Concept explainers

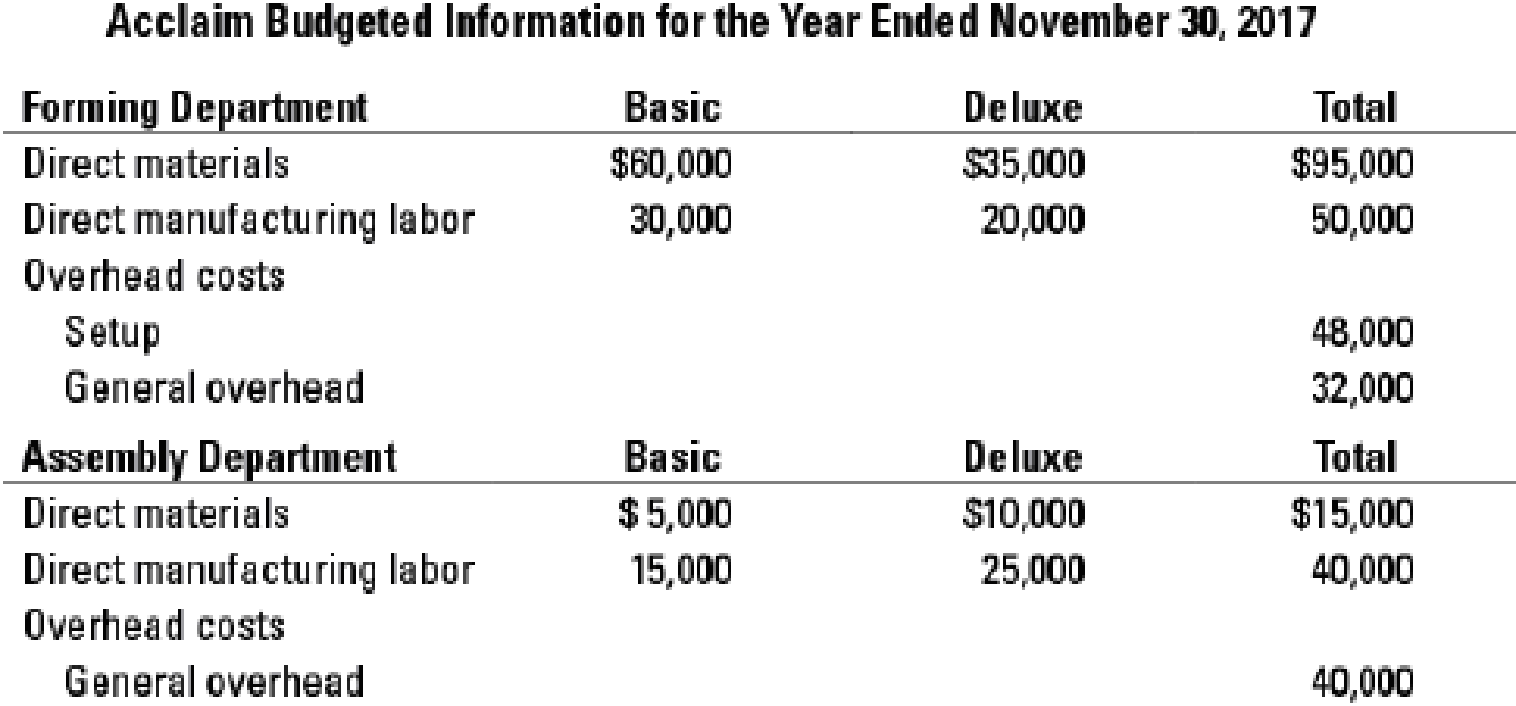

Plant-wide, department, and activity-cost rates. Acclaim Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Acclaim does large custom orders. Acclaim budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect

The controller has asked you to compare plant-wide, department, and activity-based cost allocation.

- 1. Calculate the budgeted unit cost of basic and deluxe trophies based on a single plant-wide overhead rate, if total overhead is allocated based on total direct costs. (Don’t forget to include direct material and direct manufacturing labor cost in your unit cost calculation.)

Required

- 2. Calculate the budgeted unit cost of basic and deluxe trophies based on departmental overhead rates, where forming department overhead costs are allocated based on direct manufacturing labor costs of the forming department and assembly department overhead costs are allocated based on total direct manufacturing labor costs of the assembly department.

- 3. Calculate the budgeted unit cost of basic and deluxe trophies if Acclaim allocates overhead costs in each department using activity-based costing, where setup costs are allocated based on number of batches and general overhead costs for each department are allocated based on direct manufacturing labor costs of each department.

- 4. Explain briefly why plant-wide, department, and activity-based costing systems show different costs for the basic and deluxe trophies. Which system would you recommend and why?

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Chapter 5 Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Additional Business Textbook Solutions

Managerial Accounting (4th Edition)

Financial Accounting

Principles of Accounting Volume 1

Construction Accounting And Financial Management (4th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

- Evans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardEclipse Motor Company manufactures two types of specialty electric motors, a commercial motor and a residential motor, through two production departments, Assembly and Testing. Presently, the company uses a single plantwide factory overhead rate for allocating factory overhead to the two products. However, management is considering using the multiple production department factory overhead rate method. The following factory overhead was budgeted for Eclipse: Direct machine hours were estimated as follows: In addition, the direct machine hours (dmh) used to produce a unit of each product in each department were determined from engineering records, as follows: a. Determine the per-unit factory overhead allocated to the commercial and residential motors under the single plantwide factory overhead rate method, using direct machine hours as the allocation base. b. Determine the per-unit factory overhead allocated to the commercial and residential motors under the multiple production department factory overhead rate method, using direct machine hours as the allocation base for each department. c. Recommend to management a product costing approach, based on your analyses in (a) and (b). Support your recommendation.arrow_forwardStacks manufactures two different levels of hockey sticks: the Standard and the Slap Shot. The total overhead of $600,000 has traditionally been allocated by direct labor hours, with 400,000 hours for the Standard and 200.000 hours for the Slap Shot. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $450.000 of overhead, with 30,000 hours used on the Standard product and 15,000 hours used on the Slap Shot product. It was also estimated that the inspection cost pool would have $150,000 of overhead, with 25,000 hours for the Standard and 5,000 hours for the Slap Shot. What is the overhead rate per product, under traditional and under ABC costing?arrow_forward

- Acclaim Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Acclaim does large custom orders. Acclaim budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect manufacturing costs are accumulated in two cost pools, set up and general overhead. In the assembly department, all indirect manufacturing costs are accumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 units per batch but because of the more intricate detail of the deluxe trophies, they are formed in batches of 50 units per batch. The controller has asked you to compare plantwide, department, and activity-based cost allocation. Acclaim Budgeted Information for the Year Ended November 30, 2020 Forming Department Basic Deluxe Total Direct materials $37,700 $21,500 $59,200 Direct manufacturing labor…arrow_forwardRequ Gable Company uses three activity cost pools. Each pool has a cost driver. Information for Gable Company follows: Activity Cost Pools Machining Designing costs Setup costs Number of machine hours Number of design hours Number of batches Suppose that Gable Company manufactures three products, A, B, and C. Information about these products follows: Product A Product B Product C 26,000 2,800 40 Total Cost of Pool Cost Driver $250,600 Number of machine hours 61,600 Number of design hours 66,402 Number of batches Product A Product B Product C Total Overhead Assigned 36,000 1,600 170 Estimated Cost Driver 71,600 7,000 465 9,600 2,600 255 Required: 1. Using activity proportions, determine the amount of overhead assigned to each product. (Do not round your intermediate calculations. Round your final answers to nearest whole number.)arrow_forwardAtlanta Systems produces two different products, Product A, which sells for $650 per unit, and Product B, which sells for $1,200 per unit, using three different activities: Design, which uses Engineering Hours as an activity driver; Machining, which uses machine hours as an activity driver; and Inspection, which uses number of batches as an activity driver. The cost of each activity and usage of the activity drivers are as follows: Usage by Product A Usage by Product B Design (Engineering Hours) Machining (Machine Hours) Inspection (Batches) Cost $ 230,000 $2,600,000 $ 240,000 116 134 2,320 2,680 34 46 Atlanta manufactures 12,500 units of Product A and 10,172 units of Product B per month. Each unit of Product A uses $100 of direct materials and $45 of direct labor, while each unit of Product B uses $140 of direct materials and $75 of direct labor. Required: a. Calculate the activity rate for design. Rate for Design per hour b. Calculate the activity rate for machining. Rate for…arrow_forward

- Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing $ 3,740 Supervising $ 27,840 Other $ 10,600 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: MHs (Processing) Batches (Supervising) Product M0 10,450 600 Product M5 550 600 Total 11,000 1,200 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Product M0 Product M5 Sales (total) $ 75,700 $ 90,900 Direct materials (total) $ 28,700 $ 31,600 Direct labor (total) $ 28,000 $ 41,900 The activity rate for the…arrow_forwardMirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing $ 4,900 Supervising $ 34,200 Other $ 11,200 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: MHs (Processing) Batches (Supervising) Product M0 13,300 900 Product M5 700 900 Total 14,000 1,800 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Product M0 Product M5 Sales (total) $ 81,000 $ 93,900 Direct materials (total) $ 29,300 $ 32,200 Direct labor (total) $ 28,600 $ 42,500 What is the overhead cost assigned to Product…arrow_forwardMirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below: Processing $ 6,300 Supervising $ 22,320 Other $ 11,400 Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: MHs (Processing) Batches (Supervising) Product M0 14,250 450 Product M5 750 450 Total 15,000 900 Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. Product M0 Product M5 Sales (total) $ 82,600 $ 94,900 Direct materials (total) $ 29,500 $ 32,400 Direct labor (total) $ 28,800 $ 42,700 What is the product margin for Product M5 under…arrow_forward

- Tribute Inc. makes two styles of trophies, basic and deluxe, and operates at capacity. Tribute does large custom orders. Tribute budgets to produce 10,000 basic trophies and 5,000 deluxe trophies. Manufacturing takes place in two production departments: forming and assembly. In the forming department, indirect manufacturing costs are accumulated in two cost pools, set up and general overhead. In the assembly department, all indirect manufacturing costs are accumulated in one general overhead cost pool. The basic trophies are formed in batches of 200 units per batch but because of the more intricate detail of the deluxe trophies, they are formed in batches of 50 units per batch. (Click the icon to view budgeted information.) Read the requirements. Requirement 1. Ca labor cost in your u Start by calculating Direct materials Forming Assembly Total direct materia Direct manufacturin Forming Assembly Total direct manufa Total direct costs Requirements 1. Calculate the budgeted unit cost of…arrow_forwardMaxey & Sons manufactures two types of storage cabinets-lype A and Type B-and applies manufacturing overhead to all units at the rate of $120 per machine hour. Production information follows. Descriptions Anticipated volume (units) Direct-material cost per unit Direct-labor cost per unit Descriptions The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours, and outgoing shipments, which are the activities' three respective cost drivers, follow. Setups Machine hours Outgoing shipments Type A 140 48,000 200 Required 1 Type A 24,000 $28 33 Required 2 Required 3 The firm's total overhead of $13,860,000 is subdivided as follows: manufacturing setups, $3,024,000; machine processing. $8,316,000; and product shipping, $2,520,000. Required: 1. Compute the unit manufacturing cost of Type A and Type B…arrow_forwardCarson Paint Company, which manufactures quality paint to sell at premium prices, uses a single production department. Production begins by blending the various chemicals that are added at the beginning of the process and ends by filling the paint cans. The gallon cans are then transferred to the shipping department for crating and shipment. Direct labor and overhead are added continuously throughout the process. Factory overhead is applied at the rate of $3 per direct labor dollar. The company combines direct labor and overhead in computing product cost. Prior to May, when a change in the manufacturing process was implemented, Work-in-Process Inventories were insignificant. The changed manufacturing process, which has resulted in increased equipment capacity, allows increased production but also results in considerable amounts of Work-in-Process Inventory. Also, the company had 1,000 spoiled gallons in May-one- half of which was normal spoilage and the rest abnormal spoilage. The…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning