1.

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

1.

Explanation of Solution

Calculate the regular earnings for the weekly payroll ended December 13, 2019.

Step 1: Calculate the annual salary of Employee LR, Employee RB and Employee GL.

| Employee | Monthly salary (A) | Annual salary (A×12months) |

| Employee JR | $7,280 per month | $87,360.00 |

| Employee OJ | $5,265 per month | $63,180.00 |

| Employee MK | $3,400 per month | $40,800.00 |

Table (1)

Step 2: Calculate the regular earnings of each employees.

| Employee | Annual salary (A) | Regular Weekly earnings |

| Employee WH | $99,840.00 | $1,920.00 |

| Employee PB | $96,200.00 | $1,850.00 |

| Employee JR | $87,360.00 | $1,680.00 |

| Employee OJ | $63,180.00 | $1,215.00 |

| Employee MK | $40,800.00 | $784.62 |

| Total | $387,380.00 | $7,449.62 |

Table (2)

Thus, the total regular earnings for the weekly payroll ended December 13, 2019 is $7,449.62

2.

Calculate the overtime earnings if any applicable to any employee.

2.

Explanation of Solution

Calculate the overtime earnings for Employee GL.

| Employee | Weekly earnings (A) | Regular hourly rate (B) |

Overtime hourly rate (C) |

Overtime earnings (D) |

| Employee MK | $784.62 | $19.62 | $29.42 | $176.54 |

Table (3)

Thus, the overtime earnings for Employee GL is $176.54.

3.

Calculate the total regular, overtime earnings and bonus.

3.

Explanation of Solution

Calculate the total regular, overtime earnings and bonus.

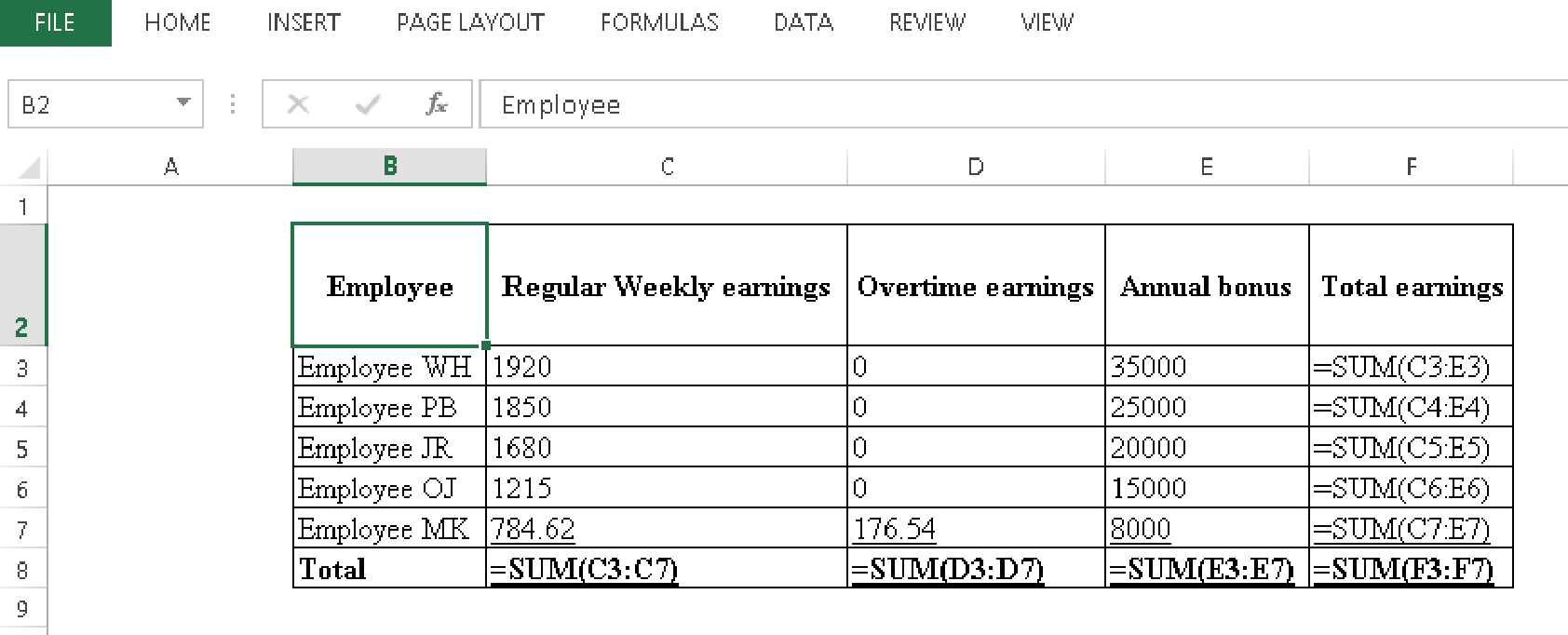

| Employee | Regular Weekly earnings | Overtime earnings | Annual bonus | Total earnings |

| Employee WH | $1,920.00 | $0.00 | $35,000 | $36,920.00 |

| Employee PB | $1,850.00 | $0.00 | $25,000 | $26,850.00 |

| Employee JR | $1,680.00 | $0.00 | $20,000 | $21,680.00 |

| Employee OJ | $1,215.00 | $0.00 | $15,000 | $16,215.00 |

| Employee MK | $784.62 | $176.54 | $8,000 | $8,961.16 |

| Total | $7,449.62 | $176.54 | $103,000 | $110,626.16 |

Table (4)

Calculation for total regular, overtime earnings and bonus is as follows.

Table (5)

4 and 5.

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

4 and 5.

Explanation of Solution

Calculate the FICA taxable wages for this period and FICA taxes to be withheld for this period.

| Cumulative earnings as of Last Pay Period | FICA Taxable Wages This Pay Period | FICA Taxes to be Withheld | Employees | ||

| OASDI (A) | HI (B) | OASDI | HI | ||

| $94,080.00 | $36,920.00 | $36,920.00 | $2,289.04 | $535.34 | Employee WH |

| $90,650.00 | $26,850.00 | $26,850.00 | $1,664.70 | $389.33 | Employee PB |

| $82,332.00 | $21,680.00 | $21,680.00 | $1,344.16 | $314.36 | Employee JR |

| $59,535.00 | $16,215.00 | $16,215.00 | $1,005.33 | $235.12 | Employee OJ |

| $38,446.38 | $8,961.16 | $8,961.16 | $555.59 | $129.94 | Employee MK |

| $110,626.16 | $110,626.16 | $6,858.82 | $1,604.08 | Totals | |

Table (6)

Step 3: Calculate the employer’s portion of the FICA taxes for the week ended.

Calculate the OASDI taxes.

Calculate the HI taxes.

Calculate the total FICA taxes.

Want to see more full solutions like this?

Chapter 3 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- Accounting for bonus and vacation pay Cathy Muench a factory worker, earns 1,000 each week. In addition, she will receive a 4,000 bonus at year-end and a four-week paid vacation. Prepare the entry to record the weekly payroll and the costs and liabilities related to the bonus and the vacation pay, assuming that Muench is the only employee.arrow_forwardAt Gleeson Brewing Company, office workers are employed for a 40-hour workweek on either an annual or a monthly salary basis.Given on the form below are the current annual and monthly salary rates for five office workers for the weekended December 13, 2019 (50th payday of the year). In addition, with this pay, these employees are paid their slidingscale annual bonuses. The bonuses are listed on the register.For each worker, compute:1. Regular earnings for the weekly payroll ended December 13, 2019.2. Overtime earnings (if applicable).3. Total regular, overtime earnings, and bonus.4. FICA taxable wages for this pay period.5. FICA taxes to be withheld for this pay period.arrow_forwardCullumber Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $11 $12 0 8 4 5 Cullumber Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are…arrow_forward

- Sheffield Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 9 6 7 Sheffield Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit…arrow_forwardAt vision club company office workers are emplyoed for a 40-hour workweek on either an annual or a monthly salary basis. Given on the form below are the current annual and monthly salary rates for five office workers for the week ended December 13,2019(50th pay day of the year) In addition, with this pay these employees are paid their sliding-scale annual bonuses. The bonuses are listed on the register For each worker, compute: 1.Regular earnings for the weekly payroll ended December 13,2019 2. Overtime earnings (if applicable) 3. Total regular. Overtime earnings and bonus 4. FICA taxable wages for this pay period. 5. FICA Taxes to be withheld for this pay period.arrow_forwardSheffield Company began operations on January 2, 2019. It employs 10 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 8 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 9 6 7 Sheffield Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Correct answer icon Your answer is correct Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account…arrow_forward

- Marin Company began operations on January 2, 2019. It employs 11 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $11 $12 0 8 5 6 Marin Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. prepare journal entries to record transactions related to compensated absences during 2019 and 2020. Compute the amounts of any liability for compensated absences that should be reported on the balance sheet at December 31, 2019 and…arrow_forwardAyayai Company began operations on January 2, 2019. It employs 9 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 8 5 6 Ayayai Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically…arrow_forwardMonty Company began operations on January 2, 2019. It employs 9 individuals who work 8-hour days and are paid hourly. Each employee earns 10 paid vacation days and 6 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $10 $11 0 9 4 5 Monty Company has chosen not to accrue paid sick leave until used, and has chosen to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation time. Year in Which VacationTime Was Earned Projected Future Pay RatesUsed to Accrue Vacation Pay 2019 $10.97 2020 11.83…arrow_forward

- Ayayai Company began operations on January 2, 2019. It employs 9 individuals who work 8-hour days and are paid hourly. Each employee earns 9 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual HourlyWage Rate Vacation Days Usedby Each Employee Sick Days Usedby Each Employee 2019 2020 2019 2020 2019 2020 $6 $7 0 8 5 6 Ayayai Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically…arrow_forwardMarin Company began operations on January 2, 2019. It employs 11 individuals who work 8-hour days and are paid hourly. Each employee earns 11 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual Hourly Wage Rate Vacation Days Used by Each Employee Sick Days Used by Each Employee 2019 2020 2019 2020 2019 2020 $8 $9 10 Marin Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Your answer is partially correct. Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is…arrow_forwardMarin Company began operations on January 2, 2019. It employs 11 individuals who work 8-hour days and are paid hourly. Each employee earns 11 paid vacation days and 7 paid sick days annually. Vacation days may be taken after January 15 of the year following the year in which they are earned. Sick days may be taken as soon as they are earned; unused sick days accumulate. Additional information is as follows. Actual Hourly Wage Rate Vacation Days Used by Each Employee Sick Days Used by Each Employee 2019 2020 2019 2020 2019 2020 $8 $9 10 Marin Company has chosen to accrue the cost of compensated absences at rates of pay in effect during the period when earned and to accrue sick pay when earned. (a) Prepare journal entries to record transactions related to compensated absences during 2019 and 2020. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning