Fundamentals Of Financial Accounting

6th Edition

ISBN: 9781259864230

Author: PHILLIPS, Fred, Libby, Robert, Patricia A.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 9E

Recording and Determining the Effects of Write-Off s. Recoveries, and Bad Debt Expense Estimates on the Balance Sheet and Income Statement

Fraud Investigators Inc. operates a fraud detection service.

Required:

- 1. Prepare

journal entries for each transaction below.- a. On March 31, 10 customers were billed for detection services totaling $25,000.

- b. On October 31, a customer balance of $1,500 from a prior year was determined to be uncollectible and was written off.

- c. On December 15, a customer paid an old balance of $900, which had been written off in a prior year.

- d. On December 31, $500 of

bad debts were estimated and recorded for the year.

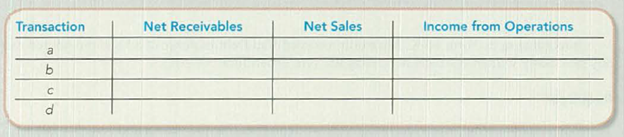

- 2. Complete the following table, indicating the amount and effect (+ for increase, − for decrease, and NE for no effect) of each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Required information

[The following information applies to the questions displayed below.]

Fraud Investigators Incorporated operates a fraud detection service.

a. On March 31, 10 customers were billed for detection services totaling $24,000.

b. On October 31, a customer balance of $1,450 from a prior year was determined to be uncollectible and was written off.

c. On December 15, a customer paid an old balance of $790, which had been written off in a prior year.

d. On December 31, $490 of bad debts were estimated and recorded for the year.

2. Complete the following table, indicating the amount and effect (+ for increase,- for decrease, and NE for no effect) of each

transaction. Ignore income taxes.

Transaction Net Receivables Net Sales

a.

b.

C.

d.

Income From

Operations

prepare journal entries for this

The following errors were found when the controller at Crane Hotel was doing the March 31 bank reconciliation.

1.

2.

3.

On March 5, Crane recorded a payment of an account payable as $2,710. The correct amount was $1,270. It was correctly

recorded by the bank.

On March 19, Crane recorded a deposit as $2,820. The correct amount was $4,280. The deposit was for the collection of an

account receivable and the bank recorded it correctly.

On March 31, the bank recorded a deposit as $5,610. The correct amount was $2,650. This error was corrected by the bank

on April 1. Crane had correctly recorded the deposit.

For each of these errors indicate if and how it would be shown on the bank reconciliation.

1.

2.

3.

$

$

+A

CAATs Application—Receivables Confirmation. You are using computer audit software to prepare accounts receivable confirmations during the annual audit of the Eastern Sunrise Services Club. The company has the following data files:Master file—debtor credit record.Master file—debtor name and address.Master file—account detail:Ledger number.Sales code.Customer account number.Date of last billing.Balance (gross).Discount available to customer (memo account only).Date of last purchase.The discount field represents the amount of discount available to the customer if the customer pays within 30 days of the invoicing date. The discount field is cleared for expired amounts during the daily updating. You have determined that this is properly executed.Required:From the data files shown, list the information that you would include on the confirmation requests. Identify the file from which the information can be obtained.

Chapter 8 Solutions

Fundamentals Of Financial Accounting

Ch. 8 - What are the advantages and disadvantages of...Ch. 8 - Prob. 2QCh. 8 - Which basic accounting principles does the...Ch. 8 - Using the allowance method, is Bad Debt Expense...Ch. 8 - What is the effect of the write-off of...Ch. 8 - How does the use of calculated estimates differ...Ch. 8 - A local phone company had a customer who rang up...Ch. 8 - What is the primary difference between accounts...Ch. 8 - What are the three components of the interest...Ch. 8 - As of May 1, 2016, Krispy Kreme Doughnuts had...

Ch. 8 - Does an increase in the receivables turnover ratio...Ch. 8 - What two approaches can managers take to speed up...Ch. 8 - When customers experience economic difficulties,...Ch. 8 - (Supplement 8A) Describe how (and when) the direct...Ch. 8 - (Supplement 8A) Refer to question 7. What amounts...Ch. 8 - 1. When a company using the allowance method...Ch. 8 - 2. When using the allowance method, as Bad Debt...Ch. 8 - 3. For many years, Carefree Company has estimated...Ch. 8 - 4. Which of the following best describes the...Ch. 8 - 5. If the Allowance for Doubtful Accounts opened...Ch. 8 - 6. When an account receivable is recovered a....Ch. 8 - Prob. 7MCCh. 8 - 8. If the receivables turnover ratio decreased...Ch. 8 - Prob. 9MCCh. 8 - Prob. 10MCCh. 8 - Prob. 1MECh. 8 - Evaluating the Decision to Extend Credit Last...Ch. 8 - Reporting Accounts Receivable and Recording...Ch. 8 - Recording Recoveries Using the Allowance Method...Ch. 8 - Recording Write-Offs and Bad Debt Expense Using...Ch. 8 - Determining Financial Statement Effects of...Ch. 8 - Estimating Bad Debts Using the Percentage of...Ch. 8 - Estimating Bad Debts Using the Aging Method Assume...Ch. 8 - Recording Bad Debt Estimates Using the Two...Ch. 8 - Prob. 10MECh. 8 - Prob. 11MECh. 8 - Recording Note Receivable Transactions RecRoom...Ch. 8 - Prob. 13MECh. 8 - Determining the Effects of Credit Policy Changes...Ch. 8 - Prob. 15MECh. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Bad Debt Expense Estimates and...Ch. 8 - Determining Financial Statement Effects of Bad...Ch. 8 - Prob. 3ECh. 8 - Recording Write-Offs and Recoveries Prior to...Ch. 8 - Prob. 5ECh. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Computing Bad Debt Expense Using Aging of Accounts...Ch. 8 - Recording and Reporting Allowance for Doubtful...Ch. 8 - Recording and Determining the Effects of Write-Off...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Recording Note Receivable Transactions, Including...Ch. 8 - Using Financial Statement Disclosures to Infer...Ch. 8 - Using Financial Statement Disclosures to Infer Bad...Ch. 8 - Prob. 15ECh. 8 - Analyzing and Interpreting Receivables Turnover...Ch. 8 - (Supplement 8A) Recording Write-Offs and Reporting...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions Jung ...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Interpreting Disclosure of Allowance for Doubtful...Ch. 8 - Recording Notes Receivable Transactions CS...Ch. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording Accounts Receivable Transactions Using...Ch. 8 - Prob. 2PBCh. 8 - Prob. 3PBCh. 8 - Accounting for Accounts and Notes Receivable...Ch. 8 - Analyzing Allowance for Doubtful Accounts,...Ch. 8 - Recording and Reporting Credit Sales and Bad Debts...Ch. 8 - Prob. 2COPCh. 8 - Recording Daily and Adjusting Entries Using FIFO...Ch. 8 - Prob. 1SDCCh. 8 - Prob. 2SDCCh. 8 - Ethical Decision Making: A Real-Life Example You...Ch. 8 - Critical Thinking: Analyzing the Impact of Credit...Ch. 8 - Using an Aging Schedule to Estimate Bad Debts and...Ch. 8 - Accounting for Receivables and Uncollectible...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- While preparing the February 28 bank reconciliation, the accountant identifies the following items: company’s balance according to the general ledger, $23,100; outstanding cheques, $550; interest earned on the chequing account, $100; a customer’s NSF cheque returned by the bank, $1,000. While preparing the reconciliation, the accountant discovers an error in recording a customer’s cheque; the amount has been incorrectly recorded on the books as a cash receipt of $600, while the bank correctly has recorded the amount as $650. What is the company’s adjusted cash balance on February 28? $22,250 $22,200 $22,150 $21,700arrow_forwardindividual customer and supplier. The management wishes to draft the related control accounts. Increase in allowance for doubtful debts (from GH¢1,750,000 to GH¢2,250,000) The following information is available. Receivables as on December 31 2018 Payables as on December 31 2018 accounting system where all separate ledger accounts are maintained for each Returns by customers from cash sales Returns by customers from credit sales Cash refund to a debtor who had paid the amount due twice Cheques received from suppliers against return of goods Cheques received from receivables in settlement of GH¢32,000,000 Cheques issued to suppliers in settlement of GH¢23,600,000 QUESTION 2 ABS Ltd has an GH¢ 2,600,000 4.100,000 23,350,000 14,360,000 550,000 31,650,000 180,000 35,900,000 320,000 980,000 27.700,000 120,000 Cash sales memos issued Goods returned to suppliers Credit sales invoices issued Goods purchased on credit 200,000 500,000 Bad debts written off Contra settlement between payables and…arrow_forwardQuestion: The following errors were found when the controller at Mountain Motel was doing the June 30 bank reconciliation. On June 25, the bank posted a cheque in the amount of $825 to Mountain’s bank account. The cheque had been written by another company, Mountainside Company. For each of these errors, (a) indicate if and how it would be shown on the bank reconciliation, and (b) prepare the journal entry for Mountain if required. Please explain for the answer.arrow_forward

- 2018. The bookkeeper of the client provided you the following summarized data taken directly You were assigned to audit the books of BACOLOD CORP. for the period ended December 31, from its records: Sales for cash Total cash collected from charge customers Cash purchases of merchandise Credit purchases of merchandise Expenses paid in cash Accounts receivable, January 1 Accounts receivable, December 31 Bad debt expense Recovery of bad debts Allowance for doubtful accounts, January 1 Allowance for doubtful accounts, December 31 Accounts payable, January 1 Accounts payable, December 31 Merchandise inventory, January 1 Merchandise inventory, December 31 Accrued expenses, December 31 Prepaid expenses, December 31 Furniture and equipment, at cost Interest received Accrued interest income, January 1 Purchase returns Purchase discounts us the CHAPTER 11-PROBLEM 8: 4. What is the net income for the year? P7,500,000 2,550,000 5,100,000 1,200,000 2,250,000 750,000 1,200,000 100,000 25,000 125,000…arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31, $24,980. Cash balance according to the bank statement at July 31, $26,470. Checks outstanding, $5,070. Deposit in transit, not recorded by bank, $4,070. A check for $170 in payment of an account was erroneously recorded in the check register as $710. Bank debit memo for service charges, $50. Journalize the entries that should be made by the company, part (A) Error and part (B) Service Charge. a. July 31 fill in the blank 2 fill in the blank 4 b. July 31 fill in the blank 6 fill in the blank 8arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Mathers Co. for July: Cash balance according to the company's records at July 31, $32,110. Cash balance according to the bank statement at July 31, $31,350. Checks outstanding, $2,870. Deposit in transit, not recorded by bank, $4,150. A check for $170 in payment of an account was erroneously recorded in the check register as $710. Bank debit memo for service charges, $20. Journalize the entries that should be made by the company, part (A) Error and part (B) Service Charge a. July 31 Cash Accounts Payable b. July 31 Miscellaneous Expense Casharrow_forward

- For each of the items in the following list, identify where it is included on a bank reconciliation: 1. EFT payment made by a customer. 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. Bank debit memorandum for service charges. Outstanding cheques from the current month. Bank error in recording a $1,779 deposit as $1,977. Outstanding cheques from the previous month that are still outstanding. Outstanding cheques from the previous month that are no longer outstanding. Bank error in recording a company cheque made out for $160 as $610. Bank credit memorandum for interest revenue. Company error in recording a deposit of $160 as $1,600. Bank debit memorandum for a customer's NSF cheque. Deposit in transit from the current month. Company error in recording a cheque made out for $630 as $360.arrow_forwardThe accountant for Beaume Corp. was preparing a bank reconciliation as of April 30. The following items were identified: Beaume's book balance $43,145 Outstanding cheques 900 Interest earned on chequing account 63 Customer's NSF cheque returned by the bank 375 In addition, Beaume made an error in recording a customer's cheque; the amount was recorded in cash receipts as $370; the bank recorded the amount correctly as $730. Required: What amount will Beaume report as its adjusted cash balance at April 30?arrow_forwardEntries for Bank Reconciliation The following data were accumulated for use in reconciling the bank account of Nakajima Co. for July: Cash balance according to the company's records at July 31, $23,900. Cash balance according to the bank statement at July 31, $25,170. Checks outstanding, $4,850. Deposit in transit, not recorded by bank, $3,900. A check for $590 issued in payment of an account was erroneously recorded in the check register as $950. Bank debit memo for service charges, $40. Journalize the entries that should be made by the company, part (a) Error and part (b) Service Charge. If an amount box does not require an entry, leave it blank. a. July 31 - Select - - Select - - Select - - Select - b. July 31 - Select - - Select - - Select - - Select -arrow_forward

- The auditor has gathered the following information to test the accuracy of the one prepared by the controller. In particular, the auditor is testing the accuracy of the outstanding cheques. Use the following information to prepare the bank reconciliation and calculate what the total of the outstanding cheques should be. 1. Cash balance - March 31 $39,500 2. Outstanding Deposits $13,810 3. NSF cheque from a customer $750 4. Bank Statement Balance - March 31 $127,100 5. The bank recorded a deposit as $10,000 when the deposit was actually $1,000 6. The bank credited the company's bank account with $3,900 of interest earned 7. The bank statement showed an EFT from a customer for $16,300 8. The bank charged a service charge of $45 9. The company posted cheque #1730 as $890 when the actual amount was properly debited by the bank for $980 a) Outstanding Cheques= $73,095 b) Outstanding Cheques= $76,995 c) Outstanding Cheques=$82,095 d) Outstanding Cheques= $56,795arrow_forward1. You are tasked to perform cut-off procedures for expenses and its related payable. In testing the completeness/cut-off assertion, what document would you most likely inspect? Group of answer choices a. Accounts payable subsidiary ledger. b. Vendor invoice register 15 days before and 15 days after report date. c. Purchase journal 15 days before and 15 days after report date. d. Cash disbursement journal 15 days before and 15 days after report date. 2. During the review of loan contracts and agreements, the auditor would most likely figure out the following, except: Group of answer choices a. The existence of loans. b. The completeness of loans. c. The accuracy of interest expense recorded by the entity. d. Related disclosures pertaining to assets pledged as collateral.arrow_forwardAPPLIED AUDITING Analyze and compute the appropriate answers for the following : (Provide the pertinent solutions to determine your correct answers. You have gathered the following data in the preparation of bank reconciliation on December 31, of the current year for AM Company: a. Balance per Bank Statement P 2,000,000 b. Balance per Book P 1,350,000 c. Bank service charge P 5,000 d. Outstanding checks P 300,000 e. Deposit in Transit P 237,500 f. Proceeds of bank loan, December 1, discounted 6 months at 12%, not recorded in AM Company’s books P 470,000 g. Customer’s NSF check charged back by bank P 25,000 h. Check of Rich Company charged by the bank against AM Company account P 75,000 i.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License