Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 6, Problem 14E

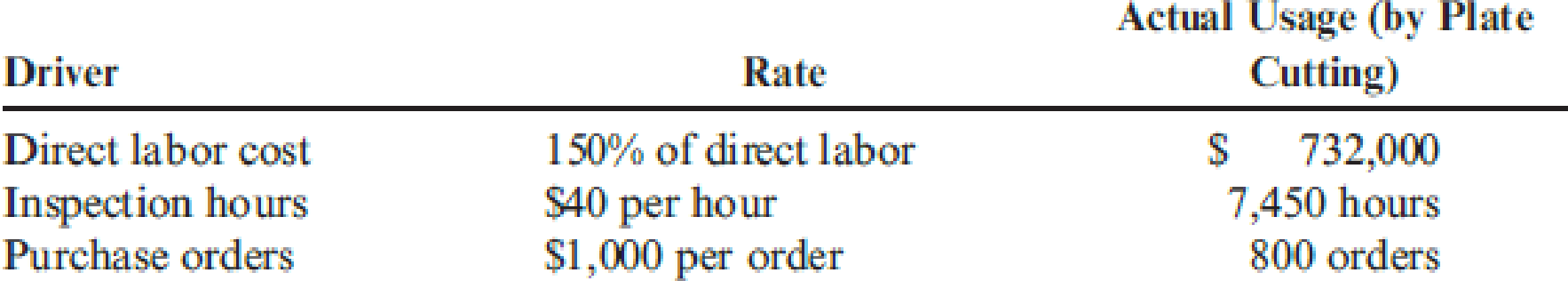

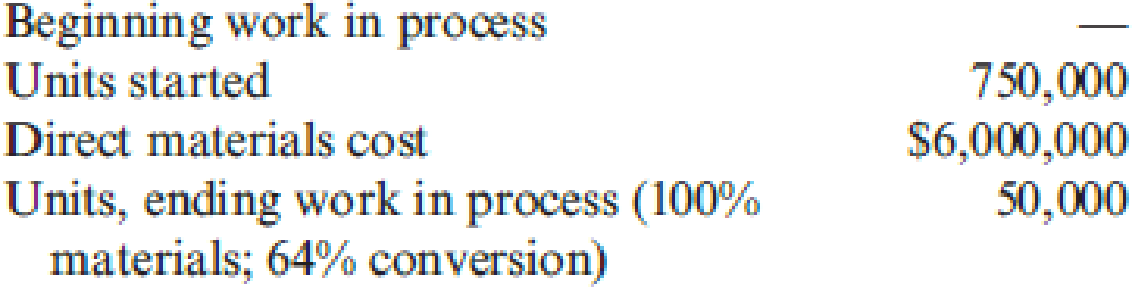

Lacy, Inc., produces a subassembly used in the production of hydraulic cylinders. The subassemblies are produced in three departments: Plate Cutting, Rod Cutting, and Welding. Materials are added at the beginning of the process. Overhead is applied using the following drivers and activity rates:

Other data for the Plate Cutting Department are as follows:

Required:

- 1. Prepare a physical flow schedule.

- 2. Calculate equivalent units of production for:

- a. Direct materials

- b. Conversion costs

- 3. Calculate unit costs for:

- a. Direct materials

- b. Conversion costs

- c. Total manufacturing

- 4. Provide the following information:

- a. The total cost of units transferred out

- b. The

journal entry for transferring costs from Plate Cutting to Welding - c. The cost assigned to units in ending inventory

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

An activity based costing system is used at Haldeman, SA to assign products overhead costs. First, the two overhead costs of Equipment depreciation and Water expense are allocated to three activity cost pools - Handling, Machining, and Other - based on resource consumption. The information used to perform these allocations is below:

Overhead Costs:

Equipment depreciation: $50,000

Water expense: $60,000

Distribution of Resource Consumption across Activity Cost Pools:

Overhead Cost

Activity Cost Pools

Handling

Machining

Other

Equipment depreciation

0.28

0.34

0.38

Water expense

0.32

0.22

0.46

The second stage of allocation is done by assigning the Handling costs to products on the basis of orders filled while products are assigned Machining costs based on machine hours. Costs assigned to the Other activity pool are not further assigned to products. Activity information for Haldeman's only two products is below:

orders filled

machine hours

Product LS-157:

3,400

3,400…

Gladden Dock Company manufactures boat docks on an assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Finishing Department. This problem focuses on the Assembly Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. The firm uses FIFO method and the controller prepared the following (correct) equivalent unit calculation.

