Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 5, Problem 5.22MCE

Cost of Goods Sold, FIFO, and LIFO

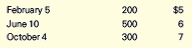

Kramer began operations early in 2016 and made the following purchases:

Kramer used the FIFO method to value its inventory and reported cost of goods sold expense for the year of $4,000.

Required

Determine the cost of goods sold expense assuming Kramer had used the LIFO method instead of the FIFO method.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the costs assigned to ending inventory and to cost of goods sold using FIFO.

Hemming Co. reported the following current-year purchases and sales for its only product.

Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods

sold using FIFO for comparison purposes.

Year 2

$ 320

900

390

855

LIFO inventory

LIFO cost of goods sold

FIFO inventory

FIFO cost of goods sold

Current assets (using LIFO)

Current assets (using FIFO)

Current liabilities

1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers.

Current ratio

Inventory turnover

Days' sales in inventory

Year 1

$ 270

840

380

450

180

Current ratio

Inventory turnover

Days' sales in inventory

(a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO

numbers.

Numerator / Denominator

295

840

350

375

160

Numerator / Denominator

(b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO

numbers.

Ratio

0

0

0

Ratio

0

0

0

(Inventoriable Goods and Costs) In your audit of Jose Oliva Company, you find that a physical inventory on December 31, 2017, showed merchandise with a cost of $441,000 was on hand at that date. You also discover the following items were all excluded from the $441,000.1. Merchandise of $61,000 which is held by Oliva on consignment. The consignor is the Max Suzuki Company.2. Merchandise costing $38,000 which was shipped by Oliva f.o.b. destination to a customer on December 31, 2017. The customer was expected to receive the merchandise on January 6, 2018.3. Merchandise costing $46,000 which was shipped by Oliva f.o.b. shipping point to a customer on December 29, 2017. The customer was scheduled to receive the merchandise on January 2, 2018.4. Merchandise costing $83,000 shipped by a vendor f.o.b. destination on December 30, 2017, and received by Oliva on January 4, 2018.5. Merchandise costing $51,000 shipped by a vendor f.o.b. shipping point on December 31, 2017, and received by Oliva on…

Chapter 5 Solutions

Financial Accounting: The Impact on Decision Makers

Ch. 5 - Merchandise Accounting Merchandise Inventory Raw...Ch. 5 - Inventory Valuation Specific identification method...Ch. 5 - Inventoriable Costs During the first month of...Ch. 5 - Perpetual and Periodic Inventory Systems Following...Ch. 5 - Missing Amounts in Cost of Goods Sold Model For...Ch. 5 - Purchase Discounts For each of the following...Ch. 5 - Working Backward: Gross Profit Ratio Acmes gross...Ch. 5 - Inventory Costing Methods VanderMeer Inc. reported...Ch. 5 - Cost of Goods Sold, FIFO, and LIFO Kramer began...Ch. 5 - Comparison of Inventory Costing Methods—Periodic...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes. Year 1 Year 2 $ 160 LIFO inventory LIFO Cost of goods sold FIFO inventory FIFO COst of goods sold Current assets (using LIFO) Current assets (using FIFO) $ 110 740 680 240 110 660 645 220 180 300 180 Current liabilities 200 170 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers. (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers. IDenominator Numerator Ratio Current ratio 1.2 to 1 220.0 Inventory turnover $ 740.0 0 Days' sales in inventory 160.0 0 (b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO numbers. Numerator Denominator Ratio Current ratio $ 300.0 0 Inventory turnover 660.0 $ 0 Days' sales in inventory 240.0 $ 0arrow_forwardCruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of sold using FIFO for comparison purposes. LIFO inventory LIFO cost of goods sold FIFO inventory FIFO cost of goods sold Current assets (using LIFO) Current assets (using FIFO) Current liabilities 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO number Current ratio Inventory turnover Days' sales in inventory Answer is not complete. (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers. Current ratio Inventory turnover Days' sales in inventory Current ratio Inventory turnover Days' sales in inventory $ $ $ $ Year 2 $ 290 870 360 825 350 420 170 Numerator 1 Denominator 350.0 / $ $ 870.0 111.0 X $ $ $ Numerator 1 350.0 / (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers.…arrow_forwards Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes. LIFO inventory LIFO cost of goods sold FIFO inventory FIFO cost of goods sold i Current assets (using LIFO) Current assets (using FIFO) Current liabilities 110 645 180 180 170 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers. Year 2 $ 160 740 240 660 220 300 200 Current rabo Inventory tumover Days' sales in inventory (a) Compute its current ratio, Inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers. Denominator Current ratio Inventory turnover have sales in invandrn Year 1 $ 110 680 Numerator (b) Computa its current ratio, inventory turnover, and days' sales in inventory for Year 2 uning FIFO numbers. Denominator Ratio Numerator Ratioarrow_forward

- The December 31, 2016, inventory of Tog Company, based on a physical count, was determined to be $450,000. Included in that count was a shipment of goods received from a supplier at the end of the month that cost $50,000. The purchase was recorded and paid for in 2017. Another supplier shipment costing $20,000 was correctly recorded as a purchase in 2016. However, the merchandise, shipped FOB shipping point, was not received until 2017 and was incorrectly omitted from the physical count. A third purchase, shipped from a supplier FOB shipping point on December 28, 2016, did not arrive until January 3, 2017. The merchandise, which cost $80,000, was not included in the physical count and the purchase has not yet been recorded. The company uses a periodic inventory system. Required: 1. Determine the correct December 31, 2016, inventory balance and, assuming that the errors were discovered after the 2016 financial statements were issued, analyze the effect of the errors on 2016 cost of…arrow_forwardCruz Company uses LIFO for Inventory costing and reports the TOllowing thancial data. It also recomputed Inventory and cost of goods sold using FIFO for comparison purposes. Year 2 Year 1 LIFO inventory $ 170 $ 120 LIFO cost of goods sold FIFO inventory FIFO cost of goods sold Current assets (using LIFO) Current assets (using FIFO) 750 690 240 145 705 690 230 200 300 225 Current liabilities 180 160 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers. (a) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using LIFO numbers. es Numerator Denominator Ratio Current ratio Inventory turnover Days' sales in inventory (b) Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using FIFO numbers. Numerator Denominator Ratio Current ratio Inventory turnover Days' sales in inventory < Prev 1 of 1 Nextarrow_forwardSchrand Corporation purchase materials from a that offers credit terms of /supplier, n It purchased $12,500 of merchandized inventory from the supplier on Jan. 20, 2016.a. Assume Schrand paid the invoice on February 15,2016. Prepare a journal entry to record the purchase of this inventory and the cash payment to the supplier using the net of discount method.b. Set up the necessary T accounts and post the journal entries from question a to the accounts.c. Compute the cost of a lost discount as an annual percentage rate.arrow_forward

- Jones Company started the year with no inventory. During the year, it purchased two identical inventory items at different times. The first purchase cost $1,170 and the other, $1,550. Jones sold one of the items during the year. Required Based on this information, how much product cost would be allocated to cost of goods sold and ending inventory on the year-end financial statements, assuming use of a. FIFO? b. LIFO? c. Weighted average? Cost of goods sold Ending inventory $ FIFO 1,170 LIFO $ 1.170 Weighted Averagearrow_forwardCruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes. LIFO inventory LIFO cost of goods sold PIPO inventory FIFO cost of goods sold Current assets (using LIFO) Current assets (using FIFO) Current liabilities Year 2 $ 160 740 240 660 220 300 200 Year 1 $ 110 680 110 645 180 100 170 1. Compute its current ratio, inventory turnover, and days' sales in inventory for Year 2 using (a) LIFO numbers and (b) FIFO numbers.arrow_forwardXYZ Inc. had the following transactions for August: On August 1 it purchased 2 inventory items for $4 each On August 10 it purchased 3 inventory items for $3.75 each On August 15, 2015. it sold 1 item for $8 each On August 20 it purchased 3 more inventory items for $4.25 each.On August 25 it sold 3 items for $8.20 each. Calculate the Cost of Goods sold using FIFO.arrow_forward

- Cost of Goods Sold Calculation The accounts of Berrett Company have the following balances for 2017: Purchases Inventory, January 1, 2017 Purchase returns. Purchase discounts.. Freight in Freight out (seling expense). £780,000 120,000 22,920 2,640 37,200 7,200 12,000 Cash The inventory count on December 31, 2017, is 144,000. Using the information given, compute the cost of goods sold for Berrett Company for 2017.arrow_forwardA) Assume that Chen uses the first-in, first-out method. Compute the cost of goods sold for 2015 and the ending inventory balance at December 31, 2015, for product A. B) Assume that Chen uses the last-in, first-out method. Compute the cost of goods sold for 2015 and the ending inventory balance at December 31, 2015, for product A. C) Assume that Chen uses the weighted-average cost method. Compute the cost of goods sold for 2015 and the ending inventory balance at December 31, 2015, for product A. Do not round until your final answers. Round your answers to the nearest dollar. Then, Assuming that Chen’s products are perishable items, which of the three inventory costing methods would you choose to: Assume this is during a period of rising costs. Reflect the likely goods flow through the business? Minimize income taxes for the period? Report the largest amount of net income for the period?arrow_forwardThe accountant for Angie Company made the following errors related to purchases of merchandise and ending inventory in 2016: 1. A $2,200 purchase of merchandise on credit was not recorded or included in ending inventory. 2. A $3,180 purchase of merchandise on credit was recorded, but it was inadvertently omitted from the end-of-year physical inventory count. Assuming a periodic inventory system, Angie's Company's 2016 net income will be a. overstated by $5,380. b. overstated by $3,180. c. understated by $2,380. d. understated by $3,180.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License