Concept explainers

Learning Curves (Appendix B)

Krylon Company purchases eight special tools annually from CO., Inc. The price of these tools has increased each year, reaching $100,000 per unit last year. Because the purchase price has increased significantly, Krylon management has asked for a cost estimate to produce the tools in its own facilities.

A team of employees from the engineering, manufacturing, and accounting departments has prepared a report for management that includes the following estimate to produce the first unit. Additional production employees will be hired to manufacture the tools. However, no additional equipment or space will be needed.

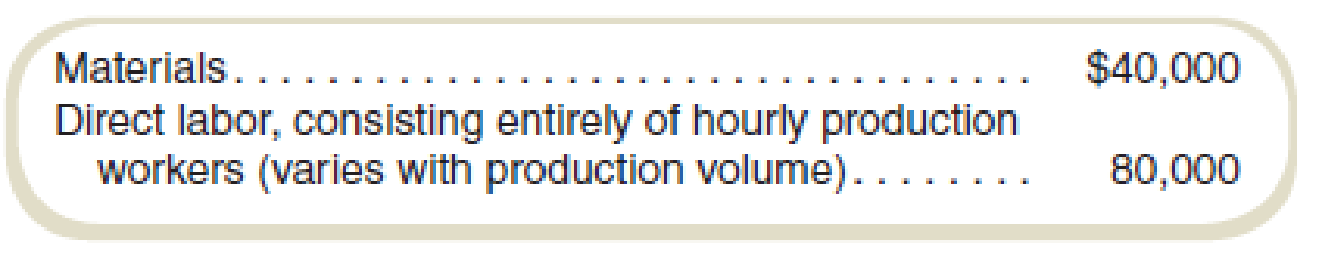

The report states that total incremental costs for the first unit are estimated to be $120,000, as shown here:

Overhead and administrative costs are not affected by producing this tool.

The current purchase price is $100,000 per unit, so the report recommends that Krylon continue to purchase the product from CO., Inc.

Required

Assume that Krylon could experience labor-cost improvements on the tool production consistent with an 80 percent learning curve. Should Krylon produce or purchase its annual requirement of eight tools? Explain your answer. (Note that the 80 percent learning rate coefficient is −0.3219.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 5 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Keleher Industries manufactures pet doors and sells them directly to the consumer via their web site. The marketing manager believes that if the company invests in new software, they will increase their sales by 10%. The new software will increase fixed costs by $400 per month. Prepare a forecasted contribution margin income statement for Keleher Industries reflecting the new software cost and associated increase in sales. The previous annual statement is as follows:arrow_forwardAcme Semiconductor is expanding its facility and needs to add equipment. There are three process tools under consideration. You have been asked to perform an economic analysis to select the most appropriate tool to acquire. You have gathered the following information for evaluation. Each of these tools has a useful life of seven years. Acme’s accounting staff has established a company-wide MARR of 8% per year.Which one of the process tools should be selected?arrow_forwardBalcom Enterprises is planning to introduce a new product that will sell for $145 a unit. Manufacturing cost estimates for 25,000 units for the first year of production are: • Direct materials $1,500,000. • Direct labor $900,000 (based on $18 per hour x 50,000 hours). Although overhead has not be estimated for the new product, monthly data for Balcom's total production for the last two years has been analyzed using simple linear regression. The analysis results are as follows: Dependent variable. Independent variable Intercept Coefficient on independent variable Coefficient of correlation R² Multiple Choice O Based on this information, how much is the variable manufacturing cost per unit, using the variable overhead estimated by the regression (assuming that direct materials and direct labor are variable costs)? O O $106 $97 $88 Factory overhead costs Direct labor hours. $130,000 $83 $ 5.00 0.941 0.834arrow_forward

- Blue Spruce Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading lamps. Each desk has a reading lamp as one of its components. Division A can purchase reading lamps at a cost of $10 from an outside vendor. Division A needs 8,200 lamps for the coming year. Division B has the capacity to manufacture 41,000 lamps annually. Sales to outside customers are estimated at 32,800 lamps for the next year. Reading lamps are sold at $12 each. Variable costs are $7 per lamp and include $1 of variable sales costs that are not incurred if lamps are sold internally to Division A. The total amount of fixed costs for Division B is $65,600. Consider the following independent situations. (a) What should be the minimum transfer price accepted by Division B for the 8,200 lamps and the maximum transfer price paid by Division A? Minimum transfer price accepted by Division B Maximum transfer price paid by Division A $ $ per unit per unitarrow_forwardAs the newly appointed Controller of Lynbrook, Inc. you have been asked to evaluate several scenarios that management is considering to improve the overall profitability of the company. Lynbrook manufactures and sells a product called a Wren, its only product. The company normally produces and sells 60,000 Wrens each year at a selling price of $32 per unit. The company's unit costs at this level of activity are included below: Direct materials $10.00 Direct labor 4.50 Variable manufacturing 2.30 overhead Fixed manufacturing overhead 5.00 ($300,000 total) Variable selling expenses 1.20 Fixed selling expenses 3.50 ($210,000 total) Total cost per unit $26.50 The CFO of Lynbrook would like your response to the following three (3) independent situations to present to the management team early next week. Situation #1 Assume that Lynbrook has sufficient capacity to produce 90,000 Wrens each year without any increase in fixed manufacturing overhead costs. The company could increase its unit…arrow_forwardCrede Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading lamps. Each desk has a reading lamp as one of its components. Division A can purchase reading lamps at a cost of $10.10 from an outside vendor. Division A needs 11,100 lamps for the coming year. Division B has the capacity to manufacture 49,600 lamps annually. Sales to outside customers are estimated at 38,500 lamps for the next year. Reading lamps are sold at $12.09 each. Variable costs are $6.87 per lamp and include $1.41 of variable sales costs that are not incurred if lamps are sold internally to Division A. The total amount of fixed costs for Division B is $75,900. Consider the following independent situations. What should be the minimum transfer price accepted by Division B for the 11,100 lamps and the maximum transfer price paid by Division A? (Round answers to 2 decimal places, e.g. 15.25.) Per unit Minimum transfer price accepted by Division B $_ Maximum transfer…arrow_forward

- Flounder Inc. has two divisions. Division A makes and sells student desks. Division B manufactures and sells reading lamps. Each desk has a reading lamp as one of its components. Division A can purchase reading lamps at a cost of $10 from an outside vendor. Division A needs 9,000 lamps for the coming year. Division B has the capacity to manufacture 45,000 lamps annually. Sales to outside customers are estimated at 36,000 lamps for the next year. Reading lamps are sold at $12 each. Variable costs are $7 per lamp and include $2 of variable sales costs that are not incurred if lamps are sold internally to Division A. The total amount of fixed costs for Division B is $72,000. Consider the following independent situations.arrow_forwardA car manufacturer is considering the purchase of an industrial robot for assembling cars. An employee who does the same tasks as the robot would do costs the company $60,000 in wages and benefits this year. Those costs are expected to increase by 5% annually over the next 10 years. A robot would cost $150,000, which includes initial purchase, installation, and training costs. The robot would cost $25,000 to operate in its first year, and costs are expected to increase by $2,000 each year. The company expects to be able to sell the robot at the end of 10 years for a salvage value of $10,000. If the company can earn 5% on its funds, then should the company purchase the robot? Of course, use calculations to justify your answer.arrow_forwardLearning Curves Hat Tricks Company (HTC) is a Buffalo, New York, manufacturer of hats andgloves. Recently, the company purchased a new machine to aid in producing the hat product lines.Production efficiency on the new machine increases with the workforce experience. It has beenshown that as cumulative output on the new machine increases, average labor time per unit decreasesup to the production of at least 3,200 units. As HTC’s cumulative output doubles from a base of 100units produced, the cumulative average labor time per unit declines by a learning rate of 80%.HTC has developed a new style of men’s hat to be produced on the new machine. One hundredof these hats can be produced in a total of 40 labor hours. All other direct costs to produce eachhat are $12 per hat, excluding direct labor cost. Direct labor cost per hour is $25. Fixed costs are$8,000 per month, and HTC has the capacity to produce 3,200 hats per month.Required HTC plans to set the selling price for the new men’s hat at…arrow_forward

- Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five-year period. His annual pay raises are determined by his division’s return on investment (ROI), which has exceeded 18% each of the last three years. He has computed the cost and revenue estimates for each product as follows: Product A Product B Initial Investment Cost of equipment (salvage value) 170000 380000 Annual revenues and costs Sales revenue 250000 350000 Variable expenses 120000 170000 Depreciation expense 34000 76000 Fixed out-of-pocket operating costs 70000 50000 The company’s discount rate is 16%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor using tables. Required: 1. Calculate the payback period for each product. 2. Calculate the net present value for each product. 3. Calculate the internal rate of return for each product. 4. Calculate the project…arrow_forwardA company intends to install new management software for its warehouse. The software will cost $47,000 to buy and will cost an additional $148,000 to install and implement. It is anticipated that it will save the company $44,000 through reductions in staff and $69,000 in general inventory costs in the first year after installation. What is the total benefit to the company in the first year if they choose to install the software?arrow_forwardCorazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College