Concept explainers

Frank Flynn is the payroll manager for Powlus Supply Company. During the budgeting process, Sam Kinder, director of finance, asked Flynn to arrive at a set percentage that could be applied to each budgeted salary figure to cover the additional cost that will be incurred by Powlus Supply for each employee. After some discussion, it was determined that the best way to compute this percentage would be to base these additional costs of payroll on the average salary paid by the company.

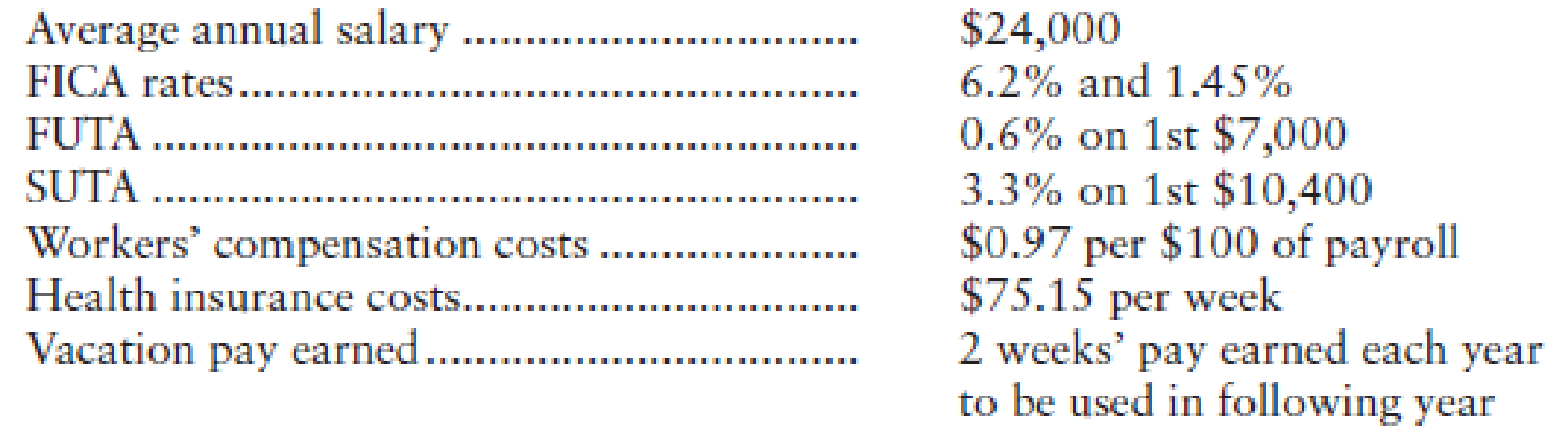

Kinder wants this additional payroll cost percentage to cover payroll taxes (FICA, FUTA, and SUTA) and other payroll costs covered by the company (workers’ compensation expense, health insurance costs, and vacation pay).

Flynn gathers the following information in order to complete the analysis:

Compute the percentage that can be used in the budget.

Trending nowThis is a popular solution!

Chapter 6 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- Classify each of the following actions as either being associated with the financial accounting information system (FS) or the cost management information system (CMS): a. Determining the total compensation of the CEO of a public company b. Issuing a quarterly earnings report c. Determining the unit product cost using TDABC d. Calculating the number of units that must be sold to break even e. Preparing a required report for the SEC f. Preparing a sales budget g. Using cost and revenue information to decide whether to keep, or drop, a product line h. Preparing an annual statement of financial position that conforms to generally accepted accounting principles (GAAP) i. Using cost and revenue information to decide whether to invest in a new production system or not j. Reducing costs by improving the overall quality of a product k. Using a debt-equity ratio and liquidity ratios from a balance sheet to assess the likelihood of bankruptcy l. Using a public companys financial statements to decide whether or not to buy its stockarrow_forwardHackshaw Co. was formed three years ago by Glenn Holding. It started as a very small company but began to expand rapidly. With the growth in the company, the owner decided to implement a formal budgetary control process. Glenn Holding provided some data and projections to the company’s Accountant which the Accountant used to prepare the master budget for the company. The master budget was then broken down into departmental budgets. These departmental budgets were distributed to the department managers with a cover letter explaining the new budgeting system and requesting the support of everyone in achieving the targets. Most of the department managers were displeased with the budget. They felt that the targets were not realistically attainable. a. What type of budgeting approach was used? Explain. What are the advantages and the disadvantages of the approach used, Discuss. What approach would you recommend? Why? Using practical illustration from your organization.arrow_forwardSwifty Corporation provides financial consulting and sells its own line of financial planners and budgeting products. The company has collected the following data for the next year's budgeted activity for a lead consultant and the supplies clerk. Consultants' wages Benefits Related overhead Clerk's wages Benefits Related overhead Profit margin per hour Profit margin on materials Total estimated consulting hours Total estimated material costs $100000 O $19.00. O $58.00. O $50.67. O $38.00. 60000 30000 $19000 3000 15000 $20 The labor rate per hour for this consultant is 15 % 5000 $172000arrow_forward

- The managing partner at Mina's Accounting Service typically hires one part-time intern to complete her client's basic tax returns. Mina expects her intern to complete 280 of these basic returns, estimating each one to take 30 minutes of the intern's time. Mina pays her intern $25/hr and incurs additional variable overhead costs of $20/hr associated with the resources that are needed behind the scenes for these jobs. What cost of services should Mina budget for all basic tax returns this season, and how much should she charge each client if she wants to earn a 60% gross margin on each of these returns?arrow_forwardAssume that you are one of the owners of Pinoy Corporation. Upon reviewing the project income statements as shown in Tables 7.3 and 7.4 you realized that salaries are understated because it only accounts for the 12 months of salary of each employee and does not include the 13th month pay, which is required by law. You also feel that cost of goods sold ought to be computed at 45% instead of 40% of salles revenues. Using a spreadsheet program, revise the projected income statements for the first year and the first three years of the business.arrow_forwardJane and Alex both work at Spartans Inc. Jane, the manger of a production department, buys lunch for Alex, who works in Accounting. Alex is preparing the monthly projections for the various production departments. At lunch, Jane asks Alex "to be conservative in his estimates" of variable costs in crafting the budget. Which, if any, ethical standards did Jane violate? O Credibility - failure to provide all relevant information that could influence a decision. O Competence - failure to maintain an appropriate level of expertise. O Integrity - failure to abstain from activities that might discredit the profession. Confidentiality - failure to refrain from using information for an unethical advantage. O Integrity - failure to mitigate conflicts of interest. O Confidentiality - disclosure of confidential information without authorization or legal requirement.arrow_forward

- You are the managerial accountant at Reliable Company and are part of the organization’s budgeting committee. You have been assigned to support the marketing department and manage its master budget. The marketing department is responsible for the following: • Managing the firm's marketing • Hiring subcontractors • Selling the consulting expertise to smaller outside firms The department's expenses are as follows: • Salaries and benefits of $48,000/month • Web site operations of $21,000/ month • Online advertising expenses of $15,000/month • Miscellaneous expenses of $3,500/month The sales forecast for its consulting services are as follows: • April: $190,000 • May: $200,000 • June: $205,000 The department pays a sales commission of 5%, and this is paid in the following month. Subcontractor expenses are estimated at 45% of sales and are paid the month after they are billed. Consulting fees are collected 20% in the month of sale, 70% in the following month, and 10% in…arrow_forwardYou are the managerial accountant at Reliable Company and are part of the organization’s budgeting committee. You have been assigned to support the marketing department and manage its master budget. The marketing department is responsible for the following: • Managing the firm's marketing • Hiring subcontractors • Selling the consulting expertise to smaller outside firms The department's expenses are as follows: • Salaries and benefits of $48,000/month • Web site operations of $21,000/ month • Online advertising expenses of $15,000/month • Miscellaneous expenses of $3,500/month The sales forecast for its consulting services are as follows: • April: $190,000 • May: $200,000 • June: $205,000 The department pays a sales commission of 5%, and this is paid in the following month. Subcontractor expenses are estimated at 45% of sales and are paid the month after they are billed. Consulting fees are collected 20% in the month of sale, 70% in the following month, and 10% in…arrow_forwardYou are the managerial accountant at Reliable Company and are part of the organization’s budgeting committee. You have been assigned to support the marketing department and manage its master budget. The marketing department is responsible for the following: • Managing the firm's marketing • Hiring subcontractors • Selling the consulting expertise to smaller outside firms The department's expenses are as follows: • Salaries and benefits of $48,000/month • Web site operations of $21,000/ month • Online advertising expenses of $15,000/month • Miscellaneous expenses of $3,500/month The sales forecast for its consulting services are as follows: • April: $190,000 • May: $200,000 • June: $205,000 The department pays a sales commission of 5%, and this is paid in the following month. Subcontractor expenses are estimated at 45% of sales and are paid the month after they are billed. Consulting fees are collected 20% in the month of sale, 70% in the following month, and 10% in…arrow_forward

- Maira Corporation has set various goals and the management is taking various appropriate actions to ensure the company achieves these goals. One of the actions is to reduce operational costs, which exceeds budgeted amount. Which of the following functions best describes this process? A. Decision-making B. Planning C. Directing operational activities D. Controlling 2. HOC Company's costs for the month of June 2021 were as follows: direct materials, RM25,000; direct labor, RM32,500; selling, RM16,000; administrative, RM15,500; and manufacturing overhead, RM44,400. The beginning work in process inventory was RM17,000 and the ending work in process inventory was RM7,000. What was the cost of goods manufactured for the month? (a) RM105,000 (b) RM31,500 (c) RM133,400 (d) RM111,900 3. Chery Company manufactures and sells washing machines. In order to make assembly of the machines faster and easier, some of the metal parts in the machines are coated with grease. How should the cost of…arrow_forwardYou are the managerial accountant at Reliable Company and are part of the organization’s budgeting committee. You have been assigned to support the marketing department and manage its master budget. The marketing department is responsible for the following: • Managing the firm's marketing • Hiring subcontractors • Selling the consulting expertise to smaller outside firms The department's expenses are as follows: • Salaries and benefits of $48,000/month • Web site operations of $21,000/ month • Online advertising expenses of $15,000/month • Miscellaneous expenses of $3,500/month The sales forecast for its consulting services are as follows: • April: $190,000 • May: $200,000 • June: $205,000 The department pays a sales commission of 5%, and this is paid in the following month. Subcontractor expenses are estimated at 45% of sales and are paid the month after they are billed. Consulting fees are collected 20% in the month of sale, 70% in the following month, and 10% in…arrow_forwardPease Contractors is a local home remodeling company. In analyzing financial performance, the accountant compares actual results with a flexible budget. The standard direct labor rates used in the flexible budget are established each year at the time the annual plan is formulated and held constant for the entire year. The standard direct labor rates in effect for the current fiscal year and the standard hours allowed for the actual output of work for August are shown in the following schedule. Worker Classification Standard Direct Labor Rate per Hour Standard Direct Labor-Hours Allowed for Output Supervisor $ 50 1,800 Skilled 30 2,250 General 20 4,950 The actual direct labor-hours worked and the actual direct labor rates per hour experienced for the month of August were as follows. Worker Classification Actual Direct Labor Rate per Hour Actual Direct Labor-Hours Supervisor $ 54 2,112 Skilled 32 2,112 General 18 5,376 Required: Calculate the dollar…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning