Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.6P

Single-Step Income Statement

The following income statement items, arranged in alphabetical order, are taken from the records of Shaw Corporation for the current year:

Required

- Prepare a single-step income statement for the current year.

- What weaknesses do you see in this form for the income statement?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Prepare a comparative common-size income statement for Jubilee Corporation. To an investor, how does the current year compare with the prior year? Explain your reasoning.

E (Click the icon to view the comparative income statement.)

Data table

Start by calculating the percentages. (Round the percentages to two decimal places, X.XX.)

Jubilee Corporation

Comparative Common-Size Income Statement

A

C

For the Years Ended December 31

1

Jubilee Corporation

Current

2

Income Statement

year

Prior year

3

For the Years Ended December 31

Sales revenues

100.00 %

100.00 %

4

(amounts in thousands)

Less: Cost of goods sold

%

%

Current

Gross profit

%

%

year

Prior year

Less: Operating expenses

%

6 Sales revenues

$

494,208 $

429,000

%

Operating income

%

7 Less: Cost of goods sold

172,640

160,000

Less: Interest expense

8 Gross profit

2$

321,568 $

269,000

0%

Income before income taxes

%

%

9 Less: Operating expenses

143,370

135,000

Less: Income tax expense

10 Operating income

2$

178,198 $

134,000

%

%

11 Less:…

Income statements for Walton Company for Year 3 and Year 4 follow:

WALTON COMPANY

Income Statements.

Sales

Cost of goods sold.

Selling expenses

Administrative expenses

Interest expense

Total expenses

Income before taxes

Income taxes expense

Net income

Required A Required B

Year 4

$200, 300

143,300

20,900

12,900

3,200

Required

a. Perform a horizontal analysis, showing the percentage change in each income statement component between Year 3 and Year 4.

b. Perform a vertical analysis, showing each income statement component as a percentage of sales for each year.

Sales

Cost of goods sold

Selling expenses

Administrative expenses

Interest expense

Total expenses

Income before taxes

Income taxes expense

Net income

$180,300

$160,300

20,000

20,000

3,300

5,600

$ 14,400 $ 16,700

Complete this question by entering your answers in the tabs below.

Year 3

$180,300

X Answer is complete but not entirely correct.

Perform a vertical analysis, showing each income statement component as a percentage of…

Chapter 2 Solutions

Financial Accounting: The Impact on Decision Makers

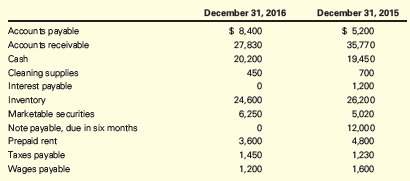

Ch. 2 - Read each definition below and write the number of...Ch. 2 - Prob. 2.1ECh. 2 - The Operating Cycle Two Wheeler Cycle Shop buys...Ch. 2 - Classification of Financial Statement Items Regal...Ch. 2 - Current Ratio Baldwin Corp. reported the following...Ch. 2 - Classification of Assets and Liabilities Indicate...Ch. 2 - Selling Expenses and General and Administrative...Ch. 2 - Prob. 2.7ECh. 2 - Income Statement Ratio The income statement of...Ch. 2 - Statement of Retained Earnings Landon Corporation...

Ch. 2 - Components of the Statement of Cash Flows Identify...Ch. 2 - Prob. 2.11ECh. 2 - Prob. 2.12MCECh. 2 - Prob. 2.13MCECh. 2 - Prob. 2.14MCECh. 2 - Materiality Joseph Knapp, a newly hired accountant...Ch. 2 - Costs and Expenses The following costs are...Ch. 2 - Prob. 2.3PCh. 2 - Prob. 2.4PCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Multiple-Step Income Statement and Profit Margin...Ch. 2 - Statement of Cash Flows Colorado Corporation was...Ch. 2 - Basic Elements of Financial Reports Comparative...Ch. 2 - Prob. 2.10MCPCh. 2 - Prob. 2.11MCPCh. 2 - Prob. 2.12MCPCh. 2 - Prob. 2.1APCh. 2 - Prob. 2.2APCh. 2 - Prob. 2.3APCh. 2 - Prob. 2.4APCh. 2 - Working Capital and Current Ratio The balance...Ch. 2 - Single-Step Income Statement The following income...Ch. 2 - Prob. 2.7APCh. 2 - Prob. 2.8APCh. 2 - Prob. 2.9APCh. 2 - Comparability and Consistency in Income Statements...Ch. 2 - Prob. 2.12AMCPCh. 2 - Prob. 2.1DCCh. 2 - Prob. 2.2DCCh. 2 - Analysis of Cash Flow for a Small Business...Ch. 2 - Prob. 2.4DCCh. 2 - The Expenditure Approval Process Roberto is the...Ch. 2 - Prob. 2.6DC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Single-Step Income Statement The following income statement items, arranged in alphabetical order, are taken from the records of Corbin Enterprises for the current year: Required Prepare a single-step income statement for the current year. What weaknesses do you see in this form for the income statement?arrow_forwardComprehensive income Anson Industries, Inc., reported the following information on its 20Y1 income statement: Prepare the following for Anson Industries, Inc.: A. Income statement, including comprehensive income. B. Income statement and a separate statement of comprehensive income.arrow_forwardThe income statement, statement of retained earnings, and balance sheet for Santiago Systems are as follows: Includes both state and federal taxes. Refer to the information for Santiago Systems above. Required: Compute the price-earnings ratio. (Note: Round the answer to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Consolidated financial statements; Author: The Finance Storyteller;https://www.youtube.com/watch?v=DTFD912ZJQg;License: Standard Youtube License