Unitscompleted

Physical Units

Direct Materials

Conversion

WIP, beginning

70

0

52.5

Started and completed

30

30

30

WIP, ending

10

10

5

Totals

110

40

87.5

Cost per Equiv Unit

$4,000

$16,000

Work in process, beginning inventory: Current Costs:Direct materials $140,000 Direct materials $ 160,000Conversion costs $260,000 Conversion…

Muskoge Company uses a process-costing system. The company manufactures a product that isprocessed in two departments: Molding and Assembly. In the Molding Department, directmaterials are added at the beginning of the process; in the Assembly Department, additionaldirect materials are added at the end of the process. In both departments, conversion costs areincurred uniformly throughout the process. As work is completed, it is transferred out. Thefollowing table summarizes the production activity and costs for February: Molding AssemblyBeginning inventories: Physical units 10,000 8,000 Costs: Transferred in — $ 45,400 Direct materials $22,000 — Conversion costs $13,800 $ 16,700Current production: Units started 25,000 ? Units transferred out 30,000 35,000 Costs: Transferred in — ? Direct materials $ 56,250 $ 40,250 Conversion costs $103,500 $142,845 Percentage of completion: Beginning inventory 40% 55% Ending inventory 80 50Required:3. Using the FIFO method, prepare the following for…

Chapter 6 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 6 - What is a process? Provide an example that...Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 3DQCh. 6 - What are transferred-in costs?Ch. 6 - Explain why transferred-in costs are a special...Ch. 6 - What is a production report? What purpose does...Ch. 6 - Can process costing be used for a service...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - How is the equivalent unit calculation affected...Ch. 6 - Describe the five steps in accounting for the...

Ch. 6 - Under the weighted average method, how are...Ch. 6 - Under what conditions will the weighted average...Ch. 6 - In assigning costs to goods transferred out, how...Ch. 6 - Prob. 14DQCh. 6 - What is operation costing? When is it used?Ch. 6 - Lamont Company produced 80,000 machine parts for...Ch. 6 - Lising Therapy has a physical therapist who...Ch. 6 - Fleming, Fleming, and Johnson, a local CPA firm,...Ch. 6 - During October, McCourt Associates incurred total...Ch. 6 - Tomar Company produces vitamin energy drinks. The...Ch. 6 - Apeto Company produces premium chocolate candy...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Gunnison Company had the following equivalent...Ch. 6 - Jackson Products produces a barbeque sauce using...Ch. 6 - Morrison Company had the equivalent units schedule...Ch. 6 - Shorts Company has three process departments:...Ch. 6 - A local barbershop cuts the hair of 1,200...Ch. 6 - Friedman Company uses JIT manufacturing. There are...Ch. 6 - Lacy, Inc., produces a subassembly used in the...Ch. 6 - Softkin Company manufactures sun protection...Ch. 6 - Heap Company manufactures a product that passes...Ch. 6 - K-Briggs Company uses the FIFO method to account...Ch. 6 - The following data are for four independent...Ch. 6 - Using the data from Exercise 6.18, compute the...Ch. 6 - Holmes Products, Inc., produces plastic cases used...Ch. 6 - Dama Company produces womens blouses and uses the...Ch. 6 - Fordman Company has a product that passes through...Ch. 6 - Using the same data found in Exercise 6.22, assume...Ch. 6 - Baxter Company has two processing departments:...Ch. 6 - Tasty Bread makes and supplies bread throughout...Ch. 6 - Under either weighted average or FIFO, when...Ch. 6 - During the month of June, the mixing department...Ch. 6 - As goods are transferred from a prior process to a...Ch. 6 - During March, Hanks Manufacturing started and...Ch. 6 - Proteger Company manufactures insect repellant...Ch. 6 - Swasey Fabrication, Inc., manufactures frames for...Ch. 6 - Refer to the data in Problem 6.31. Assume that the...Ch. 6 - Hatch Company produces a product that passes...Ch. 6 - FIFO Method, Single Department Analysis, One Cost...Ch. 6 - Hepworth Credit Corporation is a wholly owned...Ch. 6 - Muskoge Company uses a process-costing system. The...Ch. 6 - Prob. 37PCh. 6 - Healthway uses a process-costing system to compute...Ch. 6 - FIFO Method, Two-Department Analysis Refer to the...Ch. 6 - Jacson Company produces two brands of a popular...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - Larkin Company produces leather strips for western...Ch. 6 - Novel Toys, Inc., manufactures plastic water guns....Ch. 6 - Prob. 44P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Reducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity. Other overhead activities, their costs, and drivers are listed below. Other production information concerning the two hydraulic cylinders is also provided: Required: 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost. 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios. 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification. 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.arrow_forwardK-Briggs Company uses the FIFO method to account for the costs of production. For Crushing, the first processing department, the following equivalent units schedule has been prepared: The cost per equivalent unit for the period was as follows: The cost of beginning work in process was direct materials, 40,000; conversion costs, 30,000. Required: 1. Determine the cost of ending work in process and the cost of goods transferred out. 2. Prepare a physical flow schedule.arrow_forwardHercules Inc. manufactures elliptical exercise machines and treadmills. The products are produced in its Fabrication and Assembly production departments. In addition to production activities, several other activities are required to produce the two products. These activities and their associated activity rates are as follows: The activity-base usage quantities and units produced for each product were as follows: Use the activity rate and usage information to determine the total activity cost and activity cost per unit for each product.arrow_forward

