Huron Manufacturing Co. uses a

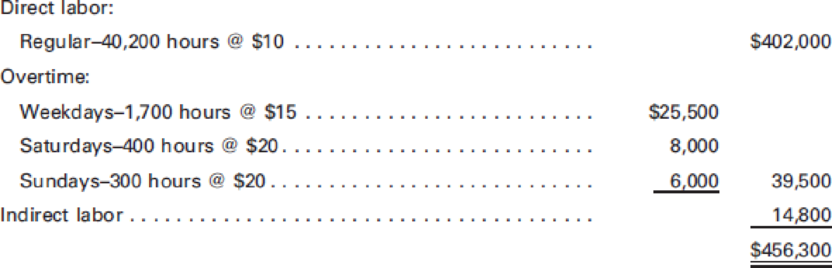

An examination of the first month’s payroll under the new union contract provisions shows the following:

Analysis of the supporting payroll documents revealed the following:

- a. More production was scheduled each day than could be handled in a regular workday, resulting in the need for overtime.

- b. The Saturday and Sunday hours resulted from rush orders with special contract arrangements with the customers.

The controller believes that the overtime premiums and the bonus should be charged to factory

The plant manager favors charging the overtime premiums directly to the jobs worked on during overtime hours and the bonus to administrative expense.

The sales manager states that the overtime premiums and bonus are not

Required:

- 1. Evaluate each position—the controller’s, the plant manager’s, and the sales manager’s. If you disagree with all of the positions taken, present your view of the appropriate allocation.

- 2. Prepare the

journal entries to illustrate the position you support, including the accrual for the bonus.

Trending nowThis is a popular solution!

Chapter 3 Solutions

Principles of Cost Accounting

- Costa, Inc., recently converted from a 5-day, 40-hour workweek to a 4-day, 40-hour workweek, with overtime continuing to be paid at one and one-half times the regular hourly rate for all hours worked beyond 40 in the week. In this company, time is recorded under the continental system, as shown on the time card on the following page. Barbara Bansta is part of the Group B employees whose regular workweek is Tuesday through Friday. The working hours each day are 800 to 1200; 1230 to 1630; and 1800 to 2000. The company disregards any time before 800, between 1200 and 1230, and between 1630 and 1800, and permits employees to ring in up to 10 minutes late before any deduction is made for tardiness. Deductions are made to the nearest of an hour for workers who are more than 10 minutes late in ringing in. Refer to the time card and compute: a. The daily total hours ..........................................................................___________ b. The total hours for the week ...............................................................___________ c. The regular weekly earnings ................................................................___________ d. The overtime earnings (company rounds O.T. rate to 3 decimal places)___________ e. The total weekly earnings .....................................................................__________arrow_forwardR. Herbert of Crestview Manufacturing Co. is paid at the rate of 20 an hour for an eight-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular employment is on the basis of 40 hours a week, five days a week. At the end of a week, the labor time record shows the following: Because jobs are randomly scheduled for the overtime period, any overtime premium is charged to Factory Overhead. a. Compute Herberts total earnings for the week. b. Present the journal entry to distribute Herberts total earnings. (Note: These single journal entries here and in E3-2, E3-3, E3-4, E3-8 and E3-9 are for the purpose of illustrating the principle involved. Normally, the entries would be made for the total factory payroll plus the administrative and sales payroll.)arrow_forwardPotts, Inc., recently converted from a 5-day, 40-hour workweek to a 4-day, 40-hour workweek, with overtime continuing to be paid at one and one-half times the regular hourly rate for all hours worked beyond 40 in the week. In this company, time is recorded under the continental system, as shown on the time card on the following page. Sue Ellen Boggs is part of the Group B employees whose regular workweek is Tuesday through Friday. The working hours each day are 800 to 1200; 1230 to 1630; and 1800 to 2000. The company disregards any time before 800, between 1200 and 1230, and between 1630 and 1800, and permits employees to ring in up to 10 minutes late before any deduction is made for tardiness. Deductions are made to the nearest of an hour for workers who are more than 10 minutes late in ringing in. Refer to the time card and compute: a. The daily total hours ..........................................................................___________ b. The total hours for the week ...............................................................___________ c. The regular weekly earnings ................................................................___________ d. The overtime earnings (company rounds O.T. rate to 3 decimal places)___________ e. The total weekly earnings .....................................................................__________arrow_forward

- A rush order was accepted by Bartley's Conversions for five van conversions. The labor time records for the week ended January 27 show the following (Hours not worked on vans are idle time andare not charged to the job.): All employees are paid 20 per hour, except Klembara, who receives 25 per hour. All overtime premium pay, except Klembara's, is chargeable to the job, and all employees, including Klembara, receive time-and-a-half for overtime hours. Required: 1. Calculate the total payroll and total net earnings for the week.Assume that an 18% deduction for federal income tax is requiredin addition to FICA deductions. Assume that none of the employees has achieved the maximums for FICA and unemploymenttaxes. 2. Prepare the journal entries to record and pay the payroll. 3. Prepare the journal entry to distribute the payroll to the appropriate accounts. 4. Determine the dollar amount of labor that is chargeable toeach van, assuming that the overtime costs are proportionateto the regular hours used on the vans. (First compute an average labor rate for each worker, including overtime premium,and then use that rate to charge all workers' hours to vans.)Round the labor rates to the nearest whole cent.arrow_forwardKyle Forman worked 47 hours during the week for Erickson Company at two different jobs. His pay rate was 14.00 for the first 40 hours, and his pay rate was 11.80 for the other 7 hours. Determine his gross pay for that week if the company uses the one-half average rate method. a. Gross pay__________ b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would be________arrow_forwardFour factory workers and a supervisor make a team in the Machining Department. The supervisor earns P100 per hour, and the combined hourly charge of the four workers is P320. Each employee is entitled to a 2-week paid vacation and a bonus equal to 4 week's wages each year. Vacation pay and bonuses are treated as indirect costs and are accrued over the 50 week work year. A provision in the union contract does not allow these employees to work in excess of 40 hours per week. What is the amount to be charged to Manufacturing Overhead Control account? Required: what is the estimated liability for bonus? what is the estimated liability for vacation pay?arrow_forward

- . Sharp Enterprises operates its factory on a two-shift basis and pays a later shift differential of 15 percent above the regular wage rate of P65 per hour. The company also pays a premium of 10 percent for overtime work. During the year, work occurred in the following categories: Number of hours worked during the regular shift Number of overtime hours for regular shift workers Number of hours worked during the late shift Requirement: 10,000 300 6,000 1.Compute for the amount to be distributed to Work-in-Process. 2.How much is distributed to Factory Overhead Account? 3.Assuming that Direct Materials amounted to P3,575,000 while Total Manufacturing Overhead is P800,000, how much is Period Cost? 4.Assuming that Direct Materials amounted to P2,500,000 while Total Manufacturing Overhead is P1,025,000, how much is Period Cost?arrow_forwardFour factory workers and a supervisor make a team in the Machining Department. The supervisor earns P100 per hour, and the combined hourly charge of the four workers is P320. Each employee is entitled to a 2-week paid vacation and a bonus equal to 4 week's wages each year. Vacation pay and bonuses are treated as indirect costs and are accrued over the 50 week work year. A provision in the union contract does not allow these employees to work in excess of 40 hours per week. What is the amount to be charged to Manufacturing Overhead Control account? SOLUTIONS MUST BE IN GOOD ACCOUNTING FORM. EXCEL FORM WILL BE ALSO GREATarrow_forwardOne Friday morning, a customer brings a rush order of 2,500 units of Product X at a unit sales price of P30. Maeca Company agrees to produce these units for the customer over the weekend for shipment on Monday. Sixty of the direct labor employees who earn P30 an hour work eight hours each day on Saturday and Sunday to complete the order. Maeca Company's regular working day is Monday to Friday. The company's policy on overtime during weekend is time and a half. Materials costing P3 per unit was used on the order. The factory overhead application rate is P18 per direct labor hour.What is the gross margin on the order?arrow_forward

- One Friday morning, a customer brings a rush order of 2,500 units of Product X at a unit sales price of P30. Maeca Company agrees to produce these units for the customer over the weekend for shipment on Monday. Sixty of the direct labor employees who earn P30 an hour work eight hours each day on Saturday and Sunday to complete the order. Maeca Company's regular working day is Monday to Friday. The company's policy on overtime during weekend is time and a half. Materials costing P3 per unit was used on the order. The factory overhead application rate is P18 per direct labor hour. Determine the amount of direct labor.arrow_forwardBert Garro is a waiter at La Bron House, where he receives a weekly wage of $75 plus tips for a 40-hour workweek. Garro's weekly tips usually range from $300 to $350. Round your answers to the nearest cent. a. Under the Fair Labor Standards Act, the minimum amount of wages that Garro must receive for a 40-hour workweek is$fill in the blank 1 b. Since La Bron House is in violation of the FLSA, the additional amount it should pay Garro each week to meet the minimum wage requirement for a tipped employee is (Hint: Employer must an additional amount to bring current gross of $75 up to minimum tipped wages.)$fill in the blank 2arrow_forwardDeborah's employer offers fringe benefits that cost the company P3 for each hour of employee time (both regular and overtime). Her regular wage rate is P70 per hour while her overtime rate is P17.50/hour. During a given week, Deborah works 42 hours but is idle for 3 hours due to material shortages. The company treats all fringe benefits as part of manufacturing overhead. The allocated of Deborah's wages and fringe benefits for the week for the direct labor cost will be:arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning