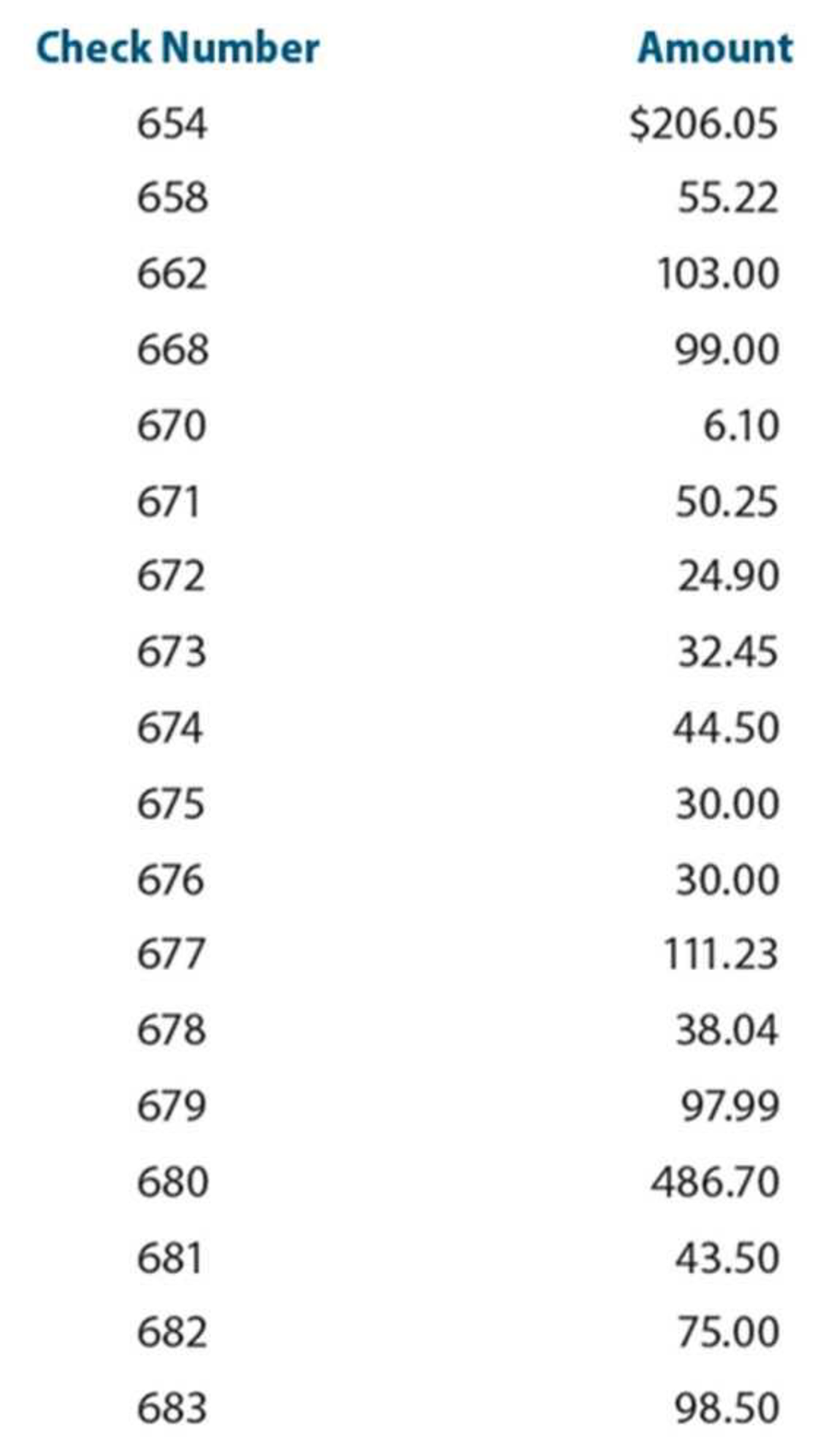

Checking account reconciliation. Use Worksheet 4.1. Mateo Gonzalez has an interest-paying (NOW) checking account at the Second State Bank. His checkbook ledger lists the following checks:

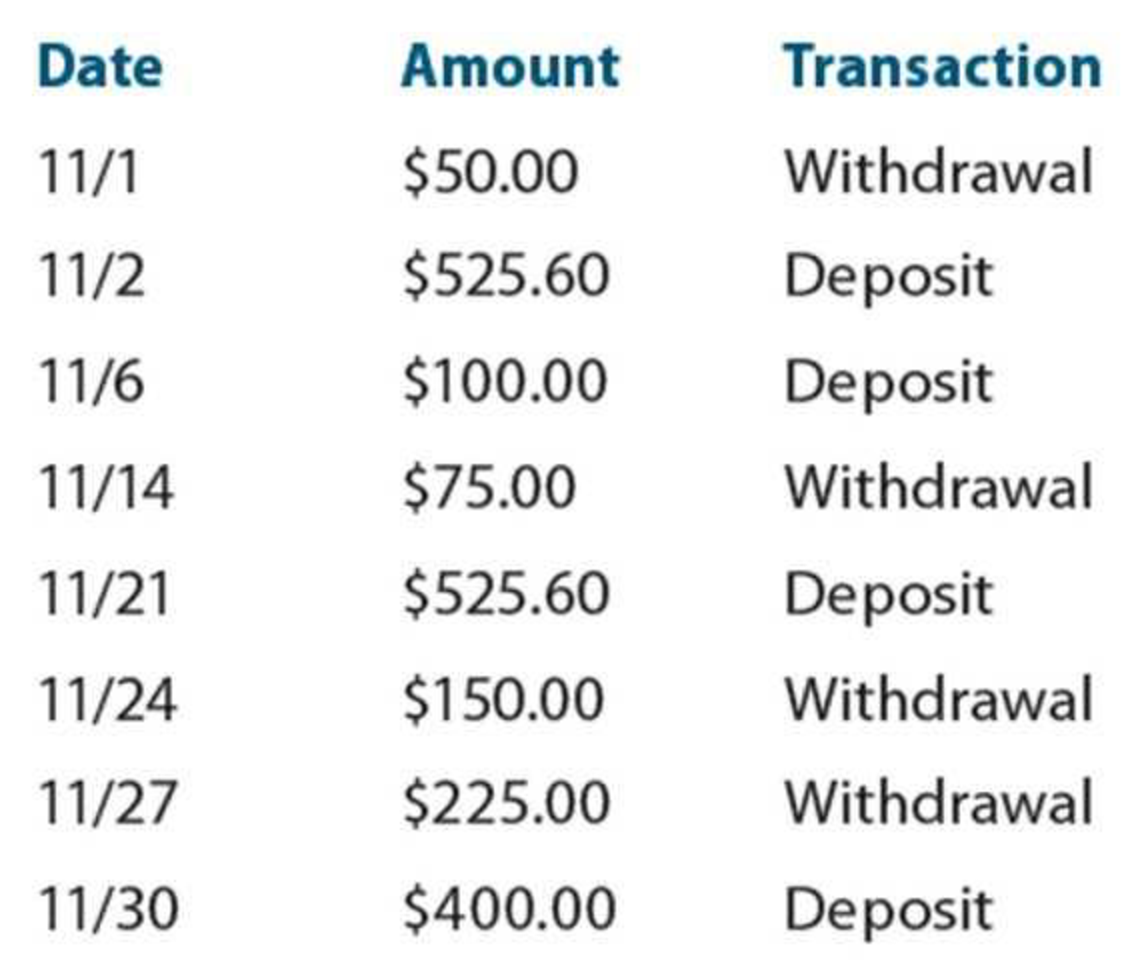

Mateo also made the following withdrawals and deposits at an ATM near his home:

Mateo’s checkbook ledger shows an ending balance of $286.54. He has just received his bank statement for the month of November. It shows an ending balance of $622.44; it also shows that he earned interest for November of $3.28, had a check service charge of $8 for the month, and had another $20 charge for a returned check. His bank statement indicates the following checks have cleared: 654, 662, 672, 674, 675, 676, 677, 678, 679, and 681. ATM withdrawals on 11/1 and 11/14 and deposits on 11/2 and 11/6 have cleared; no other checks or ATM activities are listed on his statement, so anything remaining should be treated as outstanding. Use a checking account reconciliation form like the one in Worksheet 4.1 to reconcile Mateo's checking account.

Trending nowThis is a popular solution!

Chapter 4 Solutions

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

- The U.S. Chamber of Commerce provides a free monthly bank reconciliation template at business.uschamber.com/tools/bankre_m.asp. Paula Hein just received her bank statement notice online. She wants to reconcile her checking account with her bank statement and has chosen to reconcile her accounts manually. Her checkbook shows a balance of $698. Her bank statement reflects a balance of $1,348. Checks outstanding are No. 2146, $25; No. 2148, $58; No. 2152, $198; and No. 2153, $464. Deposits in transit are $100 and $50. There is a $15 service charge and $5 ATM charge in addition to notes collected of $50 and $25. Reconcile Annie's balances. BANK RECONCILIATION Annie's checkbook balance Bank balance Add: Add: Subtotal Subtotal Deduct: Deduct: Subtotal Reconciled balance Reconciled balance aw 4 of 15arrow_forwardFor the following question, reconcile the bank statement and check register. Would they need to make an adjustment or does everything reconcile? Sylvia’s checkbook balance on July 31 is $389.32. The information on her bank statement is given below. The outstanding checks, unrecorded deposits, and unrecorded ATM transactions are listed here also. From this information will her account reconcile? Bank statement: $434.30; Interest: $0.79; Service charge: $2.75 Outstanding checks: #911: $53.29; #912: $31.16; #913: $20.04; #920: $11.42; #923: $24.50; #925: $16.90; #930: $33.30; #932: $8.70; #933: $10.55. Unrecorded deposits ATM: 7/30: $183.52; 7/31: $69.40. Unrecorded ATM withdrawals: 7/30: $40.00; 7/31: $50.00 Bank Statement Reconcile Amount: Check Register Reconcile Amount:arrow_forwardYou are the training director for tellers at a large local bank. As part of a new training program you are developing, you have given your trainees this "sample" check register. It is filled out but some of the balances are incorrect. Check Number Date 4/7 4/14 4/16 1208 4/17 4/21 PLEASE BE SURE TO DEDUCT ANY BANK CHARGES THAT APPLY TO YOUR ACCOUNT. Description of Transaction To: Deposit For: To: Mario's Market Debit Card For: To: ATM Withdrawal For: To: Bargain Properties For: To: Electronic Payroll Deposit For: Amount of payment or withdrawal (-) 48 65 135 00 870 00 ✓ Amount of Deposit or interest (+) 755 80 1,350 00 Balance Forward Bal. Bal. Bal. Bal. 469 30 1,225 10 1,176 45 996 45 181 45 Bal. 1,531 45 You instruct your trainees to find and correct the errors in the balances. If your trainees do so, what should the corrected final balance be (in $)? $arrow_forward

- Miss Corina Cruz bank statement on September 30 showed a balance of P 26,091.20.Her checkbook showed a balance of P 23,305.70.She had noticed that checks # 13 for P 1,168.00 and # 18 for P 1,628.50 were outstanding.There was also a service charge of P 11.00. Prepare a bank reconciliation statement.arrow_forwardBen Luna received his bank statement with a $31.35 fee for a bounced-check (NSF). He has an $841.80 monthly mortgage payment paid through his bank. There was also a $3.35 teller fee and a check printing fee of $7.10. His ATM card fee was $8.50. There was also a $571.05 deposit in transit. The bank shows a balance of $268.33. The bank paid Ben $3.03 in interest. Ben's checkbook shows a balance of $1,535.60. Check Number 234 for $121.10 and check Number 235 for $71.75 were outstanding. Prepare Ben's bank reconciliation. Note: Input all amounts as positive values. Round your answers to 2 decimal places. Ben's checkbook balance. Add: Subtotal Deduct: Subtotal Reconciled balance BANK RECONCILIATION Bank balance Add: Subtotal Deduct: Reconciled balancearrow_forwardSuppose that Lena, who has an account at SunTrust Bank, writes a check for $140 to Jose, who has an account at National City Bank. Use following the T-account for SunTrust Bank to show how it is affected after the check clears. Assets Liabilitiesarrow_forward

- Use the example attached to help fill out Zoe's checking account register. Use the information below to log Zoe’s payments and deposits in her checking account register. Wednesday, 9/26 Zoe received her car insurance bill in the mail today. She writes a check for $115 to pay the bill. Record the amount for check #101 in her check register.arrow_forwardBen Luna received his bank statement with a $31.52 fee for a bounced check (NSF). He has an $919.20 monthly mortgage payment paid through his bank. There was also a $3.20 teller fee and a check printing fee of $8.40. His ATM card fee was $10.00. There was also a $543.90 deposit in transit. The bank shows a balance of $232.91. The bank paid Ben $2.73 in interest Ben's checkbook shows a balance of $1,575.40. Check No. 234 for $100.75 and check No. 235 for $70.25 were outstanding Prepare Ben's bank reconciliation. (Round your answers to 2 decimal places.) Ben's checkbook balance Add: Subtotal Deduct: Reconciled balance Bank balance Add: Subtotal Deduct: Reconciled balancearrow_forwardOn September 1, Sharon Santos was given his monthly bank statement with a bank balance of P 17,063.50. On that date , her checkbook balance was P 24,194.50. Upon examining the bank statement and her checkbook she discovered the following: a) outstanding check as P 4,035; b) deposit of P 7,500 was not recorded on the stub. c) deposit of P 6,185 was entered as P 6,851 on the stub d) check deposit for P 25,930 was entered as P 24,930 e) deposit of P 10,240 was recorded twice on the stub f) deposit of P 12,560 was late to be included in the bank statement. g) service charge of P 200 was deducted by the bank h) check issued for P 15,645 as written on the stub as P 18,645. Prepare a bank reconciliation statement for Sharon Santos.arrow_forward

- Using the T-accounts of the First National Bank and theSecond National Bank given in this chapter, describewhat happens when Jane Brown writes a check for $90on her account at the First National Bank to pay herfriend Joe Green, who in turn deposits the check in hisaccount at the Second National Bankarrow_forwardSaved Kameron Gibson's bank statement showed a balance of $717.72. Kameron's checkbook had a balance of $209.50. Check No. 104 for $110.07 and check No. 105 for $15.55 were outstanding. A $620.50 deposit was not on the statement. He has his payroll check electronically deposited to his checking account-the payroll check was for $1,025.10. There was also a $4 teller fee and an $18 service charge. Prepare Kameron Gibson's bank reconciliation. (Input all amounts as positive values. Round your answers to 2 decimal places.) BANK RECONCILIATION Kameron's checkbook balance Bank balance Add: Add: Subtotal Subtotal Deduct: Deduct: Subtotal Reconciled balance Reconciled balancearrow_forwardDorothy, the bookkeeper of Tacurong Organic Farm recorded check no.368 in the Cash Disbursement Journal as P50,505. The correct amount of the check was P50,550. Bank. P50,550 will be added to the bank records. Bank. P45 will be deducted to the bank records. Book. P50,550 will be added to the books. Book. P45 will be deducted to the books. The deposits of Tacurong Organic Farm earned interest of P132.08 for the month. Tacurong Organic Farm does not have knowledge of interest earned until it receives the bank statement. Book. P132.08 will be added to the books. Book. P132.08 will be deducted to the books. Bank. P132.08 will be added to the bank records, Bank. P132.08 will be deducted to the bank records.arrow_forward