- Computing Equivalent Units, FIFO and Weighted Average Cost Methods Assume each of the following conditions concerning the data given: All materials are added at the beginning of the process. All materials are added at the end of the process. (Note that this would have to be a department subsequent to the first department for all materials to be added at the end of the process, but ignore that fact for purposes of this solution.) Half of the materials are added at the beginning of the process, and the balance of the materials is added when the units are three-fourths completed. In all cases, labor and factory overhead are added evenly throughout the process.arrow_forwardMuskoge Company uses a process-costing system. The companymanufactures a product that is processed in two departments: Moldingand Assembly. In the Molding Department, direct materials are added atthe beginning of the process; in the Assembly Department, additionaldirect materials are added at the end of the process. In both departments, conversion costs are incurred uniformly throughout theprocess. As work is completed, it is transferred out. The following tablesummarizes the production activity and costs for February: Required:1. Using the weighted average method, prepare the following forthe Molding Department: a. A physical flow scheduleb. An equivalent units calculationc. Calculation of unit costs. Round to four decimal places.d. Cost of ending work in process and cost of goods transferred out e. A cost reconciliation2. Prepare journal entries that show the flow of manufacturingcosts for the Molding Department. Materials are added at thebeginning of the process.3. Repeat…arrow_forwardRamsey SARL uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs - Security expense and Building depreciation - are allocated to three activity cost pools - Shipping, Carving, and Other - based on resource consumption. Data to perform these allocations appear below: Overhead Costs: Security expense: $105,000 Building depreciation: $70,000 Distribution of Resource Consumption across Activity Cost Pools: Overhead Cost Activity Cost Pools Shipping Carving Other Security expense 0.30 0.42 0.28 Building depreciation 0.34 0.32 0.34 The second stage of allocation is done by assigning the Shipping costs to products on the basis of orders shipped while products are assigned Carving costs based on machine hours. Costs assigned to the Other activity pool are not further assigned to products. Activity information for Ramsey's only two products is below: orders shipped machine hours Product BA-15: 6,300 1,500…arrow_forward

- Please refer to the pictures for parts A and B. Part C is below: Cost assignment—Weighted average EUP Cost per EUP Total cost Completed and transferred out Direct materials Conversion Total Completed and transferred out Ending work in process Direct materials Conversion Total ending work in process Total costs accounted for HI-T Company.arrow_forwardCycle Time, Velocity, Product Costing Mulhall, Inc., has a JIT system in place. Each manufacturing cell is dedicated to the production of a single product or major subassembly. One cell, dedicated to the production of mopeds, has four operations: machining, finishing, assembly, and qualifying (testing). The machining process is automated, using computers. In this process, the model’s frame and engine are constructed. In finishing, the frame is sandblasted, buffed, and painted. In assembly, the frame and engine are assembled. Finally, each model is tested to ensure operational capability. For the coming year, the moped cell has the following budgeted costs and cell time (both at theoretical capacity): Budgeted conversion costs $5,541,120 Budgeted materials $18,668,000 Cell time 35,520 Theoretical output 17,760 models During the year, the following actual results were obtained: Actual conversion costs $5,541,120 Actual materials $4,009,000 Actual cell time…arrow_forwardFields Company has two manufacturing departments, forming and painting. The company uses the weighted average method and it reports the following unit data for the Forming department. Units completed in the forming department are transferred to the painting department. Beginning work in process inventory Units started this period Completed and transferred out Ending work in process inventory Production cost information for the forming department follows. Beginning work in process Direct materials Units 34,500 490,000 494,500 30,000 Conversion Costs added this period Direct materials Conversion Total costs to account for $ 56,200 22,900 1,800, 200 1, 179,000 Direct Materials Percent Complete 80% 85% $79,100 2,979,200 $ 3,058, 300 Conversion Percent Complete 20% 35%arrow_forward

- Compute equivalent units of production for both direct materials and conversion. For the first two columns above "total units" the options are: beginnings work in process - units, completed and transferred out, ending work in process, total units accounted for, units started this period. for the rest of the empty spaces, you use numbersarrow_forwardPrism Company has two service departments: security departments and maintenance departments that give services to two producing departments: machining department and assembling department. Security department costs will be allocated using the number of employees and maintenance department costs will be allocated using direct labor hours. For calculation of predetermined rate, machine hours and direct labor hours are used for machining and assembling departments, respectively.arrow_forwardWay Cool produces two different models of air conditioners. The company produces the mechanical systems in its components department. The mechanical systems are combined with the housing assembly In Its finishing department. The activities, costs, and drivers associated with these two manufacturing processes and the production support process follow. Process Activity Components Changeover Machining Setups Finishing Welding Support Inspecting Rework Purchasing Providing space Providing utilities Units produced Welding hours Batches Number of inspections Machine hours Setups Rework orders Purchase orders Required 1 Overhead Cost $ 559,650 411,510 74,000 $1,045,160 $ 288,640 257,600 55,000 601,240 $ $ 194,540 30,800 37,960 $ 263,300 Additional production Information concerning its two product lines follows. Required 2 Model 145 1,200 1,200 455 475 3,350 20 150 365 Driver Number of batches Machine hours Number of setups Required 3 Welding hours Number of inspections Rework orders Purchase…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY