Concept explainers

Benson Pharmaceuticals uses a process-costing system to compute the unit costs of the over-the-counter cold remedies that it produces. It has three departments: mixing, encapsulating, and bottling. In mixing, the ingredients for the cold capsules are measured, sifted, and blended (with materials assumed to be uniformly added throughout the process). The mix is transferred out in gallon containers. The encapsulating department takes the powdered mix and places it in capsules (which are necessarily added at the beginning of the process). One gallon of powdered mix converts into 1,500 capsules. After the capsules are filled and polished, they are transferred to bottling, where they are placed in bottles that are then affixed with a safety seal, lid, and label. Each bottle receives 50 capsules.

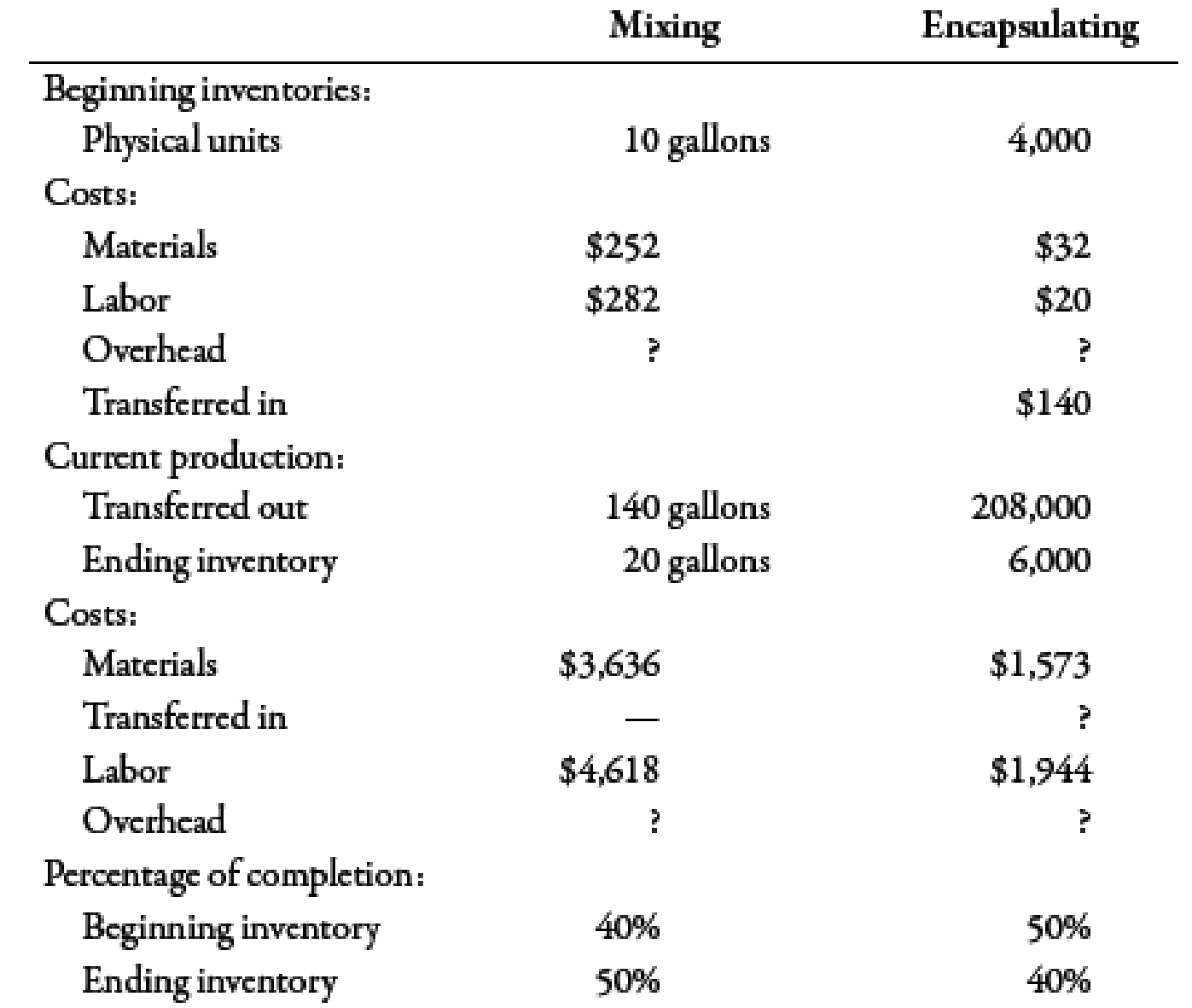

During March, the following results are available for the first two departments:

Required:

- 1. Prepare a production report for the mixing department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to two decimal places for the unit cost.)

- 2. Prepare a production report for the encapsulating department using the weighted average method. Follow the five steps outlined in the chapter. (Note: Round to four decimal places for the unit cost.)

- 3. CONCEPTUAL CONNECTION Explain why the weighted average method is easier to use than FIFO. Explain when weighted average will give about the same results as FIFO.

1.

Present a production report for the mixing department using weighted average method.

Explanation of Solution

Weighted Average Method:

Weighted average method is an inventory valuation method. In this method, cost is divided by equivalent units to obtain unit cost. This unit cost is used to value the inventory units.

Step 1: Physical flow analysis:

| Particulars | Units |

| Units to account for: | |

| Units in beginning WIP | 10 |

| Add: Units started during the period1 | 150 |

| Units to account for | 160 |

| Units accounted for: | |

| Units completed and transferred | 140 |

| Add: Units in ending WIP | 20 |

| Units accounted for | 160 |

Table (1)

Step 2: Computation of equivalent units:

| Particulars | Units |

| Units completed and transferred | 140 |

| Equivalent units from ending inventory | 10 |

| Equivalent units | 150 |

Table (2)

Step 3: Computation of unit cost:

| Particulars | Amount ($) |

| Cost of beginning inventory: | |

| Material | 252 |

| Labor | 282 |

| Overhead | 564 |

| Total cost of beginning inventory (A) | 1,098 |

| Cost incurred: | |

| Material | 3,636 |

| Labor | 4,618 |

| Overhead | 9,236 |

| Total cost incurred (B) | 17,490 |

| Total manufacturing cost | 18,588 |

| Unit cost |

123.92 |

Table (3)

Step 4: Valuation of inventories:

| Particulars | Amount ($) |

| Cost of goods transferred | 17,348.8 |

| Cost of ending WIP | 1239.2 |

| Total value | 18,588 |

Table (4)

Step 5: Cost reconciliation:

| Particulars | Amount ($) |

| Cost of goods transferred | 17,348.8 |

| Cost of ending WIP | 1239.2 |

| Total value | 18,588 |

| Total cost of beginning inventory | 1,098 |

| Total cost incurred | 17,490 |

| Total manufacturing cost | 18,588 |

Table (5)

Working Notes:

1. Computation of units started during the period:

2.

Present a production report for the encapsulating department using weighted average method.

Explanation of Solution

Step 1: Physical flow analysis:

| Particulars | Units |

| Units to account for: | |

| Units in beginning WIP | 4,000 |

| Add: Units started during the period1 | 210,000 |

| Units to account for | 214,000 |

| Units accounted for: | |

| Units completed and transferred | 208,000 |

| Add: Units in ending WIP | 6,000 |

| Units accounted for | 214,000 |

Table (6)

Step 2: Computation of equivalent units:

| Particulars | Units |

| Units completed and transferred | 208,000 |

| Equivalent units from ending inventory | 2,400 |

| Equivalent units | 210,400 |

Table (7)

Step 3: Computation of unit cost:

| Particulars | Amount ($) |

| Cost of beginning inventory: | |

| Material | 32 |

| Labor | 20 |

| Overhead | 30 |

| Transferred in | 140 |

| Total cost of beginning inventory (A) | 222 |

| Cost incurred: | |

| Material | 1,573 |

| Transferred in | 17,348.8 |

| Labor | 1,944 |

| Overhead | 2,916 |

| Total cost incurred (B) | 23,781.8 |

| Total manufacturing cost | 24,003.8 |

| Unit cost |

0.1141 |

Table (8)

Step 4: Valuation of inventories:

| Particulars | Amount ($) |

| Cost of goods transferred | 23,732.8 |

| Cost of ending WIP | 273.84 |

| Total value | 24,006.64 |

Table (9)

Step 5: Cost reconciliation:

| Particulars | Amount ($) |

| Cost of goods transferred | 23,732.8 |

| Cost of ending WIP | 273.84 |

| Total value | 24,006.64 |

| Total cost of beginning inventory | 222 |

| Total cost incurred | 23,781.8 |

| Total manufacturing cost | 24,003.8 |

Table (10)

Working Notes:

1.

Computation of units started during the period:

3.

Discuss whether or not weighted average method is easier than FIFO. Also, discuss the situation in which weighted average will give about the same results as FIFO.

Explanation of Solution

It is easier to compute unit cost in case of weighted average method, because all equivalent units are categorized in one class.

Weighted average would provide similar result from FIFO, in case, costs are not much fluctuating and are similar from previous periods.

Want to see more full solutions like this?

Chapter 6 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- Gladden Dock Company manufactures boat docks on an assembly line. Its costing system uses two cost categories, direct materials and conversion costs. Each product must pass through the Assembly Department and the Finishing Department. This problem focuses on the Assembly Department. Direct materials are added at the beginning of the production process. Conversion costs are allocated evenly throughout production. The firm uses FIFO method and the controller prepared the following (correct) equivalent unit calculation. Unitscompleted Physical Units Direct Materials Conversion WIP, beginning 70 0 52.5 Started and completed 30 30 30 WIP, ending 10 10 5 Totals 110 40 87.5 Cost per Equiv Unit $4,000 $16,000 Work in process, beginning inventory: Current Costs:Direct materials $140,000 Direct materials $ 160,000Conversion costs $260,000 Conversion…arrow_forwardMuskoge Company uses a process-costing system. The company manufactures a product that isprocessed in two departments: Molding and Assembly. In the Molding Department, directmaterials are added at the beginning of the process; in the Assembly Department, additionaldirect materials are added at the end of the process. In both departments, conversion costs areincurred uniformly throughout the process. As work is completed, it is transferred out. Thefollowing table summarizes the production activity and costs for February: Molding AssemblyBeginning inventories: Physical units 10,000 8,000 Costs: Transferred in — $ 45,400 Direct materials $22,000 — Conversion costs $13,800 $ 16,700Current production: Units started 25,000 ? Units transferred out 30,000 35,000 Costs: Transferred in — ? Direct materials $ 56,250 $ 40,250 Conversion costs $103,500 $142,845 Percentage of completion: Beginning inventory 40% 55% Ending inventory 80 50Required:3. Using the FIFO method, prepare the following for…arrow_forwardBristol Fabricators, Inc., produces air purifiers in batches. To manufacture a batch of the purifiers, Bristol Fabricators, Inc., must set up the machines and assembly line tooling. Setup costs are batch-level costs because they are associated with batches rather than individual units of products. A separate Setup Department is responsible for setting up machines and tooling for different models of the air purifiers. Setup overhead costs consist of some costs that are variable and some costs that are fixed with respect to the number of setup-hours. The following information pertains to June 2020: E (Click the icon to view the information for June 2020.) Calculate the production-volume variance for fixed overhead setup costs. (Round all intermediary calculations to two decimal places and your final answer to the nearest whole number.) O A. $2,478 unfavorable O B. $2,478 favorable i Data Table C. $363 favorable O D. $363 unfavorable Budget Amounts Actual Amounts Units produced and sold…arrow_forward

- Devereaux Cycles makes three models of scooter: Commuter, Sport, and X-treme. The scooters are produced in four departments: Assembly, Detailing, Customization, and Packaging. All three models are started in Assembly, where all materials are assembled. The Commuter is then sent to Packaging, where it is packaged and transferred to finished goods inventory. The Sport is then transferred to Detailing. Once the detailing process is completed, the Sport models are transferred to Packaging and then finished goods. The X- Treme model is assembled and then transferred to Customization, and then Packaging. When packaged, it is transferred to finished goods. Data for February are shown in the following table. Conversion costs are allocated based on the number of units processed in each department. No work-in-process inventories are maintained in any department. Materials Conversion costs: Assembly Detailing Customization Packaging Total conversion costs Commuter Sport X-Treme Total $ 3,694,000…arrow_forwardPBB Company manufactures high end product. Because of the high volume of this type of product, the company employs a process cost system using the weighted average method to determine costs. Product Parts are manufactured in the Molding Department and transferred to the assembly Department were they are partially assembled. After assembly, the product is sent to packaging department. Cost per unit data for the high end product has been completed through the Molding department. Annual cost and production figures for the assembly Department are presented below: Production Data Beg. Inventory 50% Complete as to Assembly materials; 20% complete 3,000 as to Conversion units 45,000 Transferred In during the year units 40,000 Transferred to Packaging Department units 4,000 Ending Inventory 80% complete units Cost Data: Transferred-In Materials Conversion Current Period P 1,240,800 P 97,020 P 236,470 Work in Process, beginning 82,200 6,660 11,930 Damage product are identified on inspection…arrow_forwardWatertime inc. manufactures old fashioned grandfather clocks. The production utilizes a highly automated assembly line. The firm has identified two cost categories: direct materials and conversion costs. During the production process each clock moves first through the Assembly Department, where materials are added and the clock is assembled, then through the Testing Department, where the clock is inspected for quality control. All direct materials are added at the beginning of the production process but conversion costs are allocated evenly throughout production. Spartans Inc. uses weighted-average costing. Data for Department A for June 2020 are: Beginning WiP Inventory 320 units Direct Materials (100% complete) Conversion (35% complete) Units started during June 750 units Ending WiP Inventory June 30 300 units Direct…arrow_forward

- Hales Company produces a product that requires two processes. In the first process, a subassembly is produced (subassembly A). In the second process, this subassembly and a subassembly purchased from outside the company (subassembly B) are assembled to produce the final product. For simplicity, assume that the assembly of one final unit takes the same time as the production of subassembly A. Subassembly A is placed in a container and sent to an area called the subassembly stores (SB stores) area. A production Kanban is attached to this container. A second container, also with one subassembly, is located near the assembly line (called the withdrawal store). This container has attached to it a withdrawal Kanban. Required: 1. Explain how withdrawal and production Kanban cards are used to control the work flow between the two processes. How does this approach minimize inventories? 2. Explain how vendor Kanban cards can be used to control the flow of the purchased subassembly. What implications does this have for supplier relationships? What role, if any, do continuous replenishment and EDI play in this process?arrow_forwardLacy, Inc., produces a subassembly used in the production of hydraulic cylinders. The subassemblies are produced in three departments: Plate Cutting, Rod Cutting, and Welding. Materials are added at the beginning of the process. Overhead is applied using the following drivers and activity rates: Other data for the Plate Cutting Department are as follows: Required: 1. Prepare a physical flow schedule. 2. Calculate equivalent units of production for: a. Direct materials b. Conversion costs 3. Calculate unit costs for: a. Direct materials b. Conversion costs c. Total manufacturing 4. Provide the following information: a. The total cost of units transferred out b. The journal entry for transferring costs from Plate Cutting to Welding c. The cost assigned to units in ending inventoryarrow_forwardReducir, Inc., produces two different types of hydraulic cylinders. Reducir produces a major subassembly for the cylinders in the Cutting and Welding Department. Other parts and the subassembly are then assembled in the Assembly Department. The activities, expected costs, and drivers associated with these two manufacturing processes are given below. Note: In the assembly process, the materials-handling activity is a function of product characteristics rather than batch activity. Other overhead activities, their costs, and drivers are listed below. Other production information concerning the two hydraulic cylinders is also provided: Required: 1. Using a plantwide rate based on machine hours, calculate the total overhead cost assigned to each product and the unit overhead cost. 2. Using activity rates, calculate the total overhead cost assigned to each product and the unit overhead cost. Comment on the accuracy of the plantwide rate. 3. Calculate the global consumption ratios. 4. Calculate the consumption ratios for welding and materials handling (Assembly) and show that two drivers, welding hours and number of parts, can be used to achieve the same ABC product costs calculated in Requirement 2. Explain the value of this simplification. 5. Calculate the consumption ratios for inspection and engineering, and show that the drivers for these two activities also duplicate the ABC product costs calculated in Requirement 2.arrow_forward

- Caricolor Limited operates a paint manufacturing plant, housing two distinct departments: the mixing department and the quality control department. The paint undergoes sequential processing in both of these departments. The company's process-costing system is structured around two primary cost categories: direct materials and conversion costs. Direct materials are introduced at the initial stages of the process, while conversion costs are gradually incurred throughout the process. After completing the mixing department's tasks on the paint, the product is promptly forwarded to the quality control department. Caricolor employs the weighted-average method for process costing to calculate its manufacturing costs. Data for the mixing department for October 2020 are as follows: Physical Units Cost (Gallons…arrow_forwardCaricolor Limited operates a paint manufacturing plant, housing two distinct departments: the mixing department and the quality control department. The paint undergoes sequential processing in both of these departments. The company's process-costing system is structured around two primary cost categories: direct materials and conversion costs. Direct materials are introduced at the initial stages of the process, while conversion costs are gradually incurred throughout the process. After completing the mixing department's tasks on the paint, the product is promptly forwarded to the quality control department. Caricolor employs the weighted-average method for process costing to calculate its manufacturing costs. Data for the mixing department for October 2020 are as follows: Physical Units Cost (Gallons…arrow_forwardGroFast Company manufactures a high-quality fertilizer, which is used primarily by commercial veg-etable growers. Two departments are involved in the production process. In the Mixing Department, various chemicals are entered into production. After processing, the Mixing Department transfers a chemical called Chemgro to the Finishing Department. There the product is completed, packaged, and shipped under the brand name Vegegro. Various chemicals --> Mixing Dept (Chemgro)-->Finishing Dept (Vegegro) ---> In the Mixing Department, the raw material is added at the beginning of the process. Labor and overhead are applied continuously throughout the process. All direct departmental overhead is traced to the departments, and plant overhead is allocated to the departments on the basis of direct-labor. The plant overhead rate for 20x2 is $.40 per direct-labor dollar. The following information relates to production during November 20x2 in the Mixing Department. a. Work in process,…arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning