob. 12GICh. 3 - Prob. 13GICh. 3 - Prob. 14GICh. 3 - Prob. 15GICh. 3 - Explain and provide examples of deferrals,...Ch. 3 - Prob. 17GICh. 3 - Prob. 18GICh. 3 - Prob. 19GICh. 3 - Prob. 20GICh. 3 - Prob. 21GICh. 3 - What are the major financial statements of a...Ch. 3 - Prob. 23GICh. 3 - Prob. 24GICh. 3 - Prob. 25GICh. 3 - Prob. 26GICh. 3 - Prob. 27GICh. 3 - Prob. 28GICh. 3 - Prob. 29GICh. 3 - What is cash-basis accounting? What must a company...Ch. 3 - On May 1, Johnson Corporation purchased inventory...Ch. 3 - On January 1, Tolson Company purchased a building...Ch. 3 - On July 1, Friler Company purchased a 1-year...Ch. 3 - Prob. 4RECh. 3 - Garcia Company rents out a portion of its building...Ch. 3 - Prob. 6RECh. 3 - Goldfinger Corporation had account balances at the...Ch. 3 - Prob. 8RECh. 3 - For the current year, Vidalia Company reported...Ch. 3 - Use the information in RE3-6, (a) assuming Ringo...Ch. 3 - (Appendix 3.1) Vickelly Company uses cash-basis...Ch. 3 - Financial Statement Interrelationship Draw a...Ch. 3 - Journal Entries Mead Company uses a perpetual...Ch. 3 - Journal Entries The following are selected...Ch. 3 - Adjusting Entries Your examination of Sullivan...Ch. 3 - Adjusting Entries The following are several...Ch. 3 - Adjusting Entries The following partial list of...Ch. 3 - Basic Income Statement The following are selected...Ch. 3 - Periodic Inventory System Raynolde Company uses a...Ch. 3 - Closing Entries Lloyd Bookstore shows the...Ch. 3 - Financial Statements Turtle Company has prepared...Ch. 3 - Worksheet for Service Company Whitaker Consulting...Ch. 3 - Worksheet, Including Inventory Surian Motors...Ch. 3 - Reversing Entries On December 31, 2019, Kellams...Ch. 3 - Special Journals The following are several...Ch. 3 - (Appendix 3.1) Cash-Basis Accounting Puntarelli...Ch. 3 - Adjusting Entries The following information is...Ch. 3 - Prob. 2PCh. 3 - Adjusting Entries Sarah Companys trial balance on...Ch. 3 - Prob. 4PCh. 3 - Errors in Financial Statements At the end of the...Ch. 3 - Journal Entries, Posting, and Trial Balance Luke...Ch. 3 - Effects of Errors: During the current accounting...Ch. 3 - Financial Statements Mackenzie Inc. uses a...Ch. 3 - Prob. 9PCh. 3 - Worksheet Victoria Company has the following...Ch. 3 - Worksheet Devlin Company has prepared the...Ch. 3 - Comprehensive On November 30, 2019. Davis Company...Ch. 3 - Reversing Entries Thomas Company entered into two...Ch. 3 - Reversing Entries On December 31, 2019, Mason...Ch. 3 - Adjusting Entries At the end of 2019, Richards...Ch. 3 - Prob. 16PCh. 3 - Comprehensive (Appendix 3.1) Dawson OConnor is the...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardOn June 1, Phillips Corporation sold, with recourse, a note receivable from a customer to a bank. The note has a face value of 15,000 and a maturity value (principal plus interest) of 15,400. The discount is calculated to be 385, and the accrued interest income is 100. The recourse liability is estimated to be 1,000. Prepare the journal entry of Phillips to record the sale of the note receivable.arrow_forwardA company collects an honored note with a maturity date of 24 months from establishment, a 10% interest rate, and an initial loan amount of $30,000. Which accounts are used to record collection of the honored note at maturity date? A. Interest Revenue, Interest Expense, Cash B. Interest Receivable, Cash, Notes Receivable C. Interest Revenue, Interest Receivable, Cash, Notes Receivable D. Notes Receivable, Interest Revenue, Cash, Interest Expensearrow_forward

- Notes Receivable Transactions The following notes receivable transactions occurred for Harris Company during the last three months of the current year. (Assume all notes are dated the day the transaction occurred.) Required: 1. Prepare the journal entries to record the preceding note transactions and the necessary adjusting entries on December 31. (Assume that Harris does not normally sell its notes and uses a 360-day year for the purpose of computing interest. Round all calculations to the nearest penny.) 2. Show how Harris notes receivable would be disclosed on the December 31 balance sheet. (Assume these are the only note transactions encountered by Harris during the year.)arrow_forwardPayroll accounts and year-end entries The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes Occurred during December: Dec. 2. Issued Check No. 410 for 3,400 to Jay Bank to invest in a retirement savings account for employees. 2. Issued Check No. 411 to Jay Bank for 27,046, in payment of 9,273 of social security tax, 2,318 of Medicare tax, and 15,455 of employees federal income tax due. 13. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: Dec. 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 13. Journalized the entry to record payroll taxes on employees earnings of December13: social security tax, 4,632; Medicare tax, 1,158; state unemployment tax, 350; federal unemployment tax, 125. 16. Issued Check No. 424 to Jay Bank for 27,020, in payment of 9,264 of social security tax, 2,316 of Medicare tax, and 15,440 of employees federal income tax due. 19. Issued Check No. 429 to Sims-Walker Insurance Company for 31,500, in payment of the semiannual premium on the group medical insurance policy. 27. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 27. Issued Check No. 541 in payment of the net amount of the biweekly payroll to fund the payroll bank account. 27. Journalized the entry to record payroll taxes on employees earnings of December27: social security tax, 4,668; Medicare tax, 1,167; state unemployment tax, 225; federal unemployment tax, 75. 27. Issued Check No. 543 for 20,884 to State Department of Revenue in payment of employees state income tax due on December 31. 31. Issued Check No. 545 to Jay Bank for 3,400 to invest in a retirement savings account for employees. 31. Paid 45,000 to the employee pension plan. The annual pension cost is 60,000. (Record both the payment and unfunded pension liability.) Instructions 1. Journalize the transactions. 2. Journalize the following adjusting entries on December 31: a. Salaries accrued: operations salaries, 8,560; officers salaries, 5,600; office salaries,1,400. The payroll taxes are immaterial and are not accrued. b. Vacation pay, 15,000.arrow_forwardRecording the Sale of Notes Receivable Singer Corporation was involved in the following events in the current year: Required: Prepare the journal entries to record the preceding information on Singers accounting records. Assume that the company does not normally sell its notes. (Assume a 360-day year and round all answers to the nearest penny.)arrow_forward

- Record these transactions in general journal ledger: Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. Dec 4: Accepted a sales return from Eastern for an item having an original gross sales price of $6,000. The original sale to Eastern occurred in November with terms 2/15, n/30. Dec 5: Specifically wrote off the receivable balance owed by Baker as uncollectible. Dec 7: Returned defective inventory with a gross cost of $4,000 back to Hunt Corp. Dec 14: Wilson returned an item originally purchased on Dec 12 with a gross sales price of $7,000. Dec 14: Returned inventory with a gross cost of $2,000 back to Nelson Industries. Dec 18: Bought office supplies on account for $9,000 from Staples Inc. (open a new Accounts Payable in the subsidiary ledger--Vendor # 210-30). Invoice # is OM1218. Staples Inc.’s terms are n/30 Dec 19: Received the December utilities bill for the amount of $15,000. The bill will be paid in January of next year.…arrow_forwardTyrell Company entered into the following transactions involving short-term liabilities. Year 1 April 20 Purchased $37,500 of merchandise on credit from Locust, terms n/30. May 19 Replaced the April 20 account payable to Locust with a 90-day, 8 %, $35,000 note payable along with paying $2,500 in cash. July 8 Borrowed $57,000 cash from NBR Bank by signing a 120-day, 11%, $57,000 note payable. _?Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to NBR Bank at the maturity date. November 28 Borrowed $24,000 cash from Fargo Bank by signing a 60-day, 9%, $24,000 note payable. December 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank. Year 2 _?_ Paid the amount due on the note to Fargo Bank at the maturity date. 5. Prepare journal entries for all the preceding transactions and events. Note: Do not round your intermediate calculations. View transaction list < Journal entry worksheet 1 2 3 4 5 6 7 8 Purchased $37,500 of…arrow_forwardOn June 1, Davis Inc. issued an $76,100, 12%, 120-day note payable to Garcia Company Assume that the fiscal year of Garcia ends June 30. Using a 360-day year in your calculations, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. a.$1,522 b.$9,132 c.$761 d.$2,308arrow_forward

- Sheridan Company obtains $36,800 in cash by signing a 7%, 6-month, $36,800 note payable to First Bank on July 1. Sheridan's fiscal year ends on September 30. What information should be reported for the note payable in the annual financial statements? In the balance sheet, Notes Payable of $ reported as In the income statement, Interest Expense of $ and Interest Payable of $ should be reported under should bearrow_forwardOn June 1, Davis Inc. issued an $89,300, 8%, 120-day note payable to Garcia Company. Assume that the fiscal year of Garcia ends June 30. Using a 360-day year, what is the amount of interest revenue recognized by Garcia in the following year? When required, round your answer to the nearest dollar. a. $1,806 Ob. $7,144 O c. $595 Od. $1,191 Barrow_forwardPrefix Supply Company received a 120-day, 8% note for $450,000, dated April 9 from a customer on account. Assume 360 days in a year. a. Determine the due date of the note. August 7 b. Determine the maturity value of the note. $ c. Journalize the entry to record the receipt of the payment of the note at maturity. If an amount box does not require an entry, leave it blank. Aug. 7 Cash $ $ Notes Receivable $ $ Interest Revenue $